6/17 Recap

The SPY continues on, an upward sloping 8 and 21 ema is a sign of a healthy market with nothing to be concerned about. In an uptrend like this you simply press your longs, leverage up, whatever you want, but you remain firmly aware that any break of the 21 ema means play time is over and it is time to de-risk. As long as you obey that simple rule, you will never get caught off guard and suffer. You saw how smooth that 21 ema breakdown in April went until we reclaimed it, just stick to these basic trading rules and your life will be so much simpler.

I Added A New Position

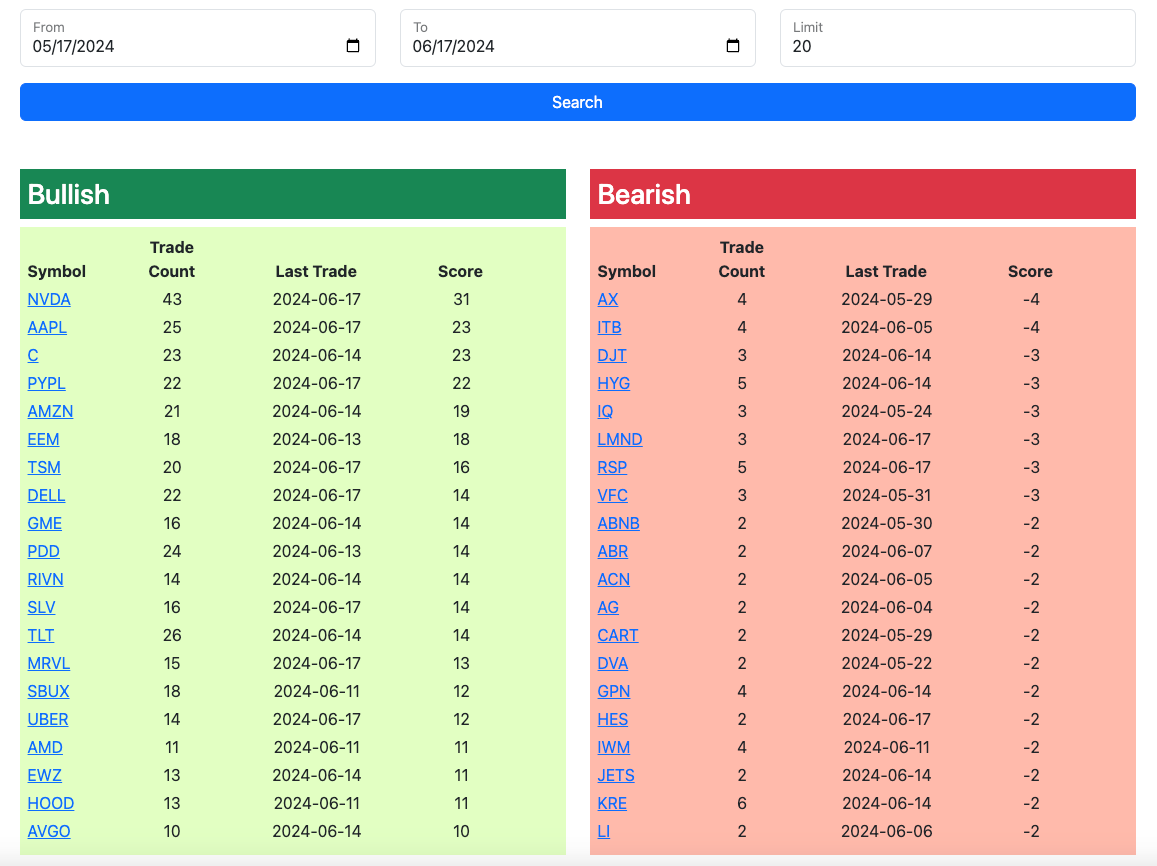

We have a new leader in the market and it’s Apple. Look at the massive option flow in the table today and you can see they are positioning for much higher levels on Apple the rest of this year. Even today you can see a big rotation where even Nvidia is red for once and Apple is nonstop buying. Honestly if I could escape my Amazon leaps without the tax punishment I’d have for short term capital gains on my calls, I would move to Apple right now. It’s just hard when you’re up over 100% on a trade that big to sell and take pay a ton of short term gains when I could easily wait a few more months and not only pay less taxes, but also have a full extra year to work with the capital and generate a return with it.

Bottom line, Apple is doing everything right and the call buying is just nonstop now the last week or so. They’re buying back tons of shares, they’re paying a dividend, nobody cares that growth isn’t there because Apple is telling you all you want to hear regarding financial engineering and AI, literally everything Amazon is not doing. That is why Amazon continues to lag so much every single day for the last month and out of the money call buying has mostly stopped. Until they give the market what it wants which is financial engineering and clarity on their AI strategy, this remains dead money probably for the next 6 weeks until earnings. This is a perfect example of how poor management, which Amazon has had for years, can ruin even a great long term story and how great management like Apple has, can put lipstick on a pig.

I’m going to do a deeper write up on Apple this weekend with more trade ideas but take heart of the one I wrote below today, it has potential to be a huge trade. For Today, I closed out all the rest of my open trades in FOUR,QRVO and some of my AMZN leaps to Add some January 2026 AAPL Calls and I spread them with short short December 300 call spreads for this year, I’m seeing too much Apple call flow to not follow along, this particular trade has a breakeven at 256 in 18 months so I’ve got time to ride it out. The breakout last week from a 3 year base was a monster technical breakout on Apple by itself, add in the call flow I’m seeing, and I had to partake.

Here is all I hold in my trading book right now.

My book has grown so much over the last 2 years that I just find myself looking for safer trades with more leverage. I missed the boat on NVDA by being stubborn and trying to wait out my AMZN trade for lower taxes, I’m not going to do it again. I know what I’m seeing with all the OTM Apple call buying and as long as the market holds up, this is our new leader, wish I could allocate more to it. If Apple pulls back some I will add short puts to fund these calls but ultimately the call flow I’m seeing points to Apple much higher. Amazon, I’m stuck with this dog until at least January, it’s hard to say but I’ve never been so disappointed in a position I’m up over 100% on, but it’s the truth, this name has just been so awful the last 2 months, it feels like I’m down 50% since I entered it.

Fear not, I’m still over 80% Amazon leaps, I’m not changing my stance at all, I just can’t miss another potential huge trade because of tax worries. You’ll see the call buying below today targeting 290-310 today.

Recent Trades

PRMW - In the 5/21 Recap here I noted that it was really odd that someone would purchase 11,000 calls on this little water name. Again, there was nothing notable at all in this thing and I said it was the most interesting one that day. This morning less than a month later, Primo Water entered into a merger agreement and the stock exploded premarket up around 15% over 25, it has now faded really hard and is barely up 5%. This is probably going for the gap fill now and will resume, this seems like a better buy now than it was before all this was known, those calls have not closed today so the player is holding on.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, I will have the rest of today’s action updated by this afternoon.