6/5 Recap

What can you say about this market other than every dip is a buying opportunity. Every single time we dip below the 8 ema and caution flags are raised, we seemingly bounce back very quickly. Even the breakdown in April it was the shortest we’ve seen in years, barely 3 weeks long. This market is just unstoppable for now, there is an insatiable appetite to be part of the AI trade, get out of cash, whatever you want. Can you blame people? 5% checking rates aren’t enough for people to sit in cash because most of us can fully accept that even 5% is probably a loss if real inflation is factored in. The SPY is back over the 8 ema and just surfing higher for now. This is why all bearish trend breaks are short term in my book, the market always seems to find a reason to want higher.

NVDA continues to carry the market on its back in maybe the most remarkable move I’ve ever seen considering it is about to usurp the top spot in the market as it sits on the cusp of overtaking Apple and probably does in the next few sessions with only Microsoft left ahead of it in terms of market cap. To put into context what has happened in less than 6 months, NVDA has nearly gained an entire Amazon in market cap in just 5 months.

Another thing I wanted to mention was I exited my IP position today. I first entered it here in the 5/8 recap. The equity was below 39 at the time, the name just went ex dividend recently so I will get that too and I sold just over 44 for a really nice gain of nearly 15% in just under a month. I still think this gets acquired, its already over the initial bid of 42 but there was a big put buy yesterday, I updated the database with all of yesterday’s trades for those interested, and it also involved a call sale at 50 so thinking about it, taking on all that risk for another hair over 10% in upside just wasn’t worth it to me. I don’t add big positions often but I always tell you the day I do. At the moment in my trading book I still remain in only my Amazon leaps, IBIT, and FOUR in terms of sizable positions.

Recent Trades

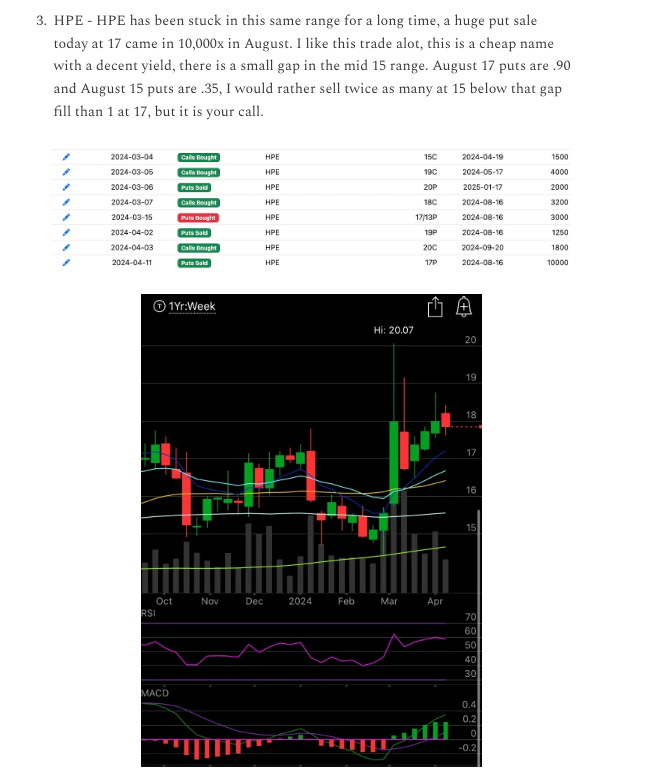

On 4/11 I highlighted this massive put sale on HPE for August where a player sold 10,000 puts at 17, you know my stance on the large put sellers, those are the most important trades daily. To me those are what you really want to take note of and try to mimic but lower, this morning HPE is up almost 16% premarket to 20.35

Trends

The big trend shift here is Paypal is now the top trending name, I highlighted it 2 days ago but there are alot of calls being bought there, something to keep an eye on in a name that has been dead money for a long time.

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database, like yesterday I made it last till monday just incase I have to be out tomorrow. I hope to have the rest of today’s trades added by tonight, I’m heading out right now to see my dad at the hospital so that’s why this is coming out just a little early.