6/29 Recap

Pretty slow day, even the option flows were alot slower than normal, probably due to the holiday weekend coming up and the half day Monday. We had GDP data come in this morning, it surprised and the market sold off. Overall, this quarter is ending on a pretty good note, the S&P is up 7% and the Nasdaq is up 11%. This has been about as good a 3 months as bulls could have hoped for. I imagine tomorrow will be even slower if that is even possible. Housing data also came in today and home sales are reaching some of their lowest points ever. I don’t know how this ends but we’re at a stalemate of sellers locked in at low rates not selling and buyers not stepping up to meet these new prices. It’s safe to say the fed definitely broke the housing market.

The SPY remains indestructible as it reclaimed the 8 ema recently and continues to trend above it. Apple continues leading the way as it seemingly cannot go down on anything, even a year over year revenue decline this past quarter. As the markets largest component the strength it displays is incredible.

On a weekly chart you can see the well defined uptrend we have been in since last October. As long as we’re trending above you stay long, when we break below you go short, it really is that simple. In March had you gone short and set your stop at a reclaim of the trend, you would have lost a little, but you wouldn’t have been killed like these bears who are short and just ignored the trend. Look below, what in that chart is bearish? It’s over every moving average, they’re all sloping up, I understand the data is horrible but as I’ve said for months, the stock market is not the economy, those 2 do not have to correlate.

Trends

Week To Date

2 Week

1 Month

Today’s Unusual Activity & What Stood Out

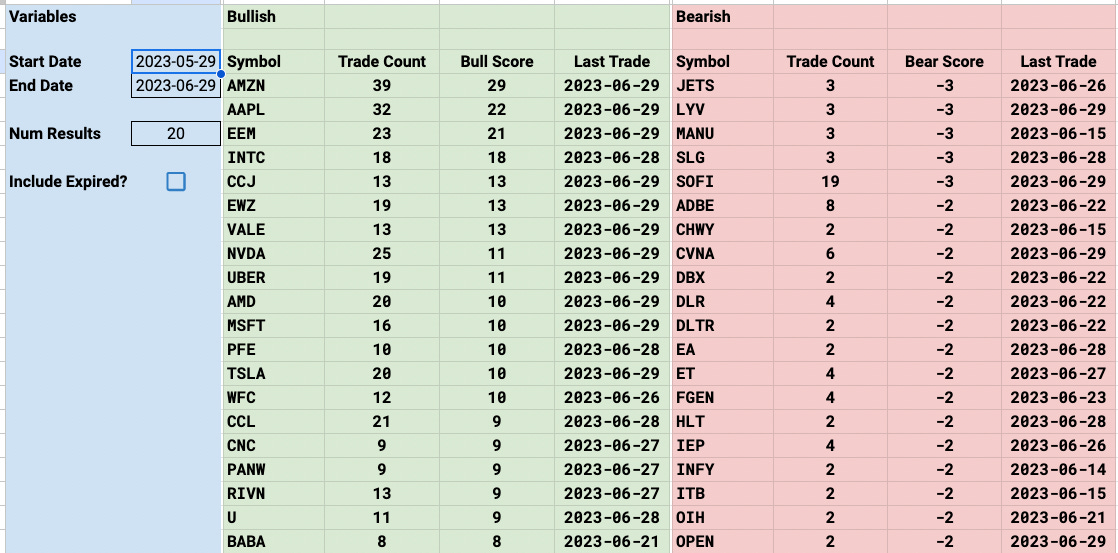

93 Trades Today. As I said slower day and this is the first time I post less than 100 trades in a long time, it rarely happens.

Of note though are 3 trades this week that came through these tables. I always tell you to pay attention to the really unusual names because those tend to be ones with way more potential than the large caps.

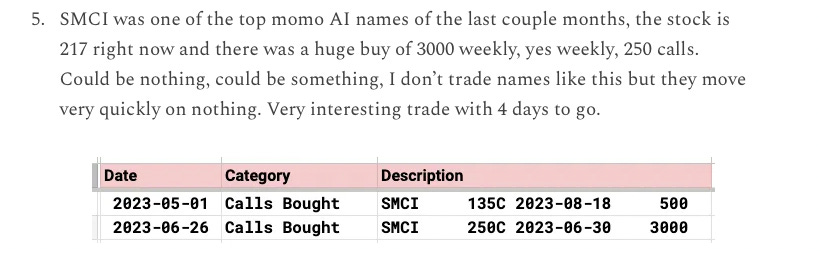

Monday SMCI calls I noted in the recap, the stock was 217 and it was 243 this morning these were up a few hundred percent

Yesterday in the recap I noted JOBY July $10 calls bought 1000x, it popped 20% at the open today

Tuesday I noted 12,000 EOSE calls bought at 7.5 in August and today it was up 9%!

The point I’m trying to make is while I may not be aggressive in these small names simply because I’m more risk averse, these smaller names, they play really dirty games with them. It’s alot easier to manipulate stuff like that vs say an Apple or Amazon. So pay attention to these obscure names when you see them in these notes everyday

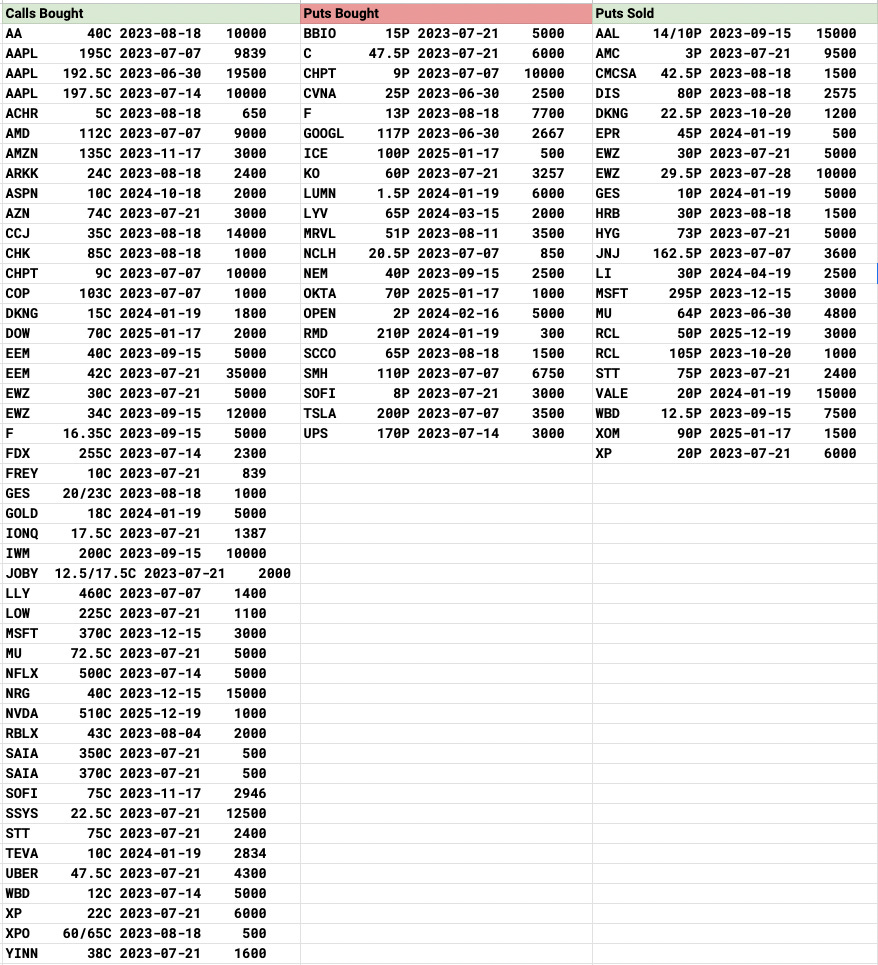

NRG - This name has been hot the last few days. It’s odd to see a utility see this kind of action but it appears there is an activist battle heating up here. 15,000 calls bought at $40 in December today. This is a good name to sell puts on these utilities don’t exactly move viciously to the downside.

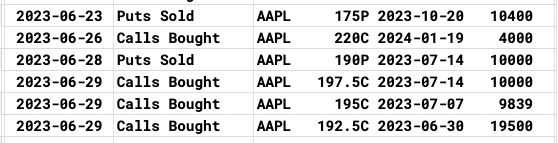

AAPL had 3 large call buys today. 1 was a large buy for tomorrow with 192.5 calls almost 20,000x. Then there were huge buys for next week and the week after 10,000x. Apple has been nonstop and has one of the best charts you will ever see. These were the odd lots I saw this week

SSYS hasn’t seen anything of note in 2 months and today saw a large buy of 12,500 calls at $22.50 in July. The stock is up 2% today to 17.xx but this is a big upside trade over the next couple weeks.

CCJ continues to see incredible action every week. This name looks great, you know I’ve liked this name for months, but it’s finally coming out of its base and the open flows in my database are still huge for such a small name. This week alone you can see the huge put sales 3x but today 14,000 calls were bought at $35 in August.

DKNG has seen mostly bullish action this month with 1200 puts sold at 22.5 today and 1800 calls bought at $15 for January. The stock is up 4% today to $26 and those large put sellers from June 2nd and June 13th is sitting nicely now. These small cap names have been so strong recently.

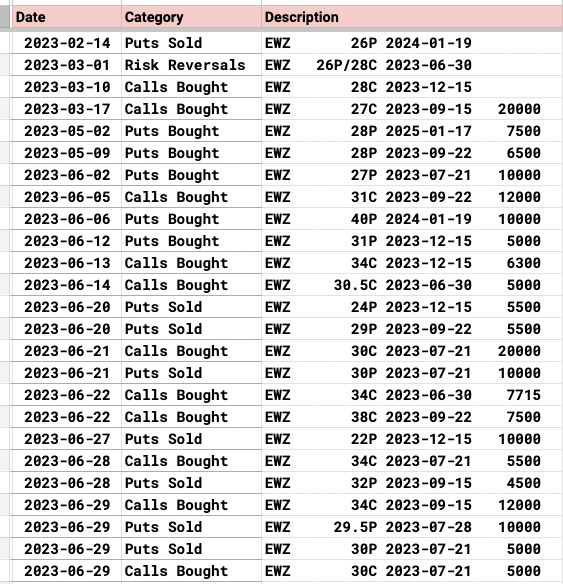

Trade Of The Week Update

EWZ has not had a great week, but the flow of money remains directionally bullish. Today it saw a couple more bullish trades with a big July risk reversal selling $30 puts to buy $30 calls 5000x and a large put sale for July 28th of 10,000 $29.50 puts along with a buy of 12,000 September $34 calls. This remains a nice play to be in the next few months.

What Did I Do Today?

Amazon had a weak session, the news about the FTC suit weighed on them today. Personally, I think the FTC suit is nonsense. The Hill actually wrote a piece yesterday in regards to how big a failure Lina Khan has been at the FTC to this point

Here is a Link

Basically for those out of the loop Lina Khan wrote a paper in law school about how much she hates Amazon, she became the FTC chair and has been nonstop with the attacks on the mega caps and nothing has gone her way. She’s been a colossal failure. Anyhow, today the rumors are that she is going to bring suit against Amazon for the second time in 1 week, last time it was over how difficult it was to cancel Amazon prime, this time over the unfair practice of Amazon prioritizing Prime sellers. The reality is this will get nowhere. Of course Amazon prioritizes Prime sellers, they have a reputation to uphold and when sellers ship their own products, you don’t get that same day or 1 day guarantee that Amazon can give you. You could imagine how low quality the Amazon experience would be if sellers shipped their own products, it would be eBay in the 90’s all over again. Shipping speeds would be all over the map and you wouldn’t have that guarantee that makes Amazon what it is. The ability to order a product and know it will be on your doorstep within a set timeframe because of the prime label letting you know it’s in Amazon’s warehouses already.

So although it makes for a neat headline, Amazon’s legal team will squash Lina for the umpteenth time. She held up the MGM studios deal for them last year, then they found an opening and squeezed it through when her hands were tied. It’s almost abuse at this point how many times Amazon has defeated Lina but here she goes for another try.

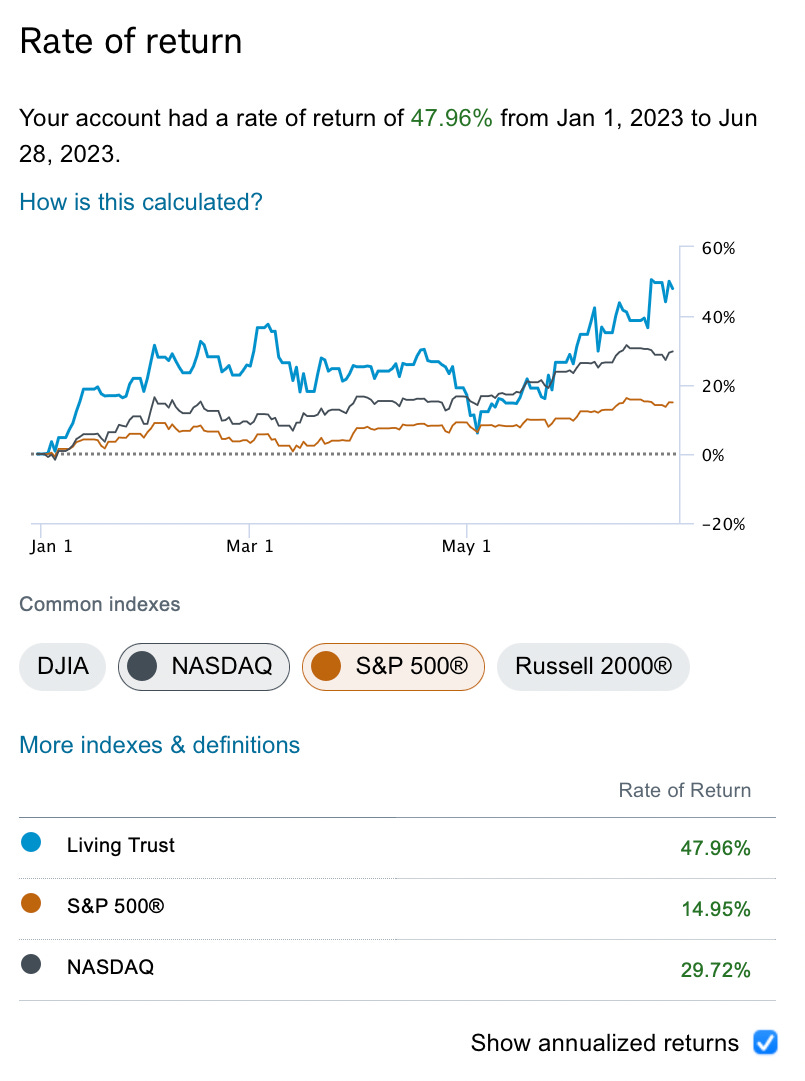

I still remain on the sidelines basically as far as I haven’t sold a put in over a month. I just can’t until the VIX pops some, I’m not in a rush to do anything at this moment I’m up 48% this year coming off an incredible 2022. The S&P as good as it has been is up just under 15% so I can’t complain being up 3x it. I’m even up far more than the Nasdaq and I’m just not seeing anything other than Amazon at this moment that I see as remotely interesting in terms of consistent option flows, so I will remain on the sidelines in terms of selling puts till we can get a VIX spike to hopefully 20+ otherwise I am not pressing anything.

Anyways I hope you all had a great day and I will see you tomorrow.

I've been curious why you aren't selling weekly calls (even way out) on your AMZN just to collect a little premium? Is it just that you feel it could run hard at any moment?

What do you have for $OKTA the last few months? And what do you think about the put buy today. I saw there was a call buy a few days ago