6/27 Recap

We remain on edge for the overall market. Tomorrow morning we have PCE data and tonight we have the presidential debate between Trump and Biden. We’ll see what direction the market takes, but for right now we just remains glued to this 8 ema and are really 1 bad session away from breaking a major trend.

On a good note, Amazon finally broke out yesterday and carried forth today. As you all know that is by far my largest position and this was the moment I’ve waited for since I entered this trade in May of 2023. Breaking above the 2021 highs and closing there was the stock moving to a new range and my leaps are up enormously these last 2 sessions. I know many of you followed that and today I rolled up my 250 short calls in January 2026 to 270 calls in June 2026. My June 2026 170 calls are basically now a 170/270 call spread. Above 270 they max out at $100 and I paid just over $28 for them. This would be the trade of a lifetime I said I thought it would be.

Funny enough this morning another options service, that charges $400/mo, caught my trade and someone sent me this. I laughed because this is some really inaccurate information below, I know this because that’s literally my trade

Here is the proof out of my account. I simply bought back the 250 calls in January and rolled out to the short June 2026 270 calls below. Filling 1200 calls for a trader at home is not easy I had to break it up into alot of smaller trades.

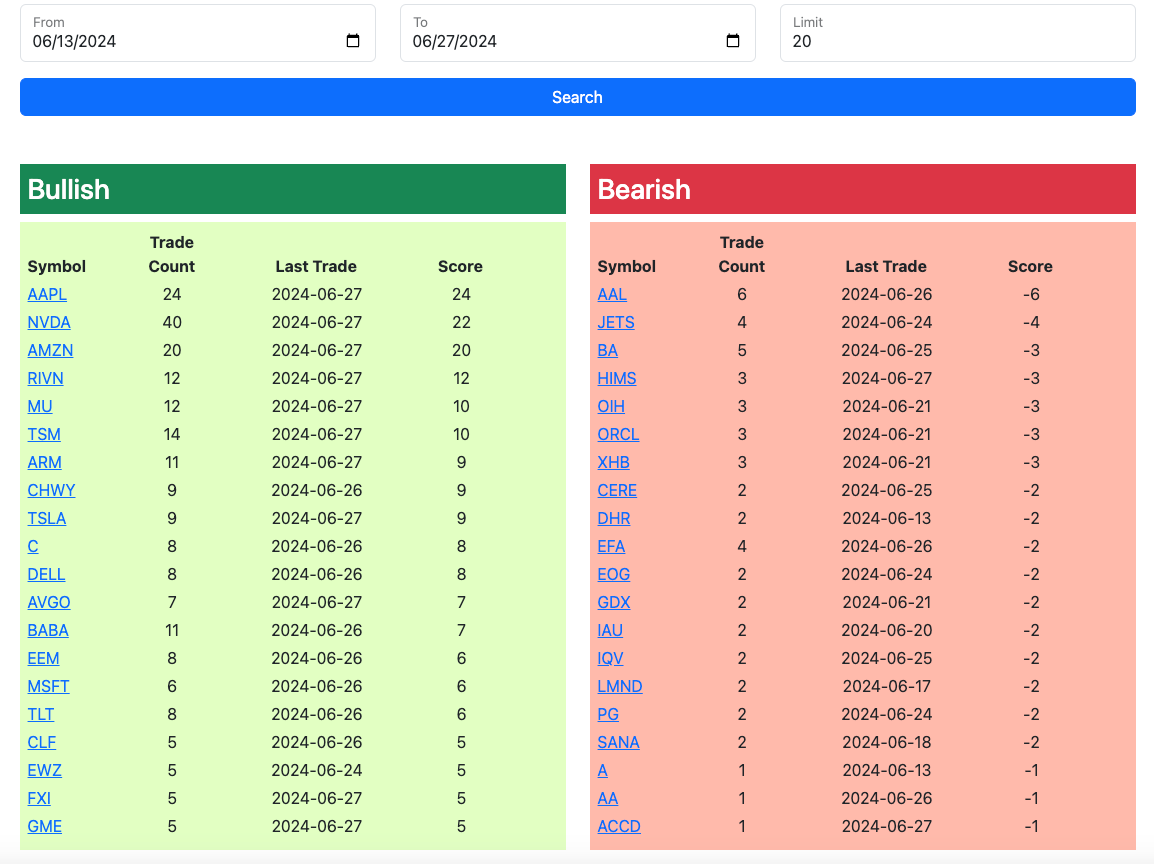

I’m not one to badmouth other services but you really have to be careful who you follow. Imagine the people in that service above buying those 270 calls thinking it was some fund buying 270 calls when it was really just me at home selling them. I know alot of you pay for all these other services but at the end of the day, you really have to do your own diligence because we’re all just reading and interpreting the same data. I’ve given you my take on why I built this place and fixed alot of things I didn’t like about other options services. I think the trends tool I share daily is about as good as you’ll find because one trade can be hit or miss, but seeing the directional trend on names seeing bullish/bearish flow is a much better indicator.

Recent Trades

Let’s talk about one that didn’t go well. IP from this weekend. SUZ pulled out of the buyout talks last night and IP dropped instantly below 40 bought was bought back up near 42 by the time the market opened and its near 43 now. The stock is not a zero without a buyout. If you remember I gave 3 options to play the potential buyout

The aggressive option

The normal option

The conservative option

The middle option if you took it, you’re down today, but those 32.50 puts in January are still going to likely expire worthless as the name is nearly 42 after a failed buyout and you likely end up losing 25 cents/share. I would sell even more puts today higher at 35 and you can recoup what you lost on the calls. The conservative trade is still going to likely expire worthless with you receiving a full profit but the point was, I never give that many trade ideas on 1 name. I did here because this was a risky trade. Those bets last week were just wrong, they bought alot of calls looking for that takeout and it just didn’t materialize. It still may later this year, but regardless, IP is a solid company with a big dividend. I’d use today as a chance to sell even more puts lower because you either get a great company with a big yield lower or you profit.

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow morning at the open. The rest of today’s action will be added throughout the afternoon.

This was a really odd session, look at the table below today, one of the weirdest I’ve ever seen here. Almost no put buys whatsoever of notable size. Usually theres 20-30 at least, literally almost none today so far.