We just wrapped up another incredible week in the “market”, as you can see the SPY just closed at a new weekly high and everything is absolutely fantastic. We are at overbought levels but as long as we’re over the 8 weekly. the dark blue line, the trend is up and we are ok.

As I’ve mentioned a few times this week, the RSP, below, is what worries me and that just closed lower for the 4th straight week and now sits near the 21 week. It is what it is, there’s no sense fighting it, we have very narrow leadership right now, that leadership happens to be the biggest weightings in the SPY and that is why it keeps going up. Will the others play catch up or are the signaling a possible recession? That is to be determined, but I remain in the camp there will absolutely not be a recession in public conversation before the election as that would be political suicide.

One of the things I want to talk about before we get into the best idea of this week is how to think about your positioning because I get questions all the time about it and it’s really hard to answer because there really isn’t a one size fits all answer. So let’s go over a few things. Here is my little primer on how to use all you see. Sorry for the length of these posts but I really do want to be thorough and leave no questions.

How Do You Size Trades? So as I’ve said before ideally you would have a trading book separate from your investments. Why? Because when you’re trading I don’t believe in rules, diversification is for investing, in trading you have to size to feel, and with some names and some setups you’re going to be more comfortable than others and you need to go with the flow. Maybe you go 20% or 40% into a trade. A 100% sizing isn’t terrible if you have the conviction and risk tolerance, again last May I closed up everything I had and went all into Amazon not only via shares but with calls because I felt the stars were aligning and I wanted to catch an outsized move, that risk was only tolerable because it was my trading book and I wasn’t worried about it since I ran every scenario and there was just no inconceivable way the equity wasn’t worth far more than it was at the time. It is up almost 65% so that that was right for me. So concentration on a few positions is key to trading, you can’t have more positions than you can handle.

How Do You Enter A Trade? Again this is an answer that isn’t one size fits all. For some it’s by buying common stock, for others it is buying calls, some prefer selling puts. There’s multiple ways to attack the same data you’re seeing. Ideally you want to see directionally what names are seeing what option flow and go with what captures the most upside. What do I mean? So when Amazon was $115 last summer, I could have sold at the money puts for $20/share, but I felt the upside on the calls was far more than $20/share meaning I thought Amazon would go much further than 115 135, so I bought calls instead of selling puts. The stock is up $70 since, had I sold puts, I would probably be up $15/share or something today.

Why Do I Always Suggest Risk Reversals? I like these because one of the biggest problems people have is they want to use stop losses, that’s fine, but options move really fast. Let’s say you buy some calls and they fall 40% in a week then go up 300% next week, you got stopped out for nothing. When I use a risk reversal, those puts I suggest, they’re typically at support. The reality is most good stocks go up over time, so you want to structure a trade to where you give yourself time for a worst case where you end up buying a good name at a good level. So the point of risk reversals is to make sure you use the short puts to finance the calls that way if you are wrong, the cost of the calls is offset by the short puts and many times I structure it to where you profit anyhow just as long as the short puts work. When I think the name is iffy, you’ll see me say I don’t suggest selling puts, like BAND in the 6/12 recap this week, I said specifically “I wouldn’t suggest selling puts” and it was a gamble. It tanked 15% yesterday.

The Importance Of Selling Puts - Look at LVS from last Monday. One of the odd trades I highlighted was a weekly buy of $46 calls which were .20. I suggested selling $43 puts for this upcoming week for .25 to offset the costs in a calendar trade. The stock was just under $45, it is now 43.25, it had a rough week. The person who bought those calls was just wrong, but by adding those short puts, you still didn’t lose money because you’re profitable down to 42.95 and even from there that is a good buy because it is lower than that monster green candle you see below 5 days ago. So that is a perfect example of why it is so key to add the sold puts layer to whatever calls you buy.

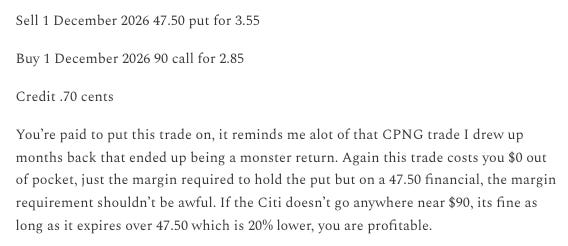

How To Think Of Weekend Best Ideas - Look at the best idea I wrote up last weekend on C, Citi closed lower nearly every day this week, had you bought common, you’re down a little. Had you used the risk reversal below, you’d be fine. For starters you have until December 2026, secondly your breakeven is 46.80, the stock is 59.33 today, so there is nothing to even think about at this moment. These trades don’t all boom the next day or next week, these weekend best ideas are longer term holdings I’m structuring trades on off of longer term option flow I’m seeing. Citi has heavy buying over $80/share in 2026, we want to position for that but in the event it doesn’t get there, we’re still ok because of the premium we sold.

If You Buy Common - do it but always sell covered calls higher right away. One of the things with too many investors is greed takes over, they want to eke out more and then the stock tumbles. Whenever you buy common, right away handcuff it and sell upside calls wherever you want ie this week, next week, 6 months out. The instant you enter a trade you have to start thinking about how to generate income on the position until it gets to the level you want to sell at. Even if you use calls, you can sell short calls vs those and generate income.

Community - I’ve said this alot, but one of the things about being in the market is alot of people feel alone, the community this place has spun off is great. The discord is nearing 800 members now, lots of those people are great traders, bounce ideas with them. If you see something that interests you, go in the current trades channel and ask for opinions, ask how others would trade it. The thing that’s great about a community like that is having others who might see something in a chart or option flow that you don’t. Maybe a big level to focus on, whatever. Having more eyes on the same things yields better results. There’s so many people who trade these things in so many different ways, you really couldn’t ask for a better place to get ideas to go along with the data what I post. For those who aren’t there the link is in the welcome email you got when you signed up.

This week’s best idea is a fintwit favorite. I’m almost ashamed to write it up because I’ve said some mean things about it in the past, mostly it’s valuation, but I do think it is at a point where we can structure an unbalanced ratio trade at levels 30% lower and make 20% on our capital waiting for it to possibly come down to where it would be a very good buy and possibly capture some immense upside if it happens.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.