6/1 Best Idea For The Week Ahead

Sorry again about yesterday, I was at the ER all day yesterday, I got home and went to bed. Obviously I didn’t sleep well so here I am up at 3 am. I updated the database with a few of the trades I found interesting the rest of the day. As for my dad I got a lot of messages from you all, he’s stable now, but he has pneumonia and he just got violently ill after this last round of chemo. He’s going to be in the hospital for a while they told us, he looked pretty awful and honestly I thought he was a goner when I first saw him in the morning but that was apparently the dehydration/high fever. He looked a lot better when I left at night. It’s day by day for now so I can’t really say much else other than thanks for all the well wishes.

As for the market, I don’t even know what to say when I left yesterday it looked like the bears were in full control and we were in a breakdown. We closed just a hair below the 21 ema on thursday and got everyone nice and bearish. We followed that up with a big move lower friday morning where we could not find buyers for the first 3 hours of the day and then went straight up for the last couple hours followed by an incredible last 30 minutes of the day.

Look at how yesterday’s candle below closed on the SPY. It gave everyone this big headfake that we were breaking down and then completely reversed and closed over the 8 and 21 ema. This is why it’s impossible to ever be bearish, it feels like every dip is just a lifetime buying opportunity. We spent 3-4 hours below the 21 ema and are now back to a very bullish look?

When people ask me why I don’t ever short things or manage a long/short book, its stuff like this that makes me not waste time on the short side, it is nearly impossible to short things today. All the things you’re taught about when to short things seem to only matter for the smallest of timeframes. Stocks by design are built to go up, that isn’t the issue, I’m not fighting that, it’s these moves where you breakdown and it should technically move lower but then it reverses out of nowhere. It feels like no matter what you buy, as long as it is quality, at some point it will be bid up again and you can seemingly never be wrong for too long. The reality is there is just ample liquidity all over the world and it wants to buy the same handful of assets. That’s fine, I’m not a hero, I’m not going to fight that I’m just going to stick to playing the best things I see with directionally bullish option flow, that’s it.

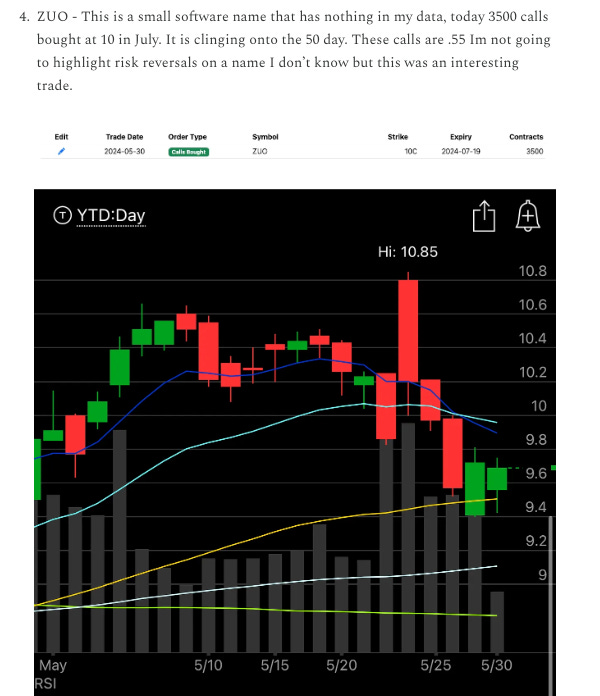

Speaking of option flow, did you see that ZUO I highlighted in thursday’s recap? It jumped 4.5% yesterday on nothing and those calls went up almost 60% in 1 session. It’s especially funny because software was killed this week, look at the move down on the IGV. It’s uncanny how they can buy something like this in size and be up so much in a session. I saw there was some heavy volume on these yesterday almost half the open interest, so if you took this trade you may want to think of cashing some in.

This week’s best idea is a longer term secular trade that has a potential major short term catalyst. It is a name I really think you need to add to your portfolio longer term but not at current levels so I have a risk reversal to try and grab shares 15% lower while playing for some big upside in the short term. There aren’t many options trades and even though analysts aren’t really too bullish on it, I am. I have some interesting data I think you can reason with.