6/28 Recap

Slow session today, really slow week in terms of option volumes. It is summer, next week is the 4th of July holiday week and we’re just in that period 2 weeks before earnings begins where nobody is really doing much. The presidential debate passed last night with nothing material, PCE was fine today, overall we’re wrapping up another great quarter right now. Tonight I will look over the quarterly candles, those are most important when looking for longer term moves. Today’s candle on the SPY isn’t the best so far, but there is still time. It’s a weird selloff because the VIX isn’t really heating up. So probably nothing just quarter end games, market makers moving things where they need to.

Recent Trades

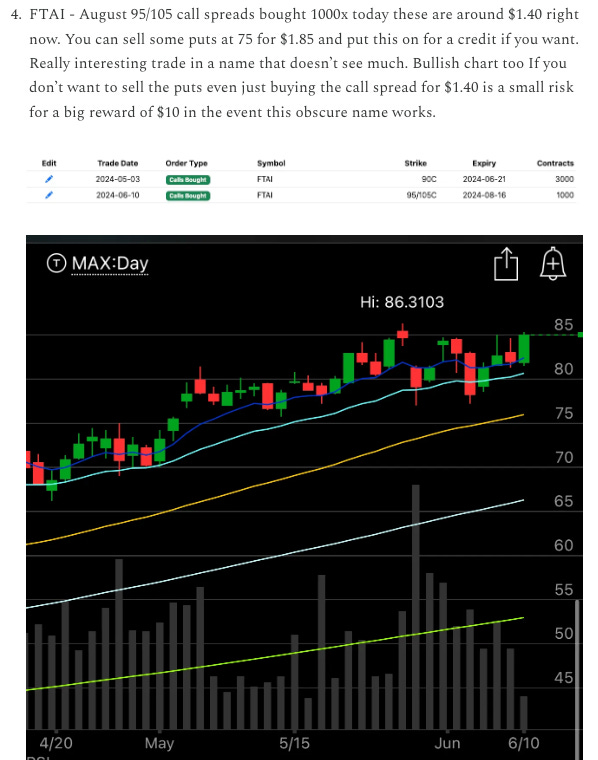

FTAI - back in the 6/10 recap here I highlighted this odd lot of 95/105 call spreads bought with the stock just below 85 for $1.40. This is over $104 right now for a quick 20% plus move up in just 3 weeks. Those calls have another 2 months until they reach full value but you could close right now for a few hundred percent. In this case, I would not hold another 2 months to eek out the last bit. If you took this, I would be closing.

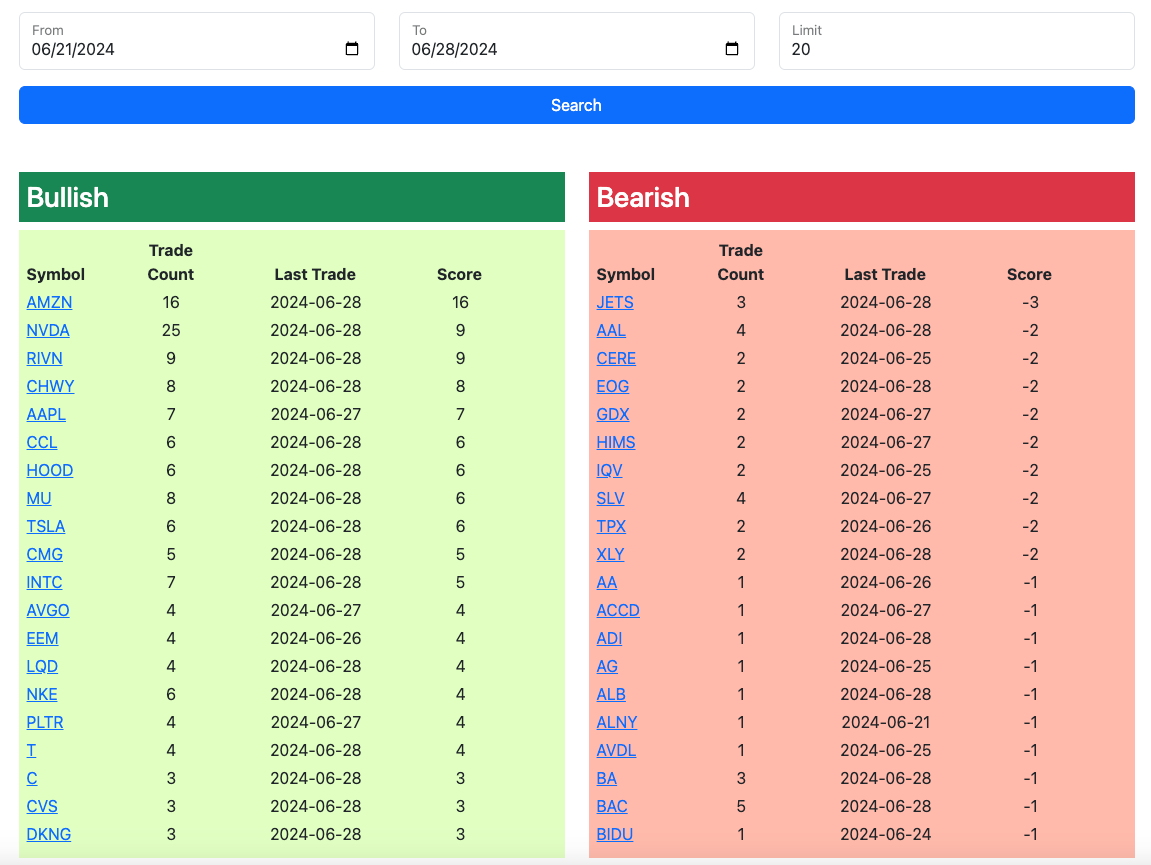

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, it will be up until monday morning at the open. I will have the rest of today’s trades added by this evening.