6/20 Recap

We came down this morning and tested the 8 ema and bounced perfectly. It’s still early in the day, but as long as we’re over the 8 ema, we’re in a healthy uptrend with occasional backtests.

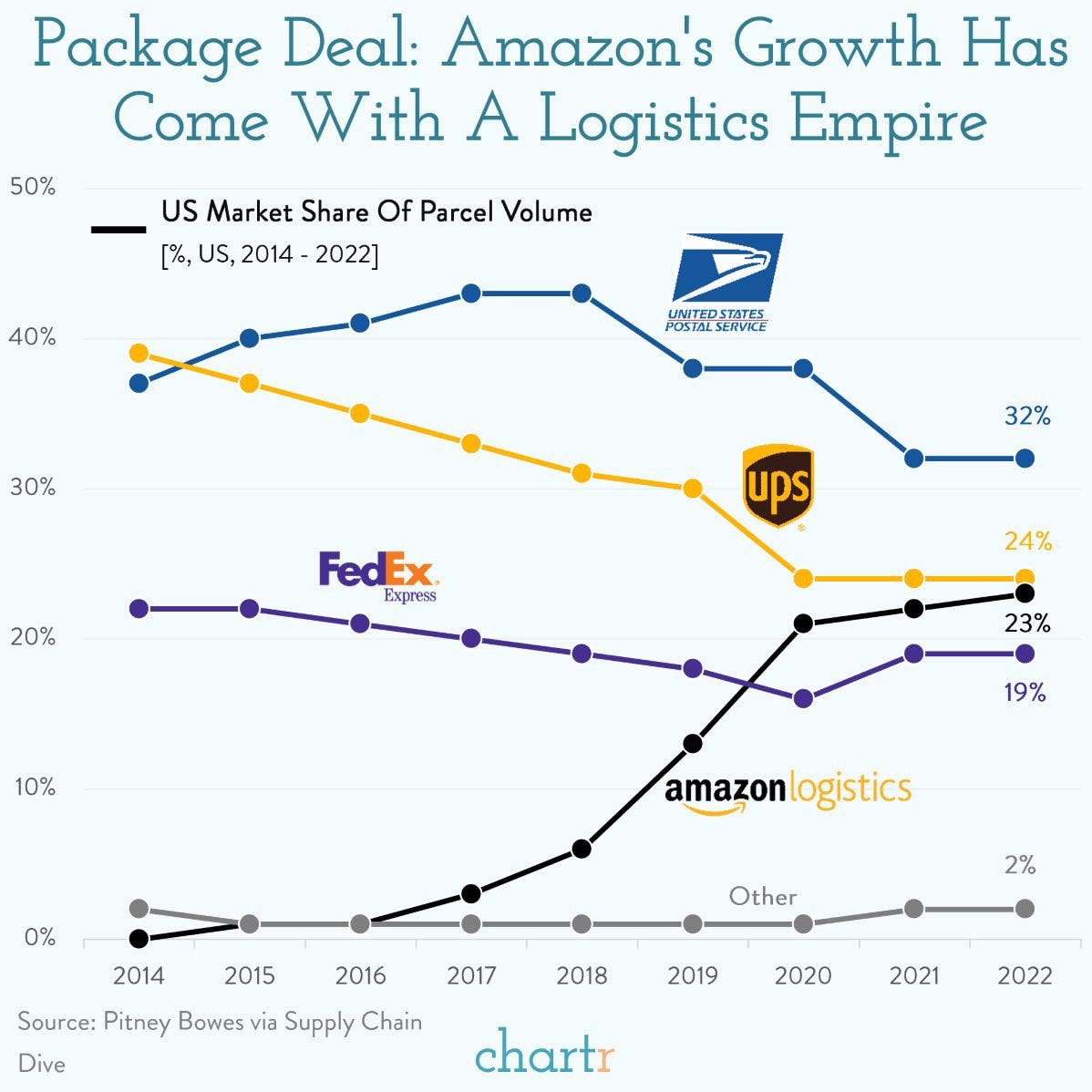

Alot can change this afternoon because Fedex is reporting. A bad print would send ripples through many big names like Amazon,UPS, and likely retailers as a potential signal of the weakening consumer we’ve heard about forever. On the other hand if Fedex has a weak report, it could just be because they are losing share to someone else as we saw in this data at the end of last year. Just keep an open mind today and don’t panic if Fedex dumps and takes many things with it, markets overreact, but Fedex isn’t the barometer many think it is. It’s just a 4th place carrier that isn’t of much significance in my opinion. With that said we’ve gotten some surprise retail data recently and FDX could be in-line for a big move up. It is pricing in a 6% move as of right now.

Trends

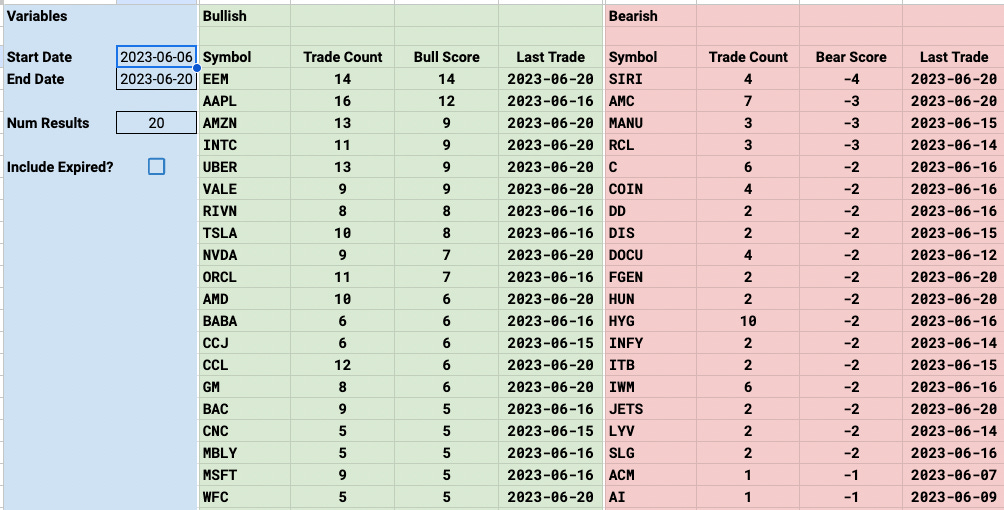

Short term, the emerging markets are leading the way with heavy activity the past week. RIVN is a top trending name and considering it’s size its been notable as I mentioned a few times last week, it’s up 4.5% today and has a very nice looking chart setup still.

1 Week

2 Week

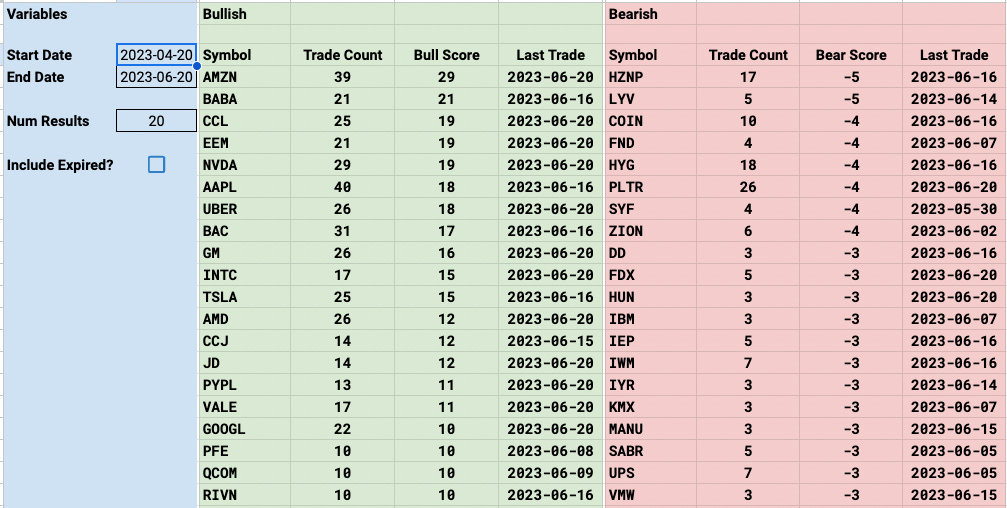

1 Month

2 Month

Today’s Unusual Options Activity & What Stood Out

111 Trades Today