6/24 Recap

The SPY is clinging onto the 8 ema and momentum looks to be weakening. If we lose the 8 ema our next target is the 21 ema which isn’t far behind. That is the one we have to hold or we’ve got bigger problems. Semis are selling off hard today and their impeccable run may be nearing a finish. The move we saw in the SMH this year was all time and was due a rest either way. You could feel it with semis being the bulk of daily option volume across the board. The market always does this though, it always overdoes things in one direction and while these semis are all great companies, sometimes things can be overdone.

Recent Trades

Speaking of semis, last thursday I mentioned that NVDA was starting to look like a blowoff top. There was a massive call sale, it was really extended and here we are 3 days later and it was down at low as 118.29 today almost 15% off highs. Those calls sold below that I showed you went from over $44.16 to $34 right now so whoever sold those vs their position picked up $10 as the stock sold off $18. That was a masterclass in how to avoid capital gains and still collect some profits.

As of this moment NVDA is sitting right ontop of the 21 ema so it should bounce here or there is much further downside to the 50 day below just over 100. You can see the MACD also flipped negative today for the first time in a long time, that call seller really nailed the absolute top in the short run selling 11,000 covered calls vs their 1.1M shares.

Trends

1 Week

2 Week

1 Month

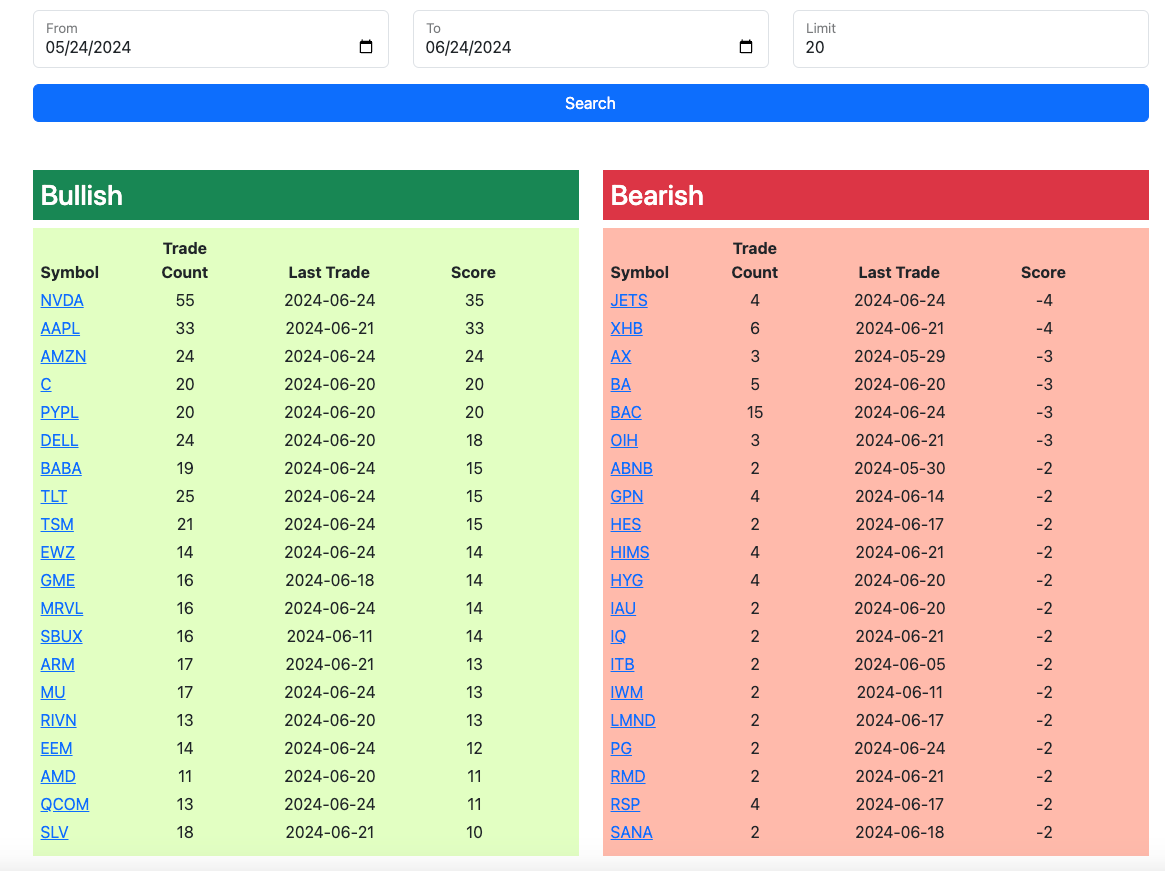

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow morning and the rest of today’s action will be added by tonight. There was alot of calls today so they are not all in the screen grab below, check the database to see them all.