6/8 Recap. 1 Year On This Platform

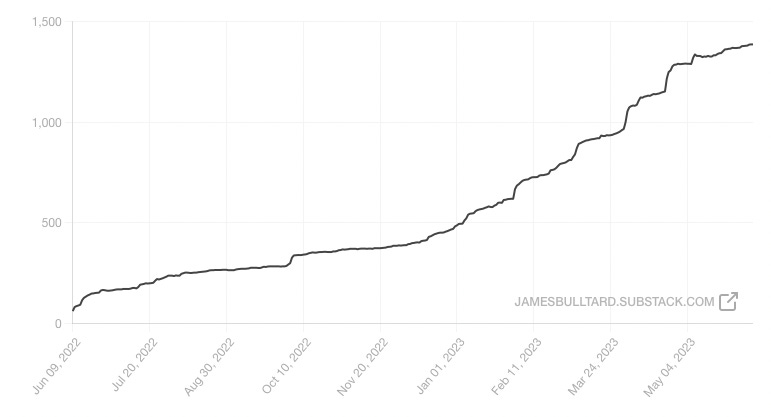

Well today is the 1 year anniversary of me starting this substack, it’s pretty amazing how far this has come so quickly. I’m at almost 1,500 subscribers. When I started, I simply wanted a place to post some unusual trades, maybe catch a few oddities that turn into big trades, but I never thought a year later it would turn into a big business with almost 1,500 subs.

I wanted to provide a service where I felt people would get far more out of it than they put in, for a reasonable price. I wasn’t going to charge hundreds a month like all these other services out there. I also wanted to post screenshots from my actual book, I always got a chuckle out of the people selling sub services posting their book on a notepad, it’s not hard to post your book if you’re actually trading what you’re saying. When I say I’m selling 1000 puts, it’s easy to see my volume in the trades. I think being transparent and honest is a big thing with making people trust you. Lastly, I wanted to be accessible to the average trader. You can’t help people understand the market better if you’re too expensive for them to give it a try.

The problem that needed solving was that the average retail trader sees the market in terms of fundamentals only which is what keeps them from making rational decisions. X has to happen because the balance sheet! Or because xyz catalyst is happening. That’s just what we were taught, efficient markets and all. The reality is the market is a series of computers trading back and forth and to succeed in short timeframes, one has to think like one of those computers, not Benjamin Graham. The flow of money is all that matters. If money isn’t going to your name, it isn’t going up no matter how hard you wish upon a star. The flow goes in this order. The options market will see it first, live, then as accumulation happens, it will appear in the chart, as the chart improves, traders will buy it and lastly by the time the stock has risen, your Wall Street analysts will come out and raise their prices targets, AFTER the move has occurred. Then your retail traders will see a 13-F months later and decide to buy/sell.

Don’t we want to know when the accumulation is actually happening, live?

I think this substack is proof that if you provide a unique, quality product, people will stick around and it’s been great to see it grow week to week. It fascinates me what one can do with the internet these days, but I definitely did not have a substantial substack business in my plans last year when this all began on June 8, 2022. I couldn’t have done it without all of you, so thanks for putting your faith in me, and I hope I’ve been able to exceed your expectations.

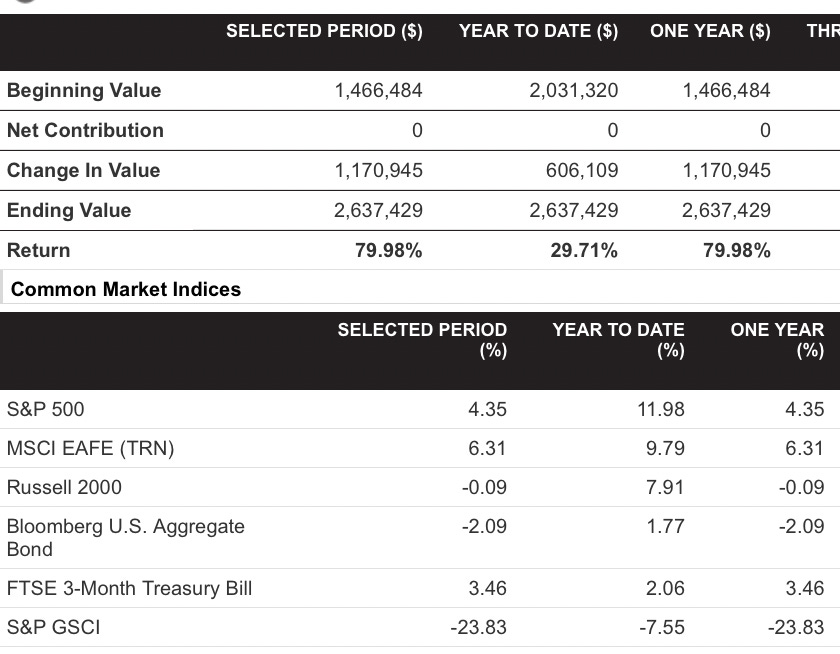

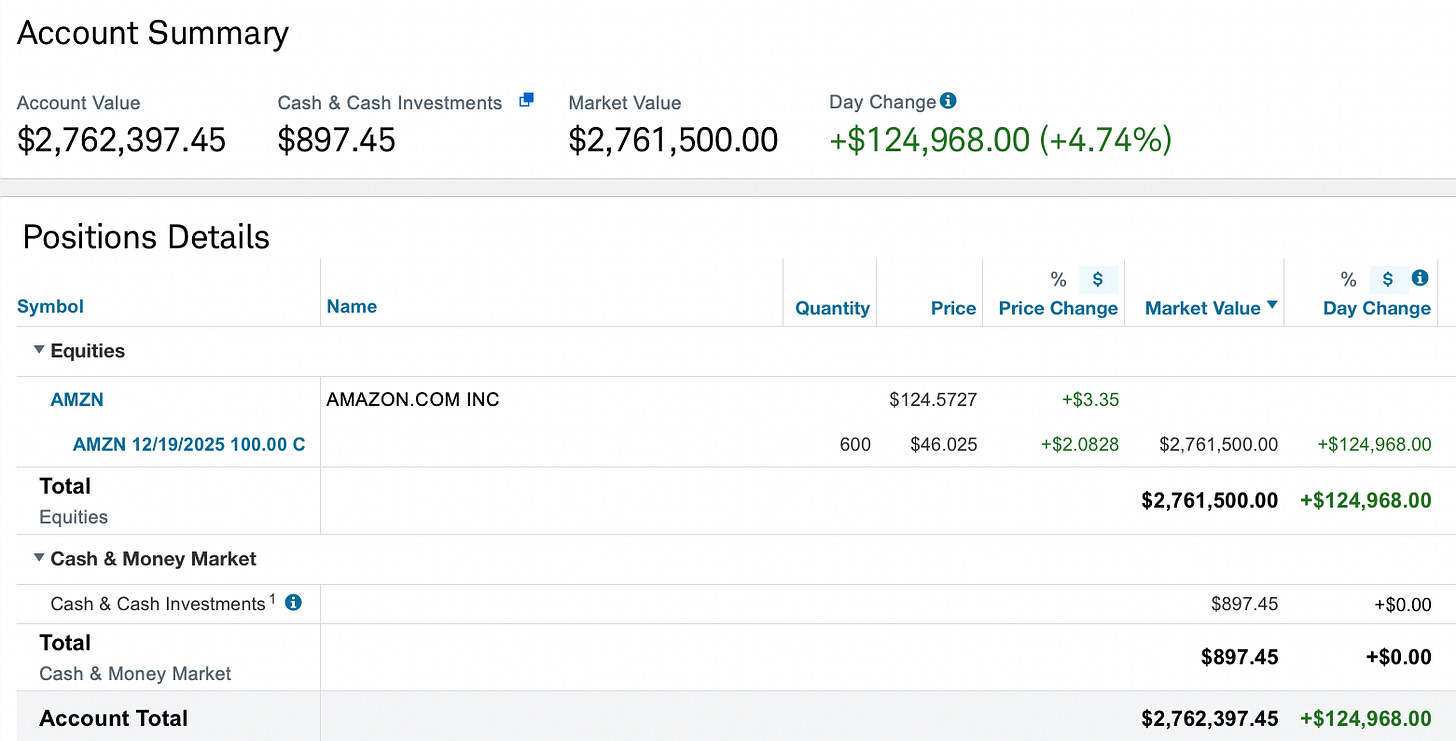

Aside from all the great people I’ve met along the way, what I’m most proud of is the outperformance I generated during what was a pretty tumultuous period. We’re all back to thinking the bull market is on, but people forget, the S&P is only up 4.35% over the past 1 year. I was up just under 80% and that’s counting yesterday’s crash of my Amazon leaps.

I always judge myself on a basis of how did I perform vs the market and in my whole career, I’ve never outperformed the market by 20x, so the last year was not only my best performance wise, but the whole journey was documented in all these daily posts. I made I don’t know how many trades, I pressed my chips all in at times on things like Twitter and it seemed nuts at the time but it worked. I have a unique style, but I believe in myself, and if you don’t believe in yourself, you probably shouldn’t be dabbling in this game. I’m not big on diversification because I’m a big proponent of knowing what you’re in and sizing your bets up in a few concentrated trades at a time. Diversification, in trading, is the enemy because it takes away your focus.

Anyways, year 1 is in the books and hopefully year 2 is even better for all of us.

The Market

The SPY continues to flag sideways, this isn’t a bearish setup, until we get over that 429.62 it’s not a breakout, but the moving averages are finally catching up after 5 days of consolidation and the market looks like it is gearing up for another leg higher. There is still a small open gap just below from 5 days ago.

Back to yesterday’s post when I highlighted the megacap names, what did I say about what the 8 ema was telling you? That Amazon was displaying more strength than it’s colleagues. Look at it today, it’s back over the 8 ema and definitely leading the pack. That’s the thing with charts, they will never lie to you.

Microsoft and Google meanwhile as you can see in the 2 charts below are still below their 8/10 ema and displaying clear weakness, even as they’re green today. As long as you focus on pockets of strength and trade those, this game is much easier than people think. It only gets tricky when people want to fight gravity and trade pockets of weakness to the long side.

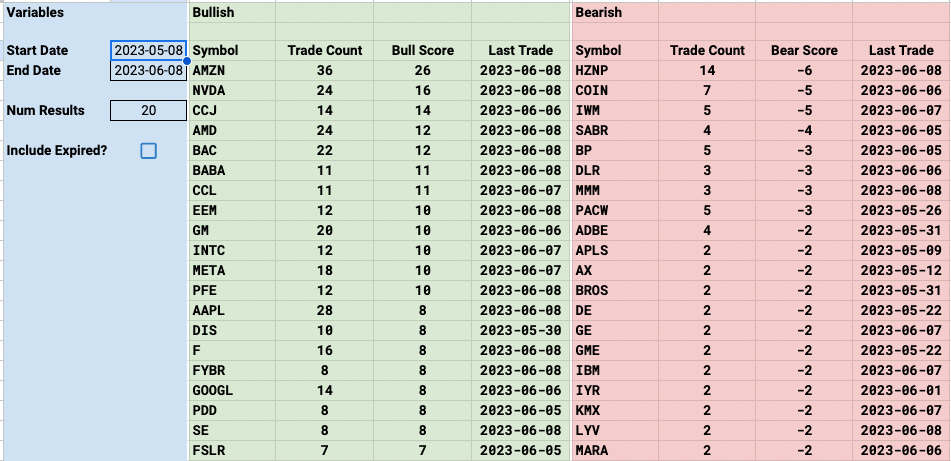

Trends

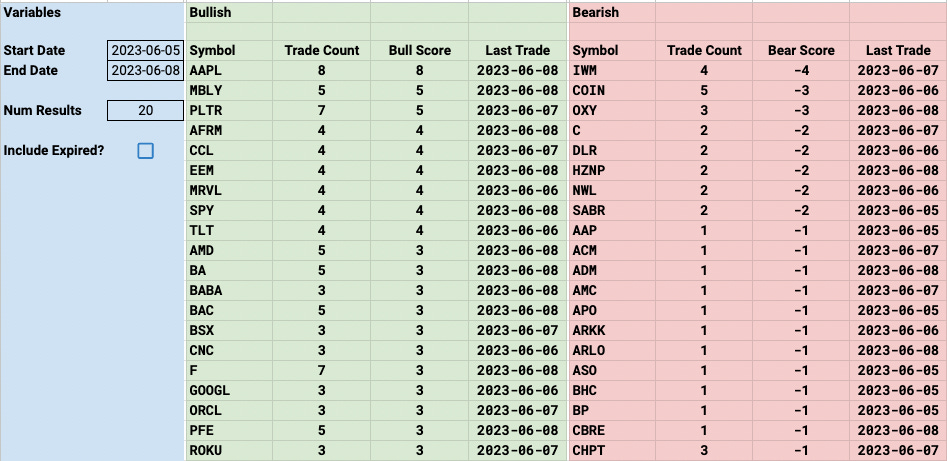

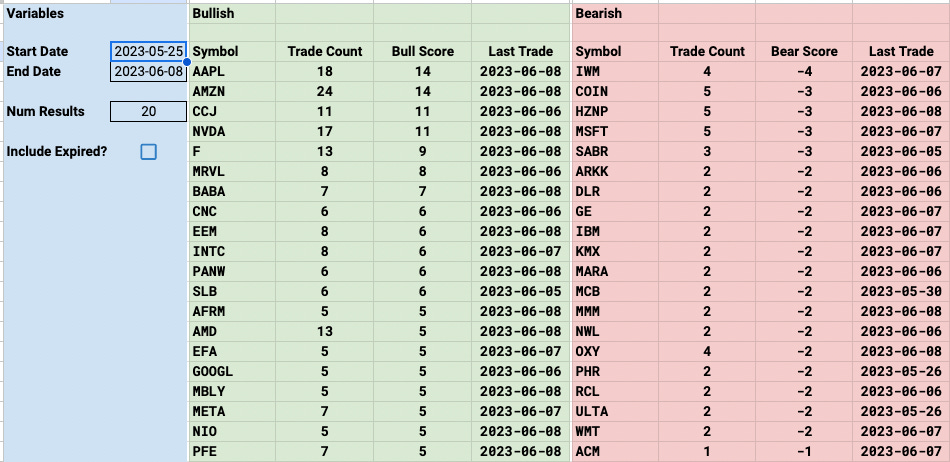

I think this segment here is one of the most important parts of this whole substack. There’s so many trades being placed daily, but with the help of Edwin, I was able to build this out to where we’re seeing an aggregate of all the unusual activity on multiple timeframes which is allowing all of us to see bullish/bearish trends developing. This is a big help as a put seller because I know what names to sell puts into or what names to avoid. When you’re a put seller like I am, nothing matters more than directionality and I’ve never seen any options service offer anything like this so this is sort of my own crazy idea brought to life. Just one of the progressions I’ve made over the year in here. I used to basically mentally mark trends throughout my career, jot down notes, and search through databases for past trades.

Week To Date

2 Weeks

1 Month

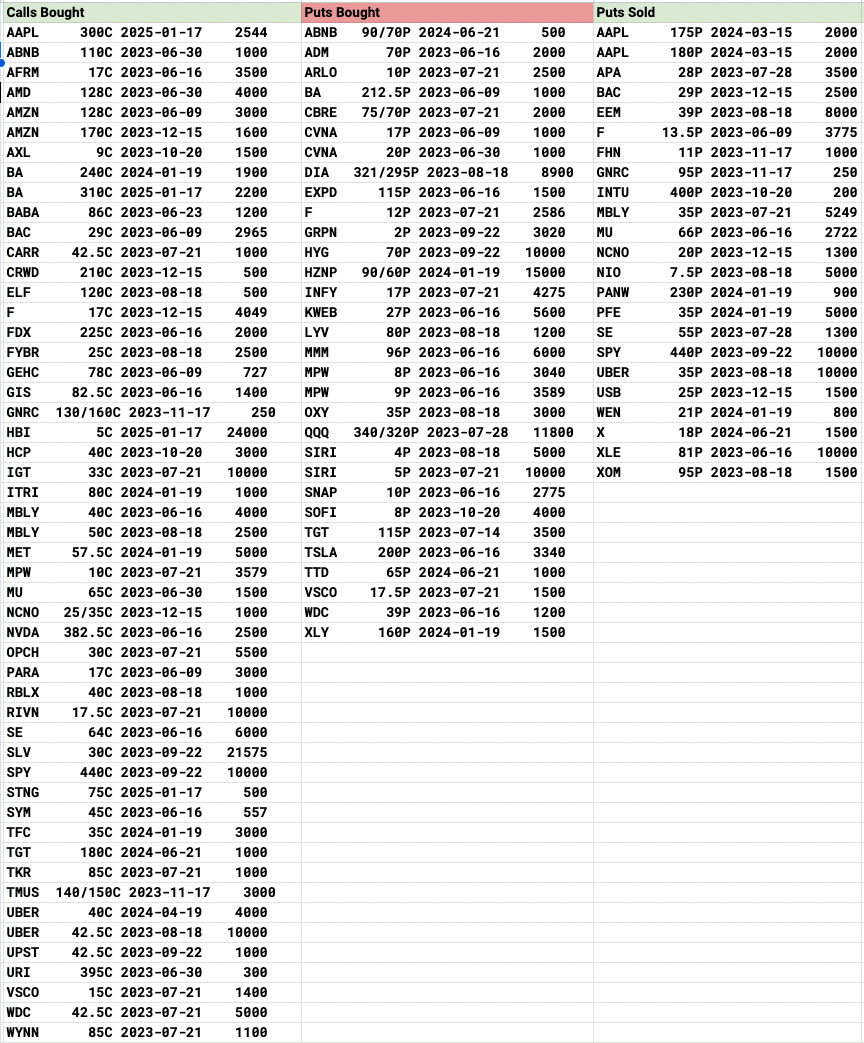

Today’s Unusual Options Activity & What Stood Out

107 Trades. I’d say the craziest thing in today’s recap is that Caravan is up 40%, I vaguely remembered noting it the other day and I looked back, Tuesday there were a couple odd call buys in the recap. I know alot of you dig into all these more than I do, but having a curated list of unusual trades was something I wanted to be a big part of this substack. You look at some of these options platforms out there and they give out thousands of trades, every trade in every name and they don’t really tell you exactly if it was bullish or bearish. I wanted to just make this as simple as possible to clear up any confusion and from the feedback I’ve gotten it’s been tweaked to the point most are happy with the daily result now.

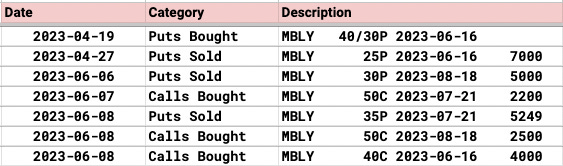

MBLY had alot of bullish trades today. The 5200 puts sold at $35 for July were a nice entry. The call buys and $40 and $50 are a bit more aggressive

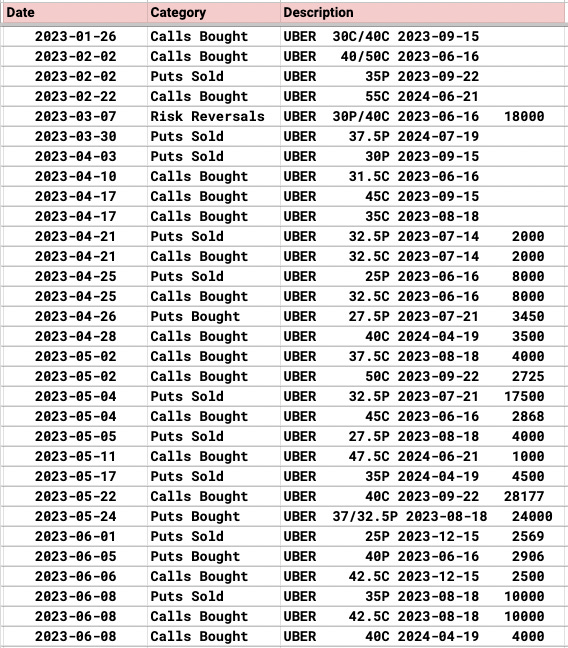

UBER saw multiple bullish trades today. These are all the trades I’ve seen for months on UBER, the flow has been dead on here and the risk reversal today selling 10,000 puts at 35 to buy 10,000 calls at 42.5 in August caught my eye.

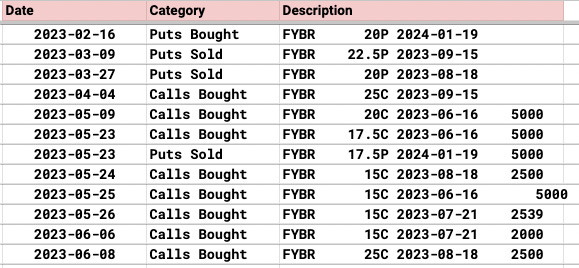

FYBR I mentioned a couple times a few weeks back. The name is up 10% since to 16.xx but today they were going hard after the $25 calls in August. That would be a very big move, so again, caught my eye.

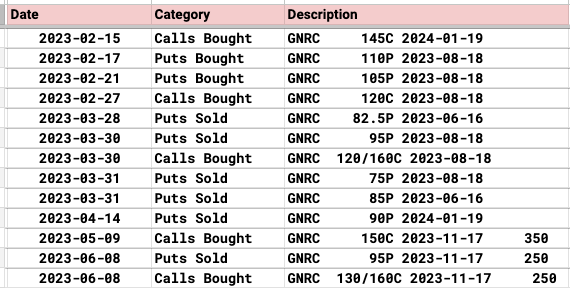

GNRC saw a risk reversal today selling $95 puts to buy a $130/160 call spread in November. Generac is always a name that does well after hurricane season because orders take off in every area destroyed by a hurricane. We are entering hurricane season and look at all the put sales below on Generac going into it.

NCNO is a name with nothing else in my database, today it saw a risk reversal selling 1000 puts at $20 to buy 1000 call spreads at 25/35. There is almost nothing in the open interest here in this name, so size like this does stand out.

What Did I Do Today?

I did bounce back today with Amazon recovering nicely. It got a couple upgrades overnight from Wells Fargo to 159 and today it saw a couple bullish trades if you look above. The 1600 $170 calls in December are interesting, I don’t see that as overvalued or out of the realm of possibility. All it will take is 1 good quarter to flip the narrative and I know it’s hard to believe that’s possible after the last 2 years, but it’s coming in my opinion, sooner than later.

I hope you all had a great day and I will see you tomorrow!.

I'm really thankful for what you provide to all of us. I've learned a ton and really admire the way you see the market so clearly. Happy 1 year anniversary man, congrats on all of your success!

Congrats on what you've done so far James. I truly hope this first year is just the beginning of the road for you. You've certainly sharpened my understanding of the capital markets. That understanding only makes me a better leader of my own business. Thank you.