6/15 Recap

The market continues the drift higher out of that flag setup I noted last week. There isn’t much to say here other than as long as it’s hanging over all these short term ema it’s not a short no matter how much bears disagree. The market is a whole lot easier if you just let the moving averages guide you and not “macro”. The moving averages have shown for weeks on end that buying is occurring and the reason why is irrelevant. At this point though you can see the RSI is very stretched. We’re way in overbought territory, a pullback to the yellow line below wouldn’t surprise me, and as long as that doesn’t break it is safe to remain long.

The dollar remains firmly in retreat which is bullish for equities, this is a nasty breakdown today of the DXY, it tried testing higher but was rejected swiftly.

Trends

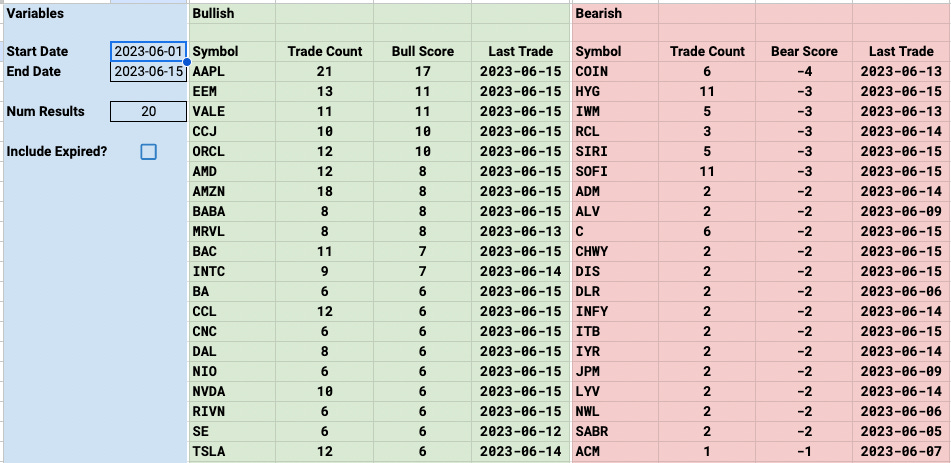

CCL remains unstoppable up another 3% today as the top trend yesterday but today finally saw a huge flow of put buying you will see in my table below, Apple following right behind it with a move to all time highs. The EEM remains very strong as well as the emerging market etc continues to grind higher..

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity & What Stood Out

115 Trades Today