6/23 Recap

The market gapped down everyday this week. It didn’t really shock me as I mentioned in last Saturday’s post a period of weakness was likely here. You can see where we are in the chart below. As of right now, we’re stuck under the 8 and 10 ema on the daily, that’s what the arrow at the top is pointing at. A clear sign of weakness, the Nikkei was down 1000 points overnight which weighed on us. Lower you can see the RSI pointing south and well off its overbought highs from 6/15 and below that the final arrow is showing you the macd crossing over to bearish after a month of a bull run. This all does not look optimal for bulls………

With that said, if we zoom out to a weekly look, even all that weakness, it was within a small range, and we’re forming an inside week right now. That is this weeks candle is fully within last weeks, thus a tight consolidation. This is normal action with how far lower the 8 week average is. See that blue line below? We ran so far so fast, markets always have this way of tagging the averages, so either we go down or they go up, but that takes time. In the short term, we have a little weakness, build a base, until the market touches those averages and then we decide where we go next.

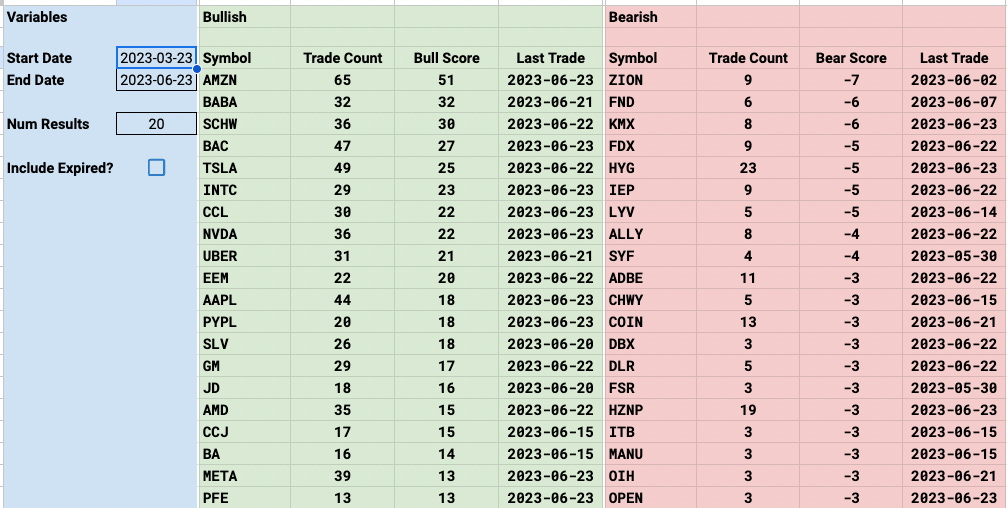

Trends

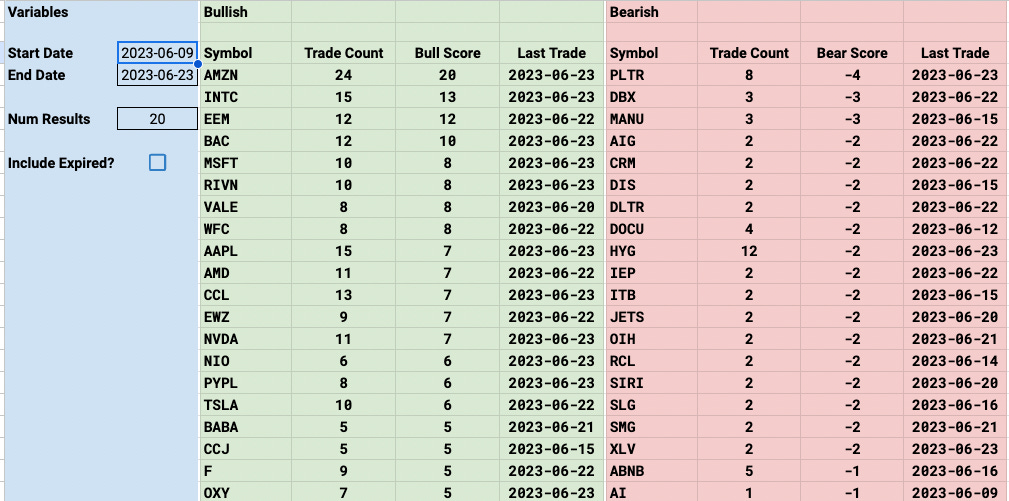

The interesting thing here is although Amazon has been the top trending name for months on end here, it was the hottest name this week too, by a lot and yesterday right after those 20,000 calls were bought at 130 not only did it take off, but today it’s displaying serious relative strength in a deeply red market. That’s the thing with these trends, they’re built to model what names are seeing inflows of unusual size which should show where the accumulation is occurring. They don’t have to work right away, it took weeks for this Amazon trade to work and it finally did. All those monster trades accumulated back in February,March,April finally paid off now after a while.

This week it seems like banks are back in favor. BAC,JPM,SCHW.WFC are all atop this weeks option flow. That doesn’t mean run out and add them now, but begin to scale in selling puts much lower. Even a name like PYPL that was left for dead is finally seeing action again.

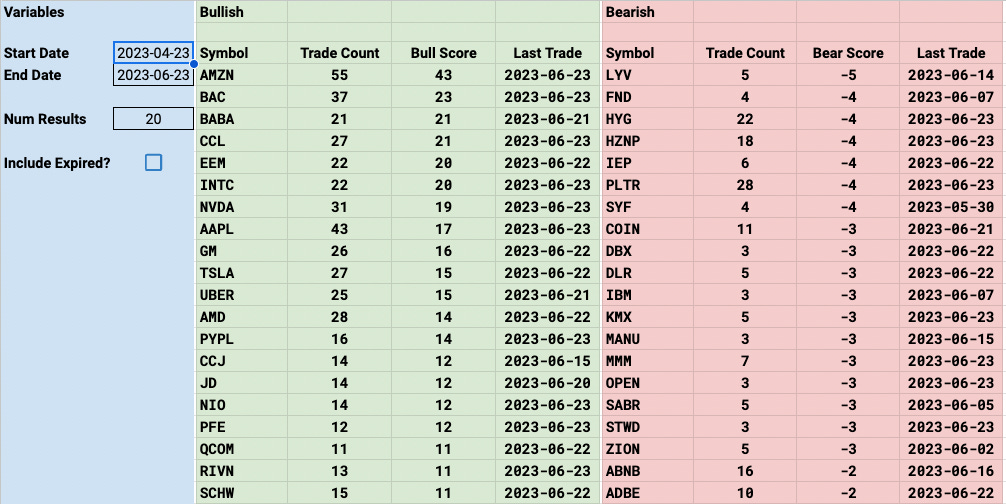

I added the 3 month today too, you can see the names that have seen the most over that timeframe, it’s the hottest names of the past quarter. NVDA,UBER,AMZN,CCL,TSLA all at the top. That’s exactly why I wanted to develop this trend system, to monitor the flow of capital.

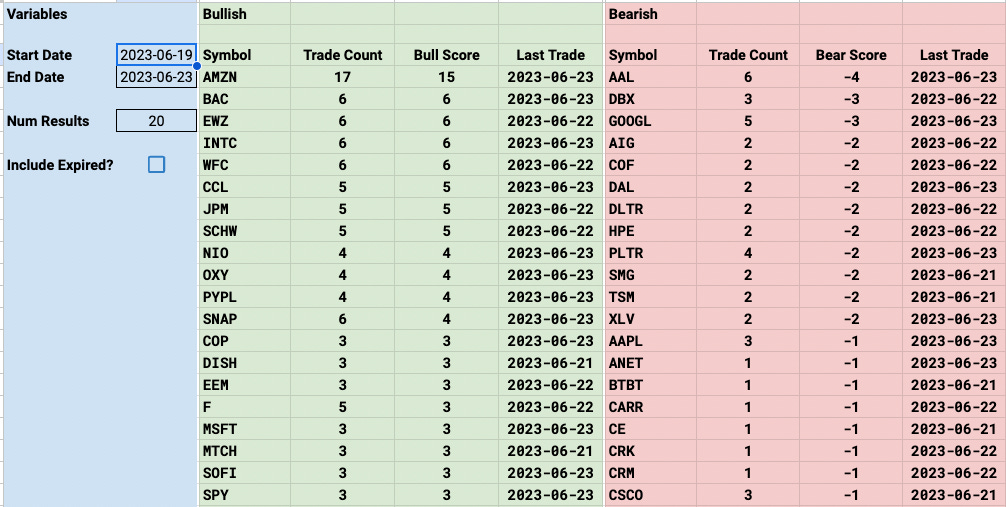

Week To Date

2 Week

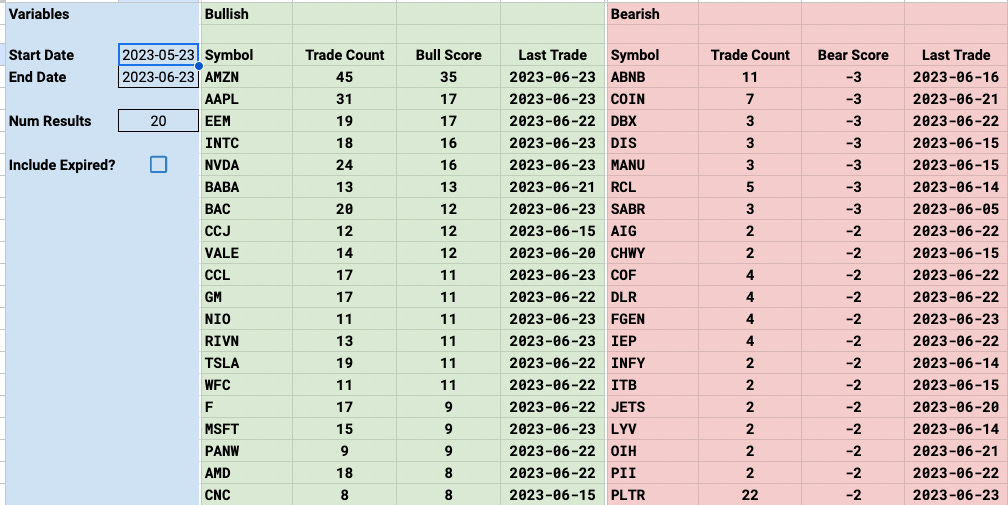

1 Month

2 Month

3 Month

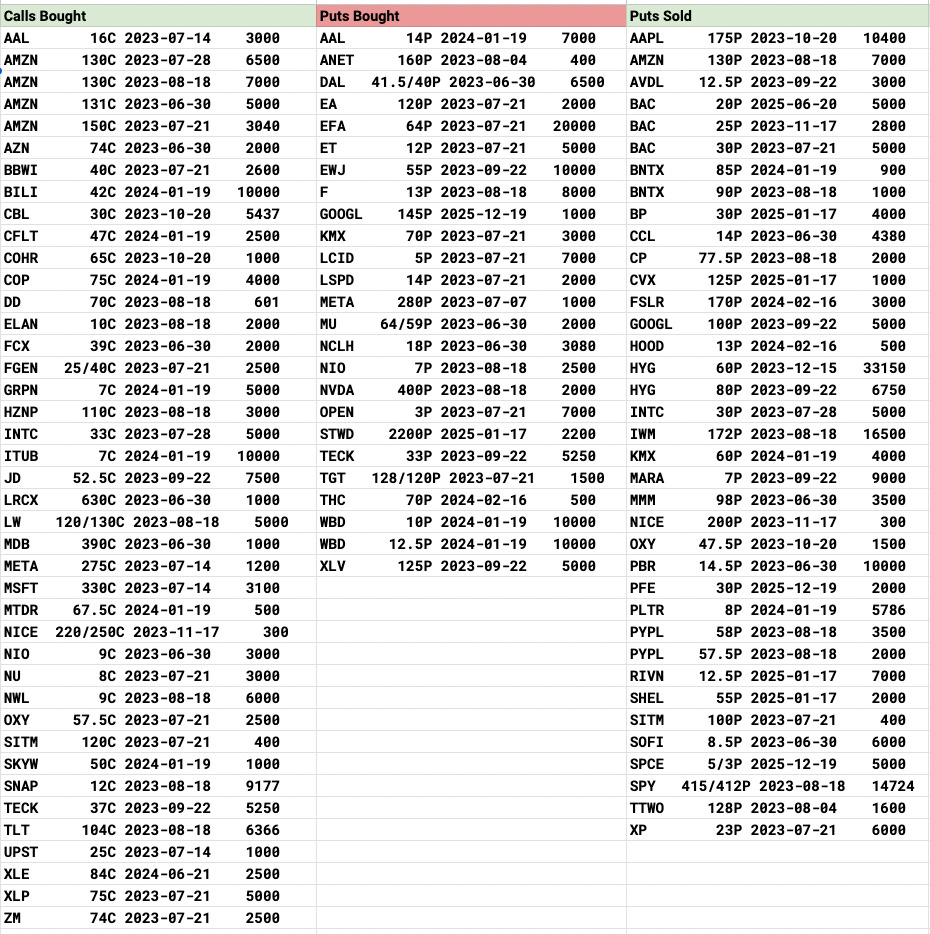

Today’s Unusual Options Activity

105 Trades Today

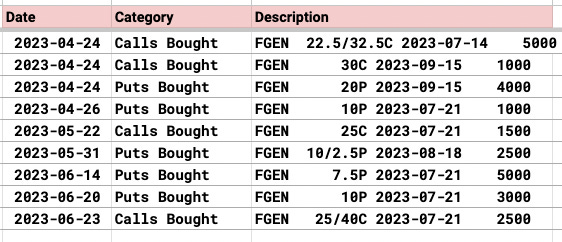

FGEN - 25/40 call spread in July bought 2500x. The stock is $16.xx I don’t follow any of these at all, that doesn’t appear to be a hedge. The flows in my database aren’t too inspiring for long. This seems like they have data because some real boom/bust trades in here

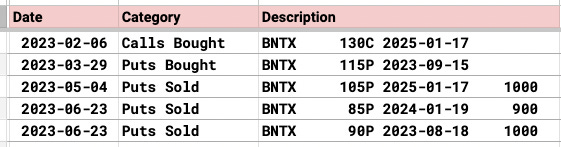

BNTX had 2 large put sales today. I always like these because they’re levels funds are looking to put longs on at. I don’t really have anything of note in my notes here but I do some previous put sales still open

LW took off after this call spread was put on today. I have nothing else in my notes, but you can see it took off midday once this was on. 5000 call spreads bought 120/130 in August.

SITM another name that never sees anything, today it saw a risk reversal in an odd lot selling 400 puts at 100 in July to buy 400 calls at 120. The stock is down 4% today but again this name rarely sees any action, so even a 400 lot, is an odd one.

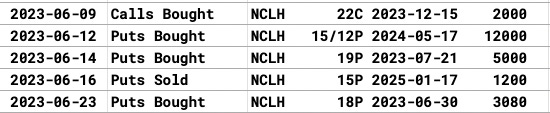

NCLH saw some put buying into next week, I assume because CCL reports and these are either a hedge or someone looking for a move down on that report. I’ve noted 5 trades there this month, and 3 were bearish. The cruise names have run really hot a pullback wouldn’t shock me.

Trade Of The Week Update

GT did not do anything this week, that’s fine, the $12 puts I suggested selling at that gap fill are still the play. That gap just feels like it wants to fill, but you can see it fell on lower volume all week, that’s a sign sellers are getting exhausted and an equity is preparing to move up.

The weekly chart below shows a perfect bounce of the 8 week. The name just remains in a very tight consolidation around the 200 week average. I still think this is a great name to tuck away and let the activists do their job.

What Did I Do Today?

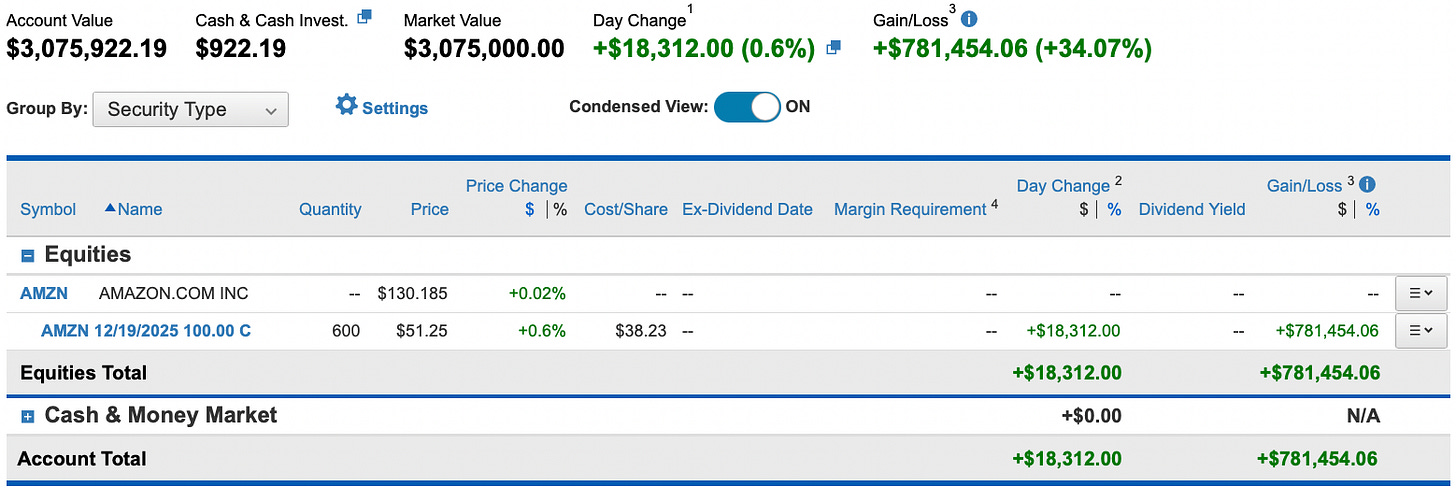

Another solid day here with Amazon continuing forth after all those call buys the last 2 days. I’m sitting at all time highs here, I’m up something like 125% now in the last year since I began writing this substack. It’s been quite a journey this quarter especially with the 4 times I went short the market on the recent breakdowns which were complete failures and then the pivot to this Amazon trade right after I saw that massive $250m call buy a month back, remember the 96,000 contract trade, which was one of the largest I had ever seen, and lined up with the option flows in my database. That 1 move to follow it, ended up leading to that huge $781,000 gain you see above in the last 4 weeks. It seemed nuts at the time but I know what I saw in that 96,000 lot buy which was so unbelievably rare to see here in the 5/23 Recap

and I went all in right after that. Crazy how quick your fortunes can turn when you believe in your work. I did and pushed all my chips in. All this monitoring of options flow, if it pays off just once like this trade did, it was worth it, right?

As for Amazon going forward as you can see below it backtested that breakout from yesterday and continued higher today, textbook action really, all dips were to be bought today.

The weekly is getting extended you can see how overbought we are now and you can see right where we are stalling out right now. Amazon is up 8 weeks in a row, when will it take a break? Likely soon, do I care? Not really I’m in December 2025 leaps, let’s see how the story unfolds going forward, you can see all the bullish action today as well.

I hope you all have a great rest of the day and I will see you tomorrow with my best idea for the week ahead, and Sunday I will have charts for the week ahead

Good work James.

Keep up the good work James! enjoy the weekend!