6/7 Recap

We finally got that rotation I mentioned I was looking for over the weekend. Tech sold off hard, especially the cloud names, and the S&P 493 so to speak, did quite well. That’s normal, healthy action after the megacap only run we’ve been on. Names like GM which was my best idea on Saturday are performing fantastic today up almost 3%. Disney is green, there is just a rotation out of megacap tech for the time being.

The SPY is just flagging sideways, it’s nowhere near the 8 ema, this is still firmly in an uptrend. You would think with MSFT,GOOG, and AMZN all down over 3% this would be hit harder, but it’s not and the VIX is still 14. There remains almost no fear here.

Tech stocks are a little shakier right now the QQQ is sitting right on the 8 ema, a break below that would signal a short term trend shift and some weakness, but there is still a lot of time in the day.

Individual former leader names are already signaling some incoming weakness. Here is Microsoft, below. As you can see it’s been quite some time since it closed below the 8/10 ema and it’s likely doing so today. When a name is below the 8 ema, it’s a do not touch until it reclaims it, remember you don’t want to be in weakness as a long.

GOOG is also doing the same, both have not done this in months. That doesn’t mean they’re in deep trouble, it just means for a period, short or long, we don’t know, they likely will not be leading the pack anymore.

Amazon is also a hair below the 8 day but right over the 10 day which it bounced right off of, so as it has been displaying leadership over the past 2 weeks, it’s also the least weak of the cloud stocks that are hammered today, that makes sense.

Trends

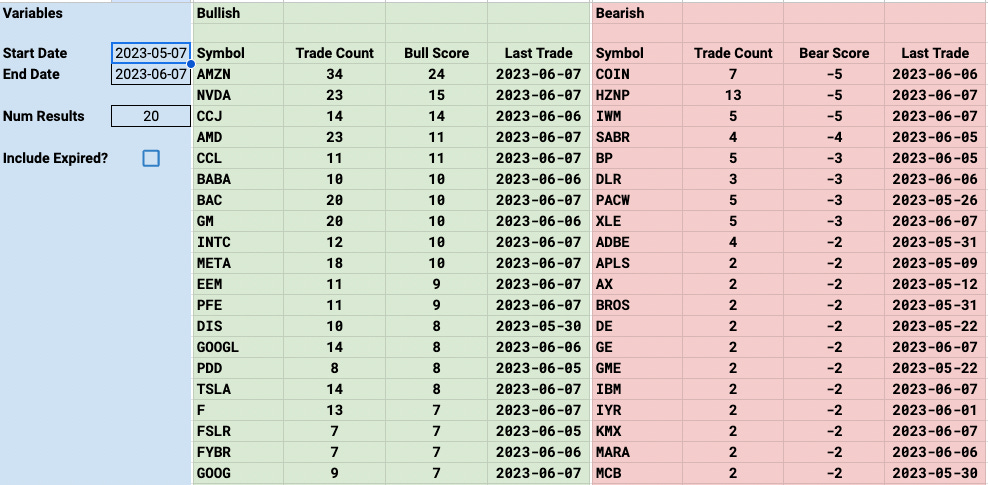

MRVL was actually up 5% at one point this morning before selling off to flat now. CCL is up 3% today and AFRM with the big boom up 15% at one point. All those AFRM calls were bought the last 2 days, nothing today. So these trends continue to catch onto moves before they occur.

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow & What Stood Out

115 Trades Today