6/10 Best Idea For The Week Ahead: A $5B Semi With Repeat 50% OTM Call Buying.......

I always get comments and questions about why I didn’t take this or why I didn’t take that. The answer is I’ve repeatedly said I just wanted to take a break for the summer from the markets, I haven’t made a trade in over 2 weeks, but my purpose here is to generate actionable ideas for you all using charts and options flows, take a look at just the last 5 best ideas I’ve posted

When I post them it’s usually with the idea of a longer term trade/hold in mind for those building a book. I always recommend a conservative way to sell puts to enter the name but I try to find bottoming names with solid charts and flows. Here is how the last 5 best idea names have performed, I didn’t want to spend time going back through a year worth of ideas, but most have gone very well.

Bottom line, you have alot of people selling these sub services who tell you to buy xyz stock or option and you gain nothing from it because you’re not learning the process involved with that decision making. I know when I was stopping posting new trades 2 weeks ago alot left here, that’s a shame because I’m actually teaching you the process I go through which is far more valuable and should allow you to depend on nobody in time.

The process is simple

Scour through unusual options activity and see active names over multiple timeframes. That is why my database exists, for my own personal idea generation

Take the names you see with the most unusual options flow, and begin to look over the charts one by one.

Analyze the chart and see where you want to enter/exit based on support levels, moving averages, etc.

That’s it. That’s the whole secret sauce to my recipe. Find names players with more knowledge and conviction than you are buying, find a level where you can enter the names, and profit? Simple enough. What I don’t explain is the amount of time involved when I’m managing 20-30 positions as I always have. Looking over those charts every night. Then taking the daily unusual options table and looking over charts of those to find potential ideas to enter. It’s a full time job, and when I say I want a break for a few months to enjoy summer, that’s what I want a break from. Hours a day of looking over charts to come up with those 80% returns you saw me post from the past year 2 days ago. This game isn’t easy and it takes more work than you can imagine to consistently be on the right side of these trades which is what I would say is my strong suit. Bouncing from sector to sector, with no emotion, and trying to find the next pocket of strength. So just keep that in mind when you keep asking me why I’m not doing anything. Trading is a grind, and sometimes you want a break.

With all that said, here is this week’s best idea and I really like this one because I’m seeing repeated option flow way way way out of the money and only 6 months away, so curious what is going on here and I’m going to discuss how I would put on a high upside trade for free while being quite conservative.

COHR

This is a very interesting semi based here in the US in Saxonburg, PA. It really hasn’t kept up with the semi boom we’ve seen in 2023, but I’m starting to see some really unusual trades here, repeatedly over the last few weeks.

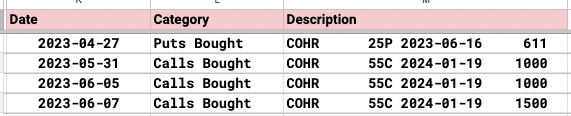

The Options Activity

As you can, three times in the past 2 weeks there’s been a big buy of $55 calls here in January. The open interest is actually over 12,000 here, but those 3 buys have stood out to me for the last few days because the stock is 38.91 right now.

Charts

The daily is up nicely in the short term and trending over all these moving averages. It’s actually in a bull flag at the moment and looks primed for a rip higher, but I also see that open gap below around $33 that isn’t ideal. Gaps tend to fill and I hate such a large open gap 20% lower.

The weekly chart is also looking nice and has clear room to $50 above before stiff resistance is going to come into play. This is a strong setup.

How Would I Play It?

It looks like a little below 28 should be the bottom in this name, that appears to be a huge washout candle where you had all the panic selling end and buyers stepped in. So to me, a close below 28 would be the time to exit this name. So how do we maximize the potential return?

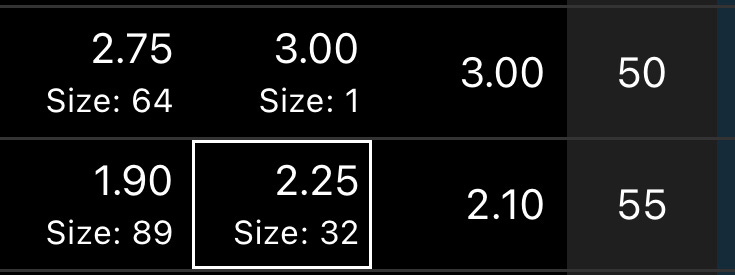

I would utilize a risk reversal here. I would sell the January $30 puts for $2.15 the midpoint of 2.05 x 2.25. Why these? Because sub $28 is where I would close this name out so these puts place me in the name sub $28 and are still over 30% lower than the current price.

I would then take the $2.15 in premium you receive and buy those January $55 calls for $2.10 with them, the last trade on the calls. Now you’ve received $2.15 for the puts sold and used $2.10 of it to buy some really aggressive calls 50% OTM.

What’s the worst than can happen?

As long as COHR is over $28, nothing. The trade only starts to lose money below 28, but as I stated above if the stock closes below 28, that is where you cut for a loss anyways. The upside is big, and it’s interesting to see repeated call buying so far OTM here with only 7 months to expiry but this was a $75 stock last March. A return there would net far over a 10x on these.

Again, it’s all about risk/reward. The trade above suggests risking nothing as long as the stock says over $28. You’re putting on the trade for free with a downside cushion of 30% to protect you if it falls. When you want to take a swing at something out of the money like this, this is how I would do it.

Could COHR be a dud and do nothing? Absolutely, that’s why you use options to give you leverage, but with downside protection.

Enjoy your Saturday and tomorrow I will have some charts for you!

Thanks for the info. Enjoy your break JB it's well deserved.

I just joined today and looked at this write up. Looking at the stock today, it is near $55. Talk about timing and seeing things in action. Question on the 200 EMA. I read in a different writeup to not trade below this level? Did I misunderstand? I ask since the COHR is about to hit the 200 EMA on the way up to $55. Aside from that, wow!