6/27 Recap

The market is attempting to push back over that 8 ema as we speak. If we close above that, there isn’t much to say other than we’re in a bull market. Forget the P/E ratios, forget all the housing data we are getting, none of that is relevant. What matters is price, and price above the 8 ema is a sign of strength. Still lots of time left today but for now, this is a really impressive move after 2 days of weakness.

We’re seeing a bit of a rotation within the “magnificent seven” that make up the bulk of the weighting in our markets. As of right now Apple,Amazon,Meta remain the only ones showing short term strength by remaining over the 8 ema the other 4 are below with Google being the weakest notably red today with /NQ +200 look at this chart below. Even though Google turned green for a bit all those moving averages are converging above and pointing lower, this name should remain weak for some time until it moves back up over those.

Another recent leader that doesn’t look so hot is Tesla which is also well below the key short term averages. Then again this is the kind of name that can pop on anything, but for now I’d put it along with Google in the avoid list of the big 7 just until they can get back over the 8 ema.

Meanwhile look at a name like Apple which I would say is the strongest of the large names . They never violated their 8 day in this whole recent dump we saw, that is how you separate the strong from the weak. Very impressive action here.

Trends

Some interesting names emerging here like STNG,ASO, SPOT these aren’t names that see much action but here they are seeing flows this week.

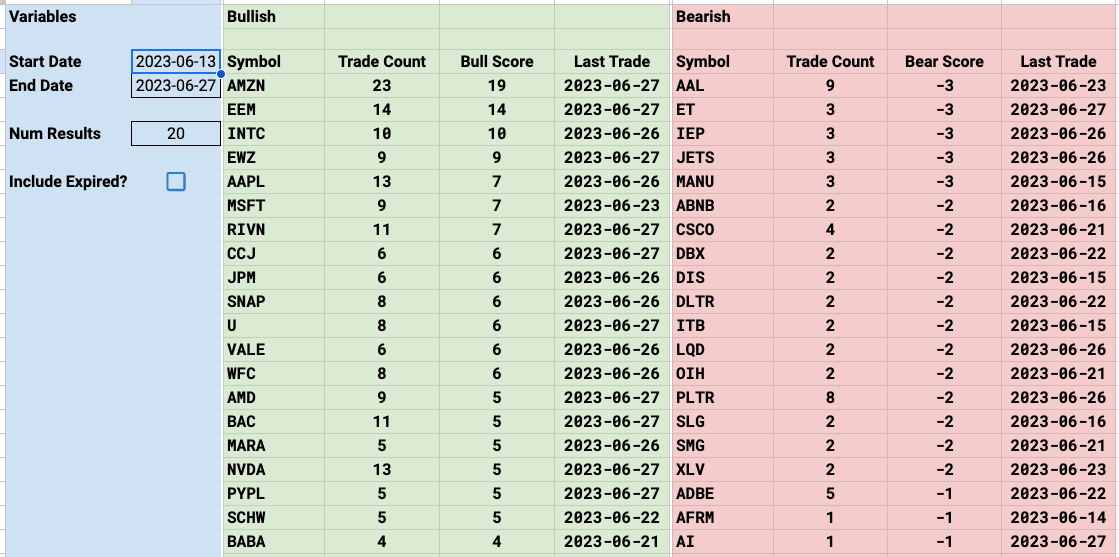

Week To Date

2 Week

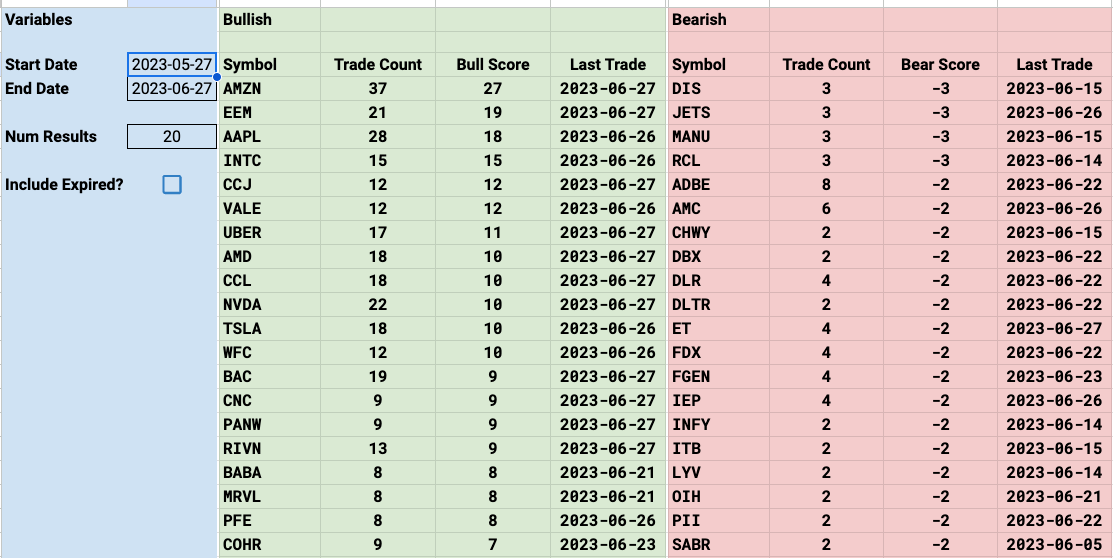

1 Month

Today’s Unusual Activity & What Stood Out

101 Trades Today