6/2 Recap

The Bull market rages on. This morning we had a hot NFP print and as we’ve seen with all the other hot prints we’ve gotten recently, every micro dip is a lifetime opportunity to get long equities. We keep roaring ahead and today the other 490 companies in the market finally kept up for once. I don't know how anyone can watch this price action and remain bearish. Remember, the market is never wrong, it’s only the participants at home that are wrong.

The daily on the SPY is a work of art, multiple failed breakdowns followed by a move to highs. The moving averages are all curling up and now really isn’t the time to get bearish. Does macro not matter? I can’t really answer that because I’ve spent my life following price action and the flow of options. Those typically front run news, earnings,etc in this case are we going to see a surprise that the economy is better than we thought in say 6 months? I suppose it can’t really get much worse from a data standpoint, can it?

The weekly is clear as day breaking over some huge levels we hadn’t crossed in a year. The RSI still isn’t exactly overbought yet, so it can run for a while longer. Look at all the long wicks lower in the last 6-7 weeks, every dip is bought, you’re really fighting gravity trying to short this.

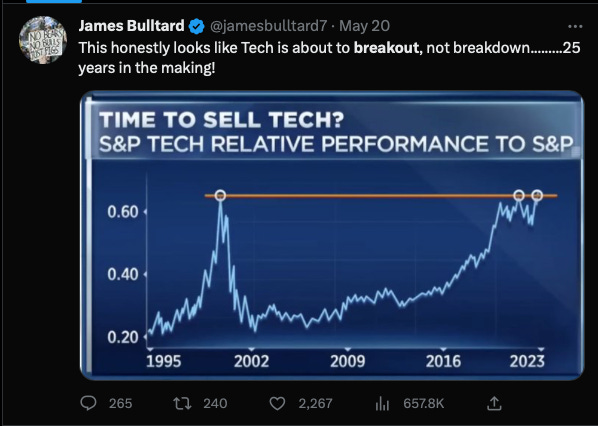

Again back to this tweet 2 weeks ago where the bears were out in full force in the comments.

Would you say this has played out since May 20th? Tech seems to be breaking out vs the S&P. Everyone was looking for a breakdown, but the saying is the longer the base, the higher the space and this is a 25 year long breakout. Believe me, it’s as confusing to me as it is to you. It doesn’t have to make sense, that’s why the charts are the charts, they tell the truth with no narratives baked in. Tech is breaking out, the end. Could it be a false breakout? Sure but until we break back down you don’t assume that. Even names like the regional banks that have been dead for some time. Remember, I mentioned in the weekend post last week as my favorite trade as they bottomed out, those exploded this week. So everything is just going now.

Trends

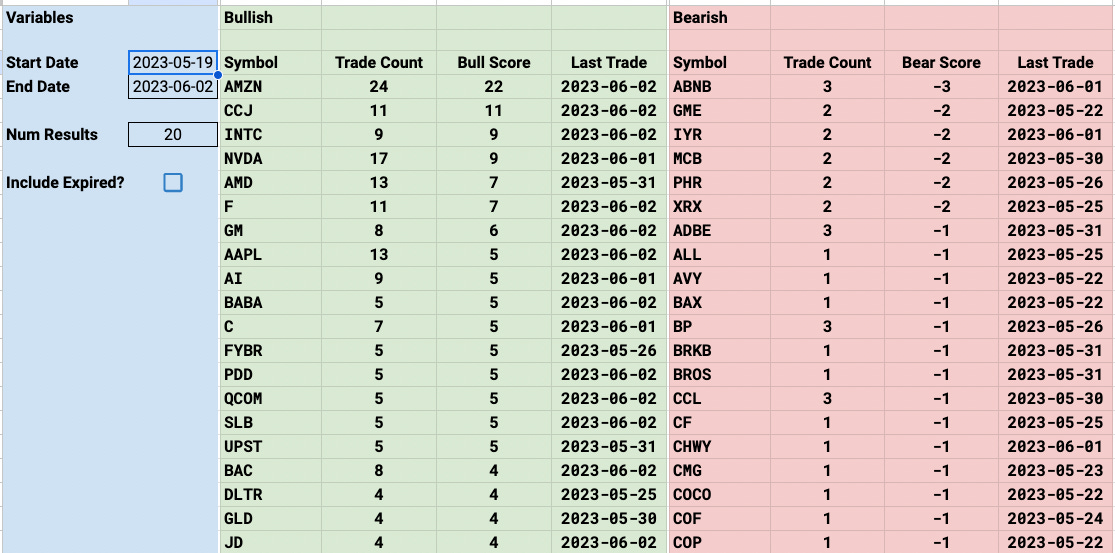

Some really big moves this week with the top of this list. AMZN,CCJ,INTC,MRVL all had huge weeks.

Week To Date

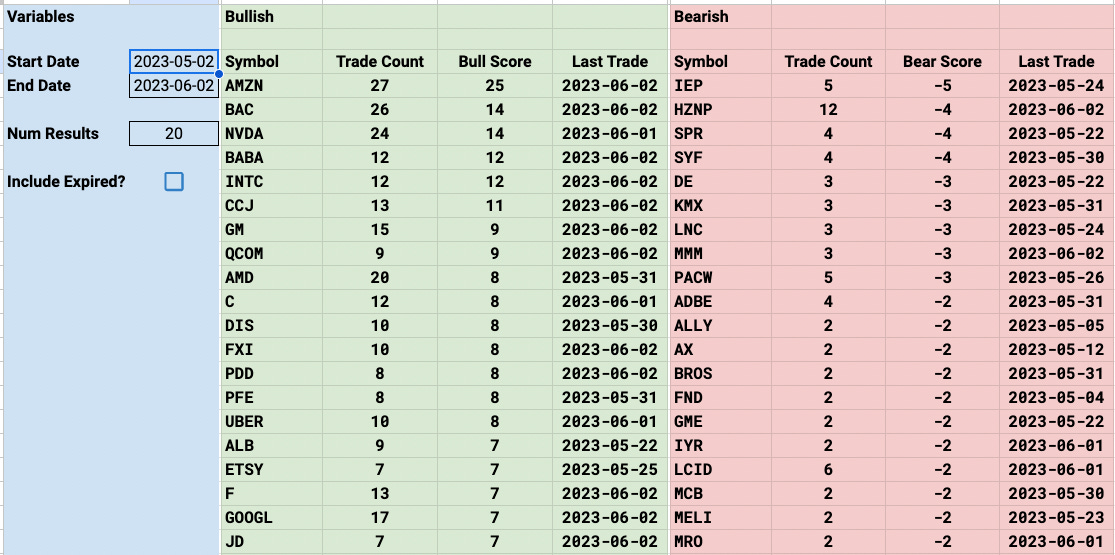

2 Week

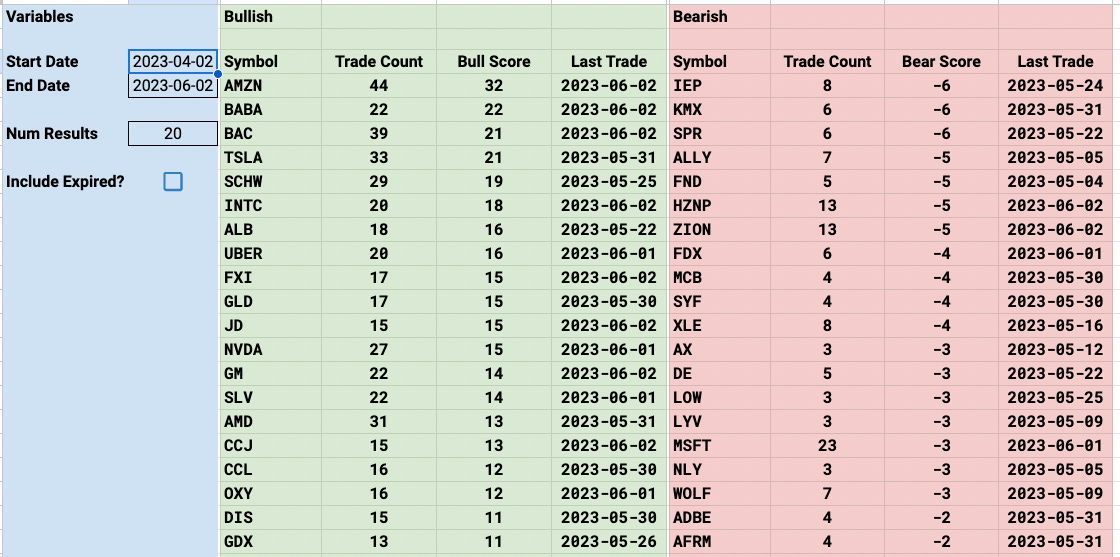

1 Month

2 Month

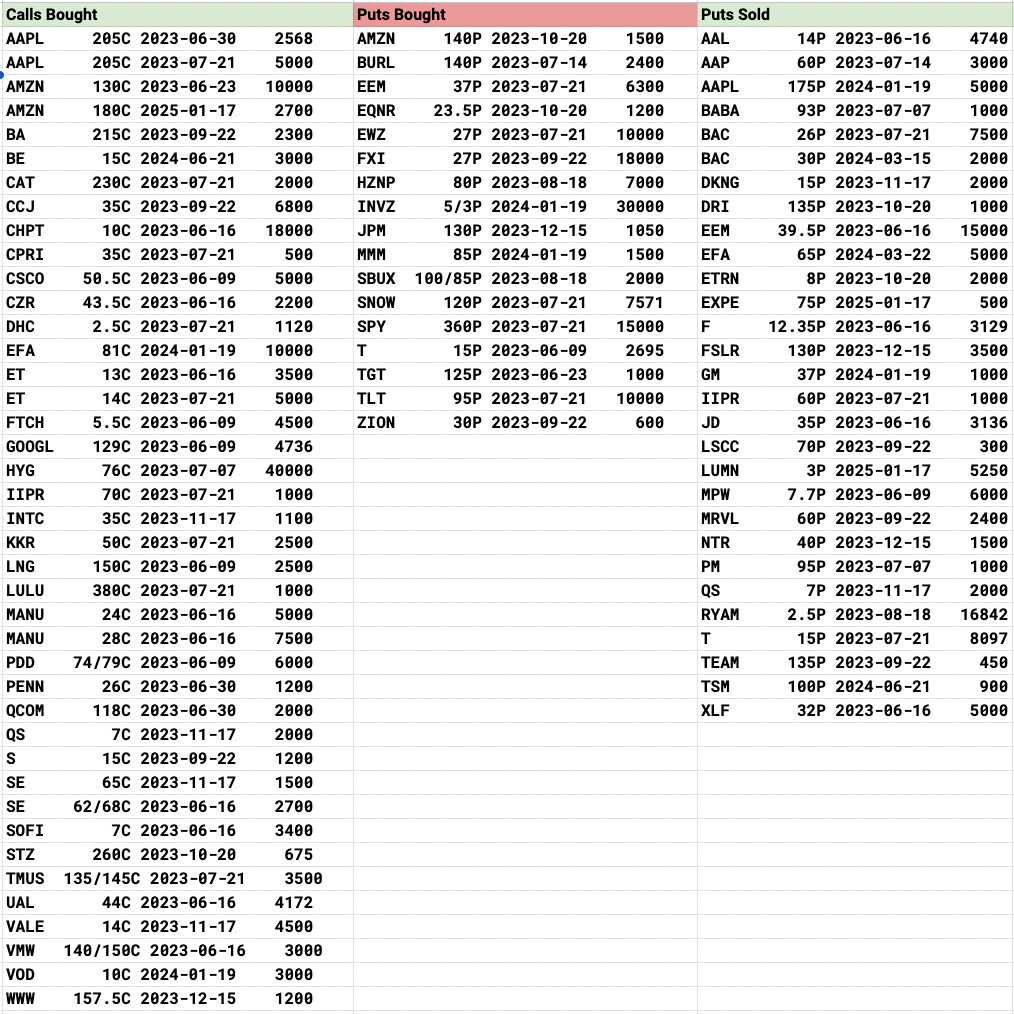

Today’s Unusual Options Activity & What Stood Out

90 Trades. What stood out most to me today is the lack of bearish trades I saw going off. You see how these tables are somewhat even most days. Today was just bears giving up. The VIX is below 15, this is when you’re supposed to be buying puts and nobody is even daring do so. Some of the names like VALE that I highlighted yesterday were up nicely today +4.5%. I see a few more trades below on MANU for June expiry, that deal is reaching a make or break point. If it doesn’t happy by July 1 transfer window opening, it likely won’t, so that should see something soon. Otherwise not really much of specific not for me today. Remember next week is Apple’s big event so that’s why you saw all the bullish flow this week, does Apple turn up and cross $200/share? Some nice sized bets placed on that.

What Did I Do Today?

Well, my timing on this Amazon trades was as close to perfect as I could get. I’m up $500k in less than 2 weeks since I put it on. I really can’t complain much as it makes my life easier going into summer now that I have a cushion to work with. Remember that huge block of 96,000 calls bought that I noted right before I went all in? That plus the golden cross forming on the chart which is the 50 crossing the 200, those were happening simultaneously and were my tell to push all my chips in. Would I do that on another name? Probably not, but you all know me, I know Amazon like the back of my hand, so my comfort level combined with those 2 factors pushed me to make the big bet and it’s really paid off.

I’m sitting at my all time highs right now and if you look at when I started writing this substack last June 8th, I’m up right around 100% right now in just under 12 months through all the chaos so I am more than thrilled. Alot of these names that you see up YTD like META or TSLA have done great, but zoom out 12 months, the returns are pretty bad for most names going back 12 months and I feel lucky to have weathered the storm so to speak. Bottom line, the trade seemed nuts when I put it on, but 2 weeks later it doesn’t seem so crazy.

I hope you all have a great weekend and tomorrow I will have my best idea for the week ahead followed by my chart session Sunday morning for the week ahead.

Enjoy your weekend. Hope your Dad is feeling better.

Thanks for sharing! 🙏