6/17/22 Recap. This Week Highlighted Why Charts And Unusual Options Activity Should Matter To You

Market was down, but If you followed me you outperformed

Im gonna make this post free, for all of you on the fence about joining, read this and decide if subscribing is worth it or not.

I want to start off by saying my post sunday night highlighting the selling of the $269/260 put spread as my favorite trade this week has played out perfectly. If you followed, well done. It’s 12 pm here, Im visiting my parents, and I was going to head out early for the day. The chart below is the one I’ve highlighted all week, look at the PERFECT bounce off the weekly 200, that’s why you look for critical levels and sell puts or put spreads lower.

As I look back at that chart above what I am most proud of is my performance over the last month. On May 17th, the QQQ closed at $306+. We are at $274 as I type this a decline of 10%. The Chart below shows you the daily.

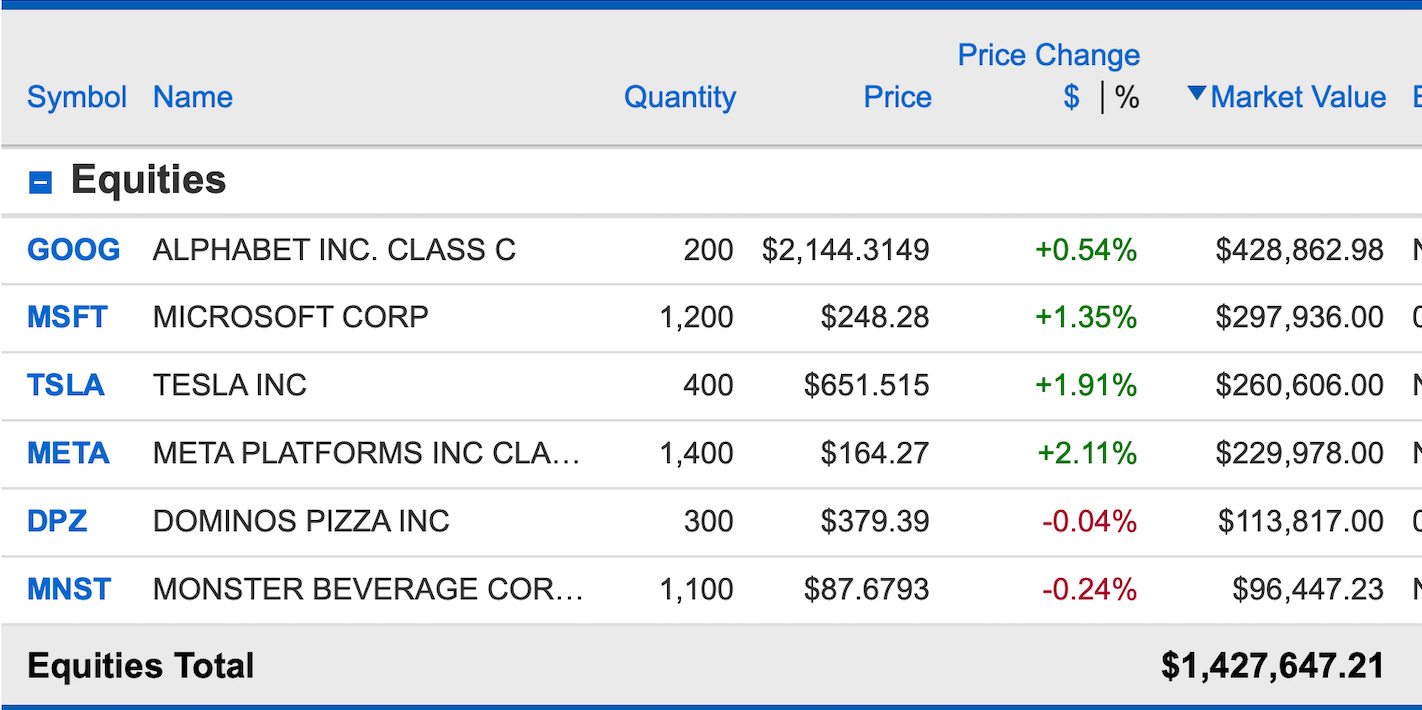

And yet with that 10%+ decline in the QQQ I was actually positive in that time frame, really does show you how proper utilization of options can lead to outperformance. Here is the 1 month return from my brokerage, I am up 1.74%, nothing to write home about, but all things considered, with how horrible the markets been, I am ecstatic.

Now onto why unusual options matter, I tweeted this 4 days ago, I began seeing massive put buying on energy names

And guess what followed? The XLE and oil names collapsed, have a look at the chart below for what happened from June 13th on. The XLE fell almost 15% in 4 days since. Almost like these guys buying up all the unusual activity knew something, weird how that works.

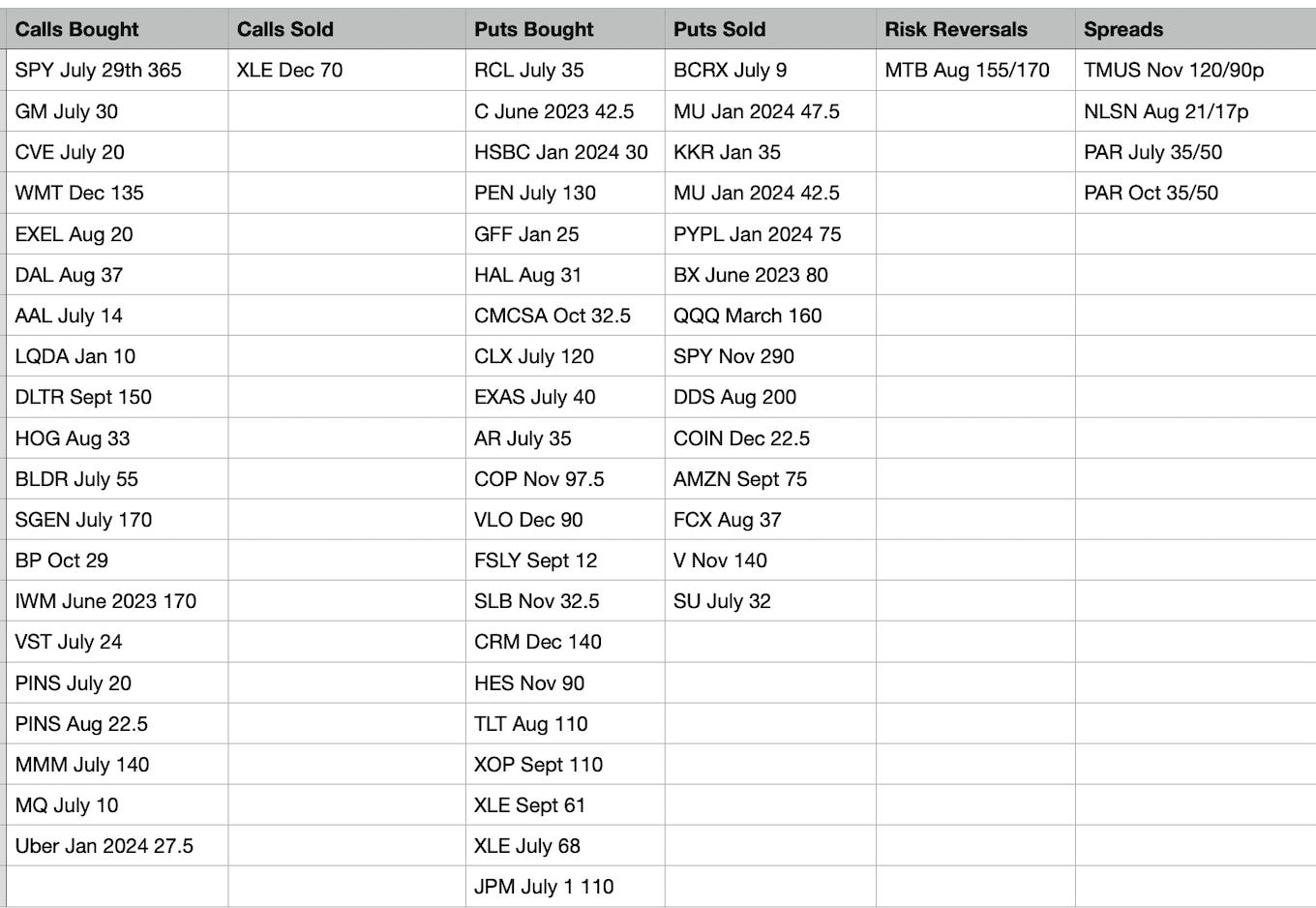

Let’s get into today’s odd flows

What stood out?

Holy cow are they still loading up energy put:HAL,AR,SLB,HES,COP,XOP,XLE my god they really are trying to kill oil names

Pinterest AGAIN with multiple blocks of 10,000 calls, I think i’ve noted it the last 3 days

The put sellers are out selling them at levels you likely won’t see ie Amazon so $75, KKR $35, V $140. They’re just looking for easy money and the ability to potentially steal shares.

Going into next week Im still long all the same names looking for a bounce but I have really handcuffed the positions with short calls for next week. I think we will retest the 269 level again and who knows from there, I have a lot of charts to look over on the weekend and from there I will decide what to do and post my best trade for the week sunday night.

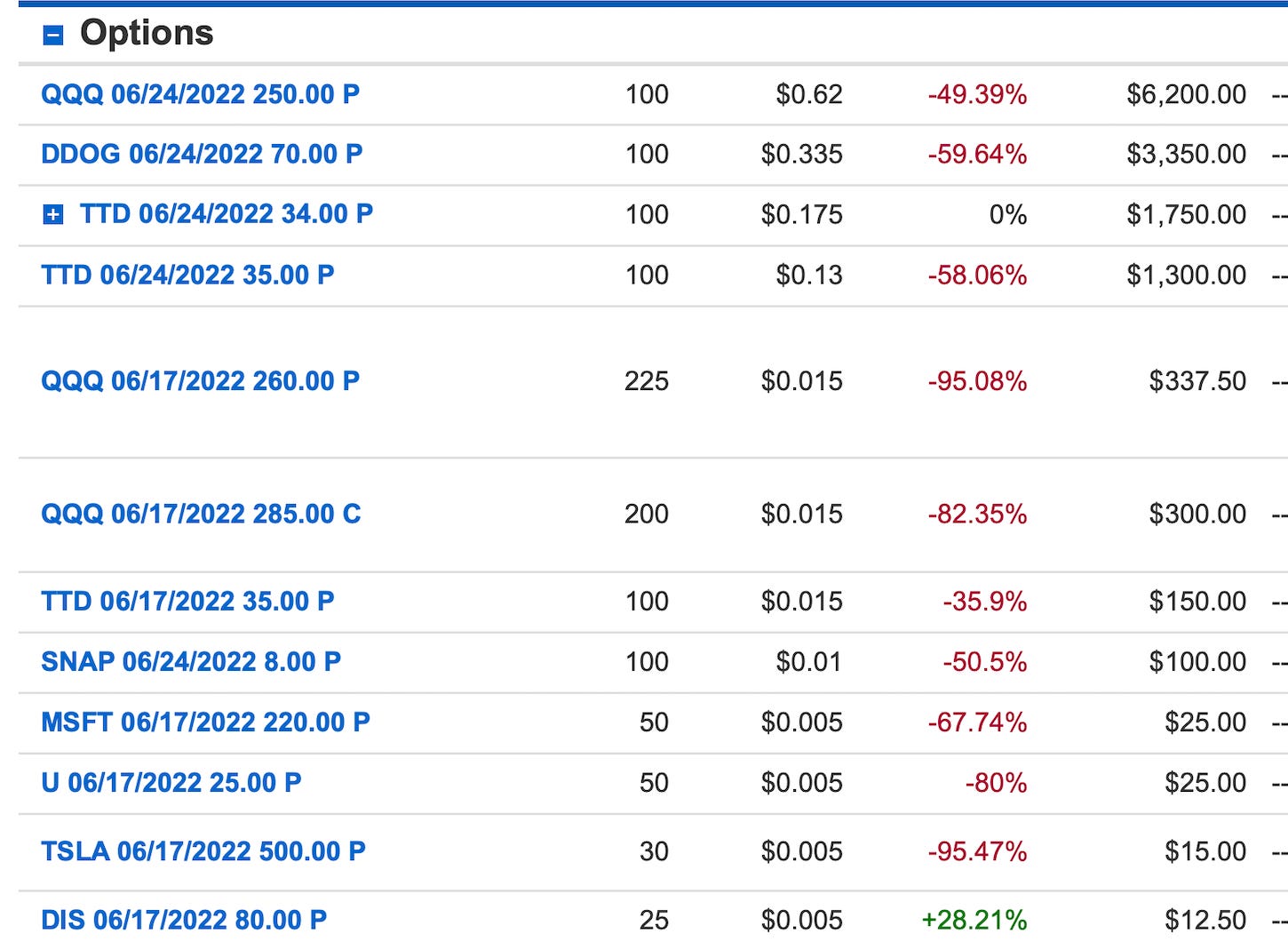

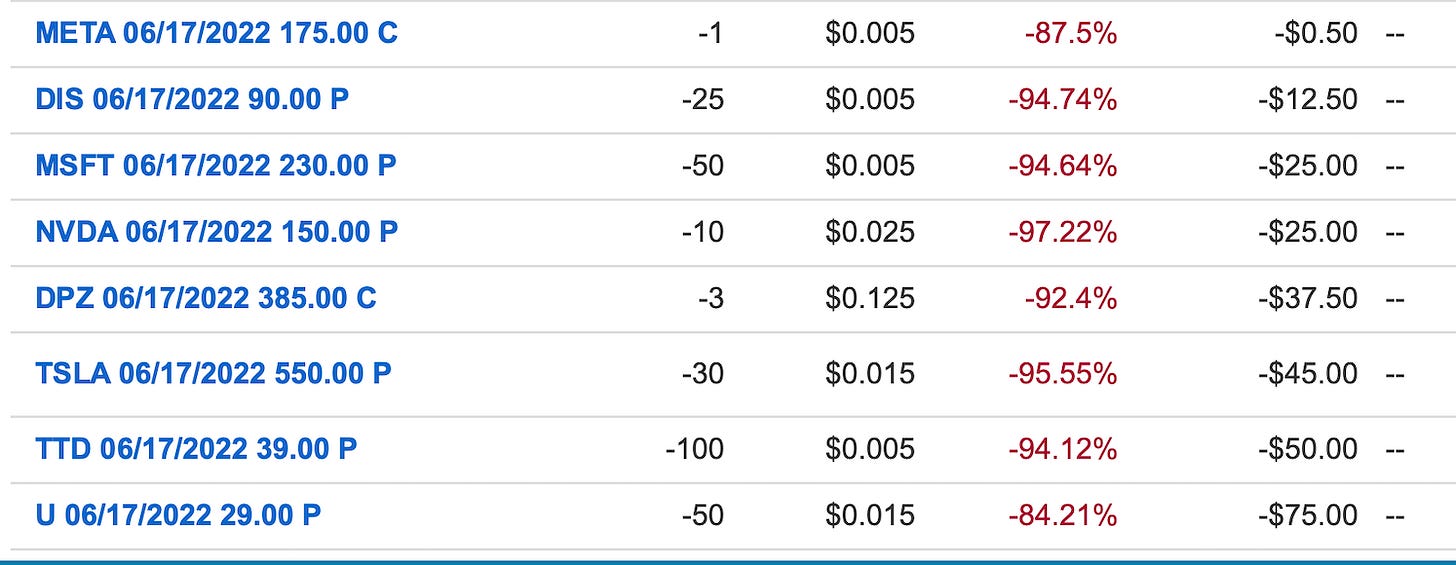

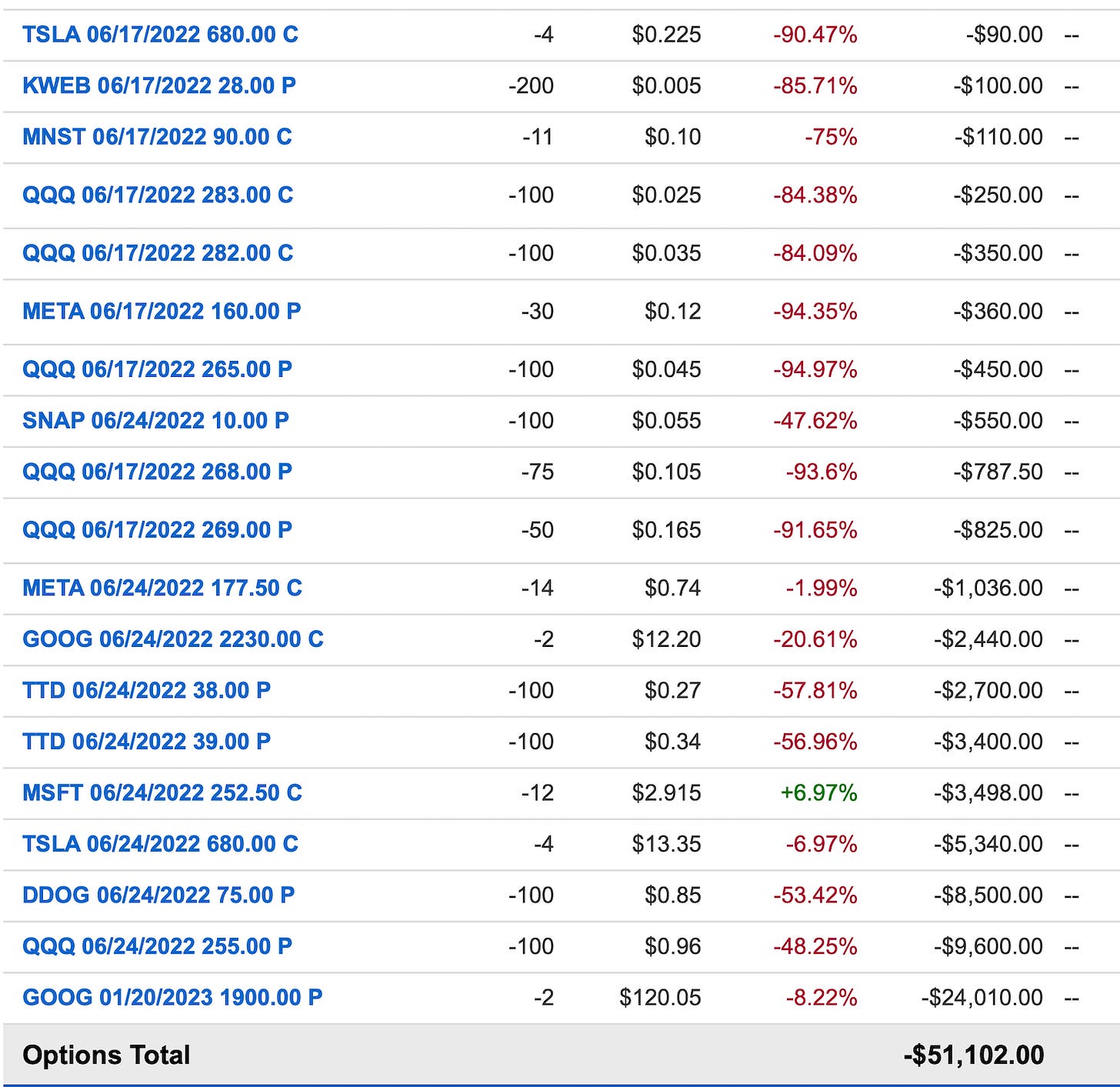

On the options front all my trades appear to be nearing expiration worthless which is what you want when you sell premium. I added some put spreads for next week on the QQQ today at 255/250. I added more on TTD at multiple strikes below $40 which is where the 52 week low is.

All in all Im very happy with how the week went. The QQQ closed last friday at $288+ and its $276 now as I type this, up $2 from when I started so with the market down around 4% I was slightly positive, and that’s all Im looking for. If you outperform the market week to week, you are doing fantastic in this current environment. Anyways, have a great weekend everyone and remember the market is closed monday as well for Juneteenth, so I will make my post on sunday/monday night.

Thank you so much for the post on Monday!

3 of my 4 (AAPL, MSFT, NVDA, LOW) trades were profitable.

I sold a put on Lowe’s at $180. Should I ‘Buy to Close’ the option and take a small loss OR get the stock assigned & sell July 15th monthly call for $180?

Hypothetically, if we were to not get fuel prices under control and if the Fed did 3 more 75 basis points what would your opinion be on how to best play this?