6/12 Recap.

The world awaits the data coming tomorrow. We have big data of Germany early and then we have our own inflation data. Credit Suisse published a note today saying

“Our work indicates that year over year inflation is likely to fall to 4.2% in May, 3.2% in June .. this would represent one of the greatest drops experienced in a 2-month period over the past 70 years.”

We will see, I’ve never really believed any of these numbers, I don’t think anyone paying any bills thinks inflation is cooling at all, but that’s another topic for another day. For now the market is still undecided on tomorrow. While we were up today, you can see below we did not surpass Friday’s highs, so not a breakout, yet. Could it happen tomorrow? It could, it also wouldn’t shock me if we cool off and go back and test some of these lower moving averages. The market has been red hot and as you can see the RSI below, it’s nearly overbought now. A breather would be normal. So be careful into tomorrow, no leverage please, these events get chaotic.

More interesting today is stocks are up while the VIX is up big and the dollar is up. Those usually don’t go up in tandem. Some weird times in our markets. Also oil was decimated today and is now down over 10% from where it opened after OPEC’s emergency cut last week. The cut seemed to come in panic but as you can see below, the oil chart is broken. Low oil is great for everyone, except oil bulls. It eases inflationary pressures, it helps consumers save money to spend in other sectors. I’m sure oil will rebound at some point it always does, but I wouldn’t expect it to be soon with this level of technical damage done.

Trends

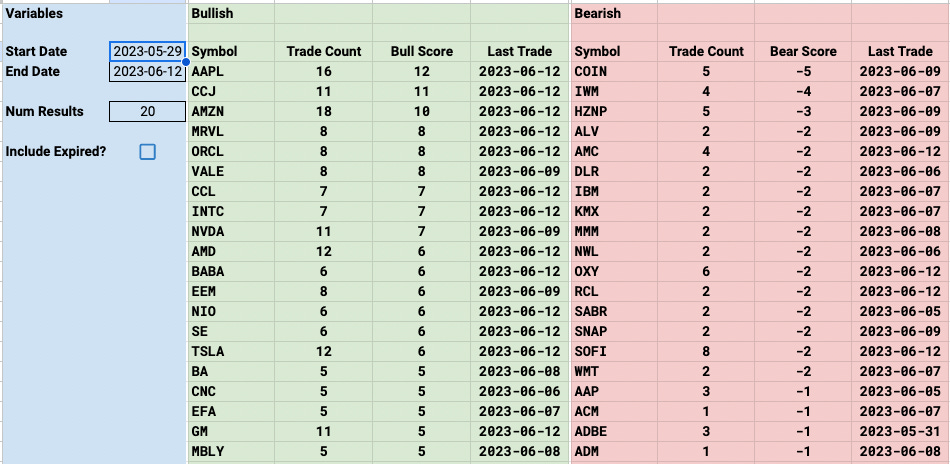

ORCL is catching my eye as it is gaining alot of bullish activity but they report today so I’m not going to touch it. There were some big buys today that you can see below in today’s table. CCL is another one that has been red hot, it’s now up 40% from when I made it my best idea a month back. It’s up 14% today alone.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity & What Stood Out

106 Trades Today