6/9 Best Idea For The Week Ahead

We closed last week with another incredible candle on the SPY. We had that breakdown in April which pulled us back to the 21 week and we found support there and rallied back to new all time highs. The thing with this market is all the data we’re getting economically is just bad. Whether it’s home sales, jobs, ISM, every single datapoint is bad but what’s happening is we have such a concentration into the biggest companies and people see them as a safe haven so they’re just pushing the market higher by piling into this handful of assets. If you step back and think about it logically, these companies really are safer than say cash or treasuries. If you sit in cash inflation is going to eat you up, at least if you sit in Apple, even if growth isn’t there, they’re going to buyback nearly 1% of the company per quarter and push your stake higher. It is a weird time in history but the market can keep going even if the data is bad as long as there is a weekly inflow of money into the 6 biggest names.

While the SPY above looks great, look at the RSP, the equal weight of the SPY, below, it is not at all time highs and you can see the lower high forming. That is because the rest of the market has not played along and this recent move after the April sell has all been the 6 big tech names.

This week’s best idea is a large cap that is getting over the 200 month for the first time in 15+ years. It has been a long journey here but it is technically on the cusp of a big move and for a large cap, that is rare. It has also seen an incredible amount of bullish activity over the last couple weeks, some targeting nearly 50% higher 2 years out, no its not PYPL, although that did see alot this week. I have a great trade idea where you can get paid a nice amount to wait and see what happens and still profit nicely even if the trade doesn’t work out.

C

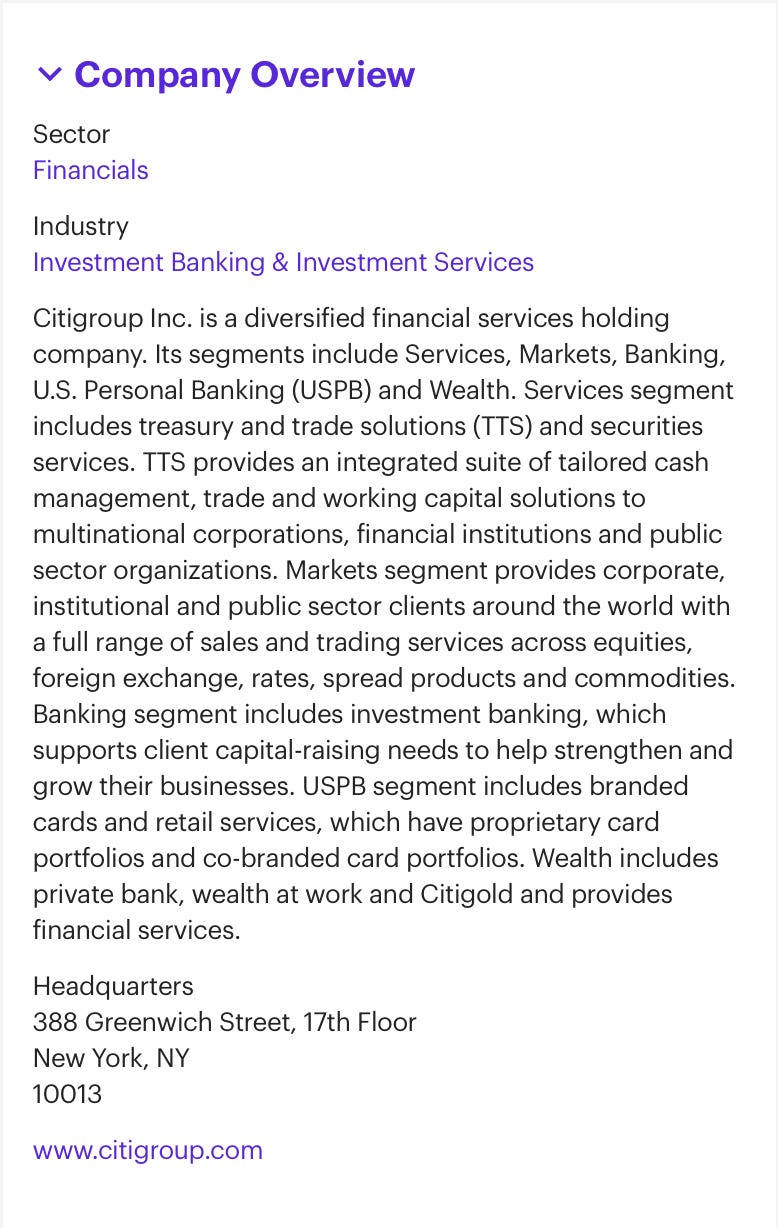

What Is It?

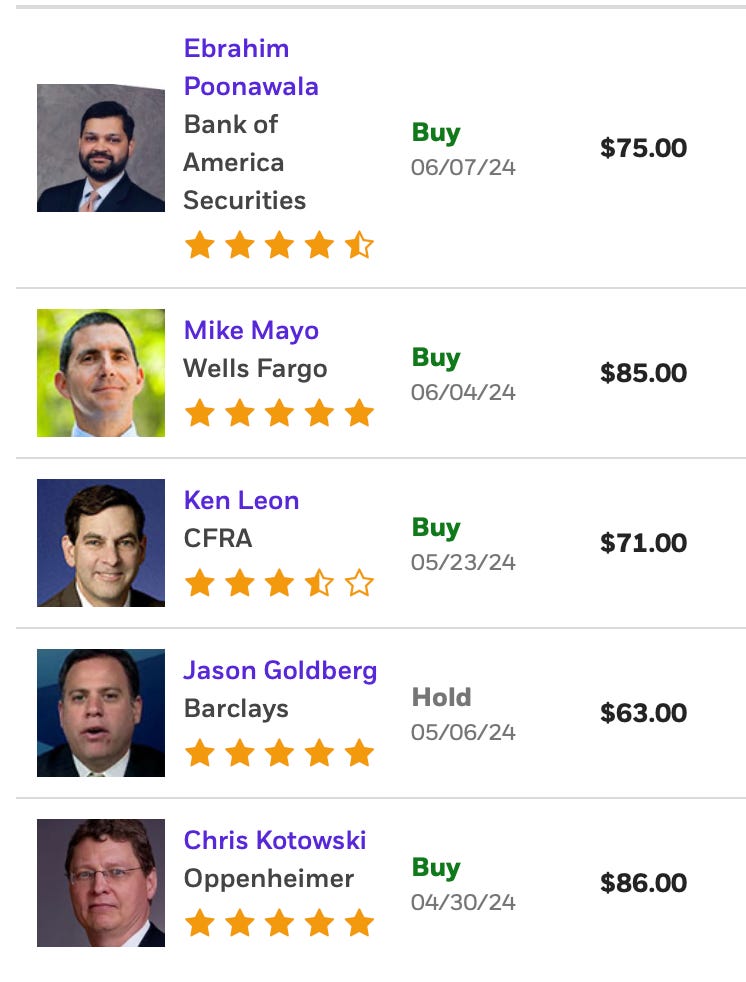

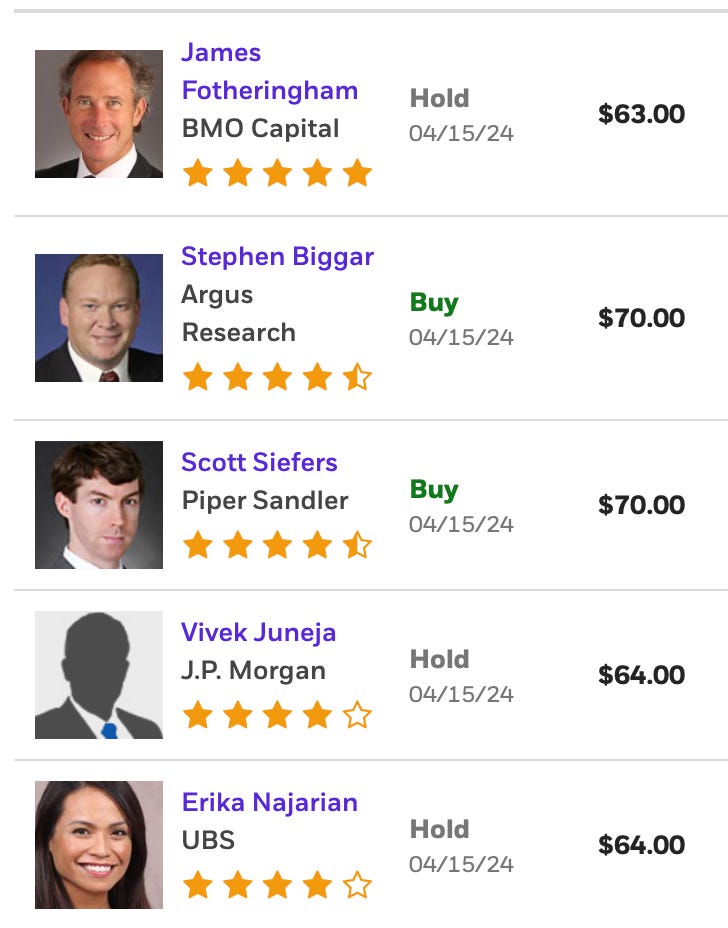

Analyst Targets

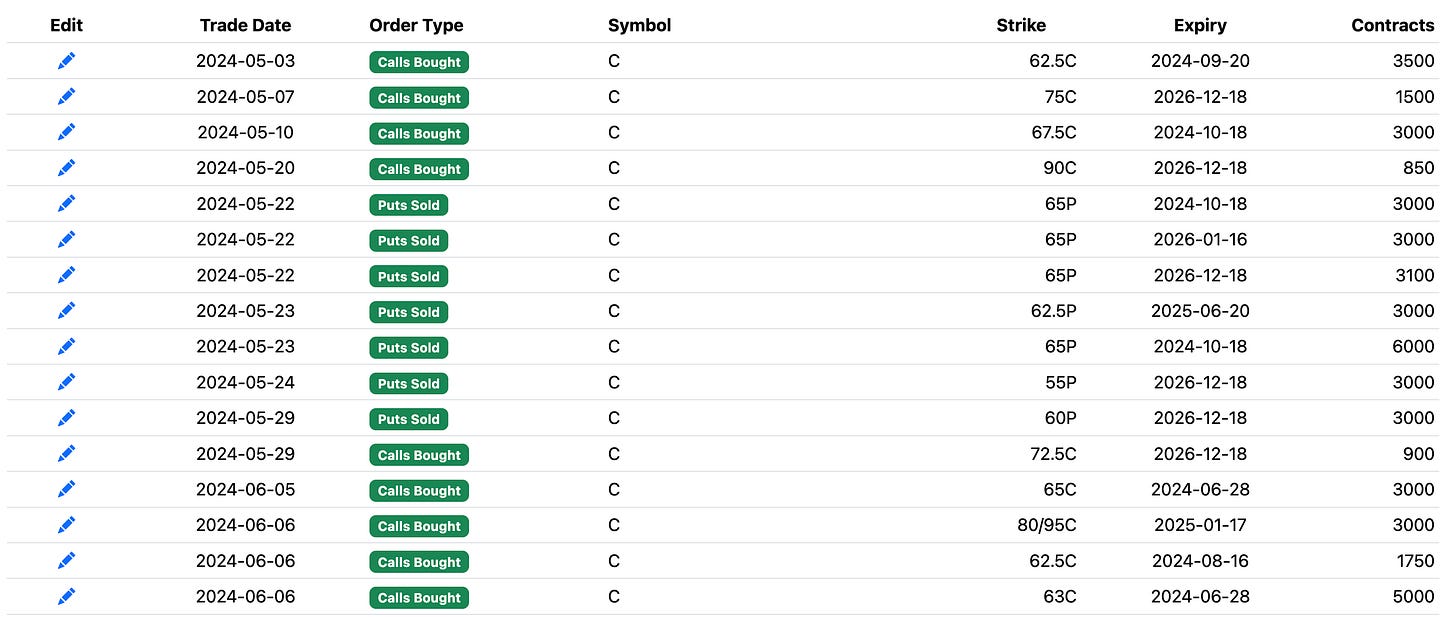

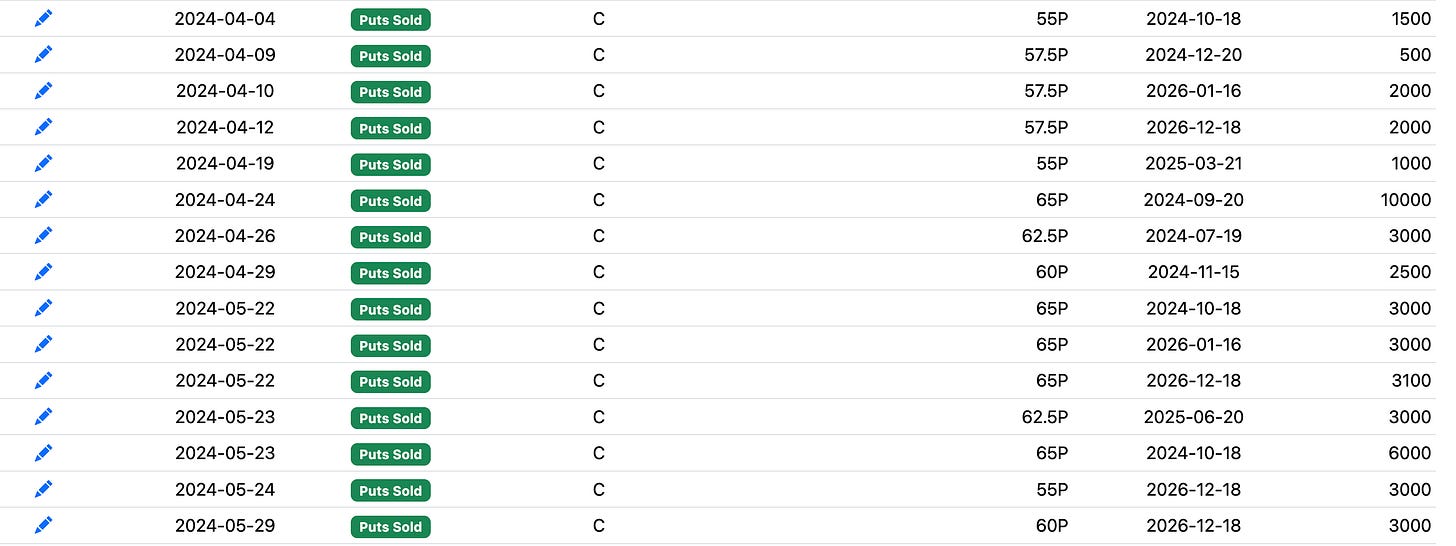

Option Flow

Here is all the option flow I have from May 1st in the database, there is more in there from further back that you can see inside the app. The calls that really stand out to me are the December 2026 90 calls 850x and the 80/95 call spread bought last week for January, that is 6 months from now. a 50% move in a bank this size is very rare, I can’t even see that happening but maybe it gets a sharp move higher soon and they close those. I don’t know, but in general look at all the put sales below. Institutions are looking to get long C in major size as it has been a top trend for over a month now in here.

Charts

Daily - The daily is not the best, it sits right below the 50 day and is below all the key short term moving averages I look for strength in with the 8 and 21 ema being overhead.

Weekly - The weekly also doesn’t look with it closing below the 8 weekly ema for the first time since last October this past week.

Monthly - Here is where it gets interesting, with any longer term trade, the longer timeframe charts are the important ones. In this case C is over the 200 month moving average for the first time since the great financial crisis right now. Think about that, this is a massive technical breakout on a longer timeframe.

Long Term - This is a funny chart but you can see where C has been since the crash in 2008. It has been a long journey and that 200 month average has finally caught up to the stock, really impressive how long this took.

Trade Ideas

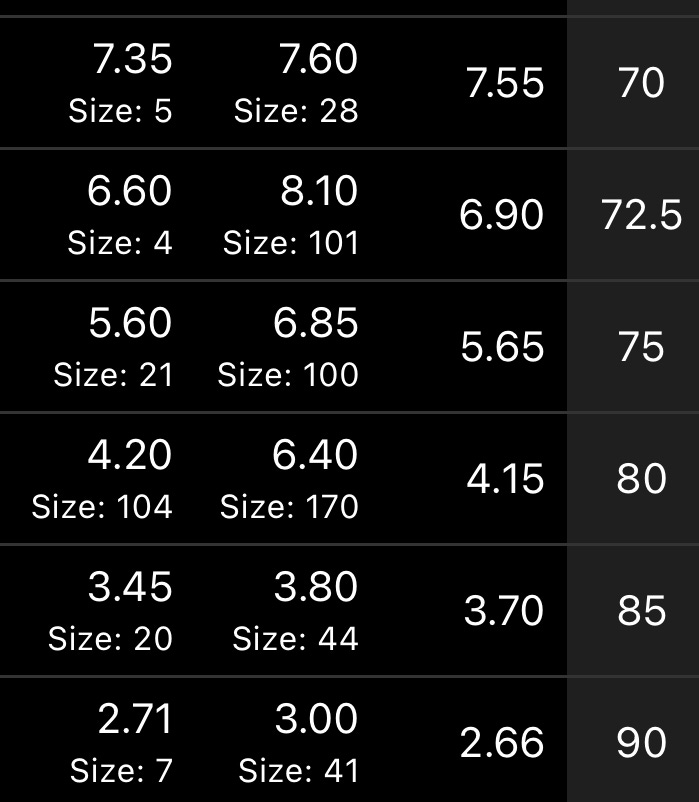

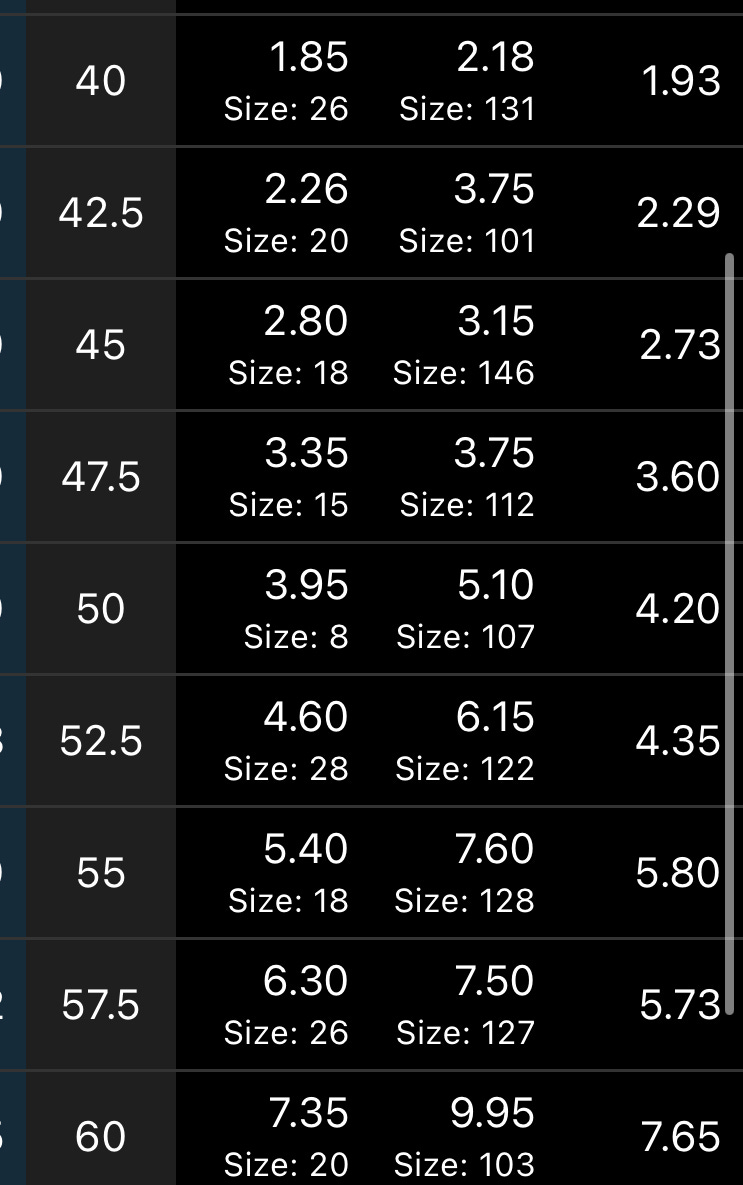

So it goes without saying that you can buy C here at 61.78 if you like, commons are fine and most analysts are looking for higher, the name pays a decent dividend and there are lots of put sellers around here so the demand is there. Of course you know my affinity for utilizing risk reversals for big returns so that’s what we will discuss here. In the database on whatever ticker you look at, you can filter by types of trade, so I like to look at the put sales first always to get an idea of levels I want to think about and C has a ton of them.

There are many for the rest of this year at 55 and 57.5 a few months out that you can sell to get the cash you want to buy upside calls. If say you wanted to be really aggressive and go for this year, you could sell something like a 57.50 put in December for 2.45 and buy a 67.5 call in December for 2.55 and pay 10 cents out of pocket but that isn’t my best idea.

My best idea is to look at those calls bought all the way in December 2026. I know its hard to think about anything 2.5 years out because life in general moves so fast but markets do too and lots can change by then, but here is why I like that trade ALOT.

If we look at those calls in December 2026 the calls at 90 can be bought for 2.85 right now

If we look at the put chain for that same month we could sell puts at 47.50 for 3.55 right now

So think about this

Sell 1 December 2026 47.50 put for 3.55

Buy 1 December 2026 90 call for 2.85

Credit .70 cents

You’re paid to put this trade on, it reminds me alot of that CPNG trade I drew up months back that ended up being a monster return. Again this trade costs you $0 out of pocket, just the margin required to hold the put but on a 47.50 financial, the margin requirement shouldn’t be awful. If the Citi doesn’t go anywhere near $90, its fine as long as it expires over 47.50 which is 20% lower, you are profitable.

You can draw this trade up so many ways you could even use a ratio and more aggressive strikes like say selling 2x the puts at 40 to buy 1 call at 90 that would look like this

Sell 2 December 2026 40 puts for 1.95 for 3.90

Buy 1 December 2026 90 call for 2.85

Credit 1.05

Again you can play with the structure however you want, but regardless lots of big money is looking for a move higher on C and we want to position for that move but in a way where we can buy the stock lower and get paid should it not work out. The short term doesn’t look the best here, so don’t get greedy with short term calls, you can just tuck this long term risk reversal into your book and just let it have time to work out.

Have a great rest of your weekend and I will see you all tomorrow.

new to the service and not sure if an issue for anyone else -but my link to the options database (no link posted since 6/7 and don't yet have discord access yet) is now working.