7/1 Best Idea For The Week Ahead

I’m writing part of this up on Saturday night because I’m flying tomorrow morning. So I won't be able to post all the charts like I normally do, just 1 best idea this week, but these tend to be the best anyways, so why waste time with the rest. Especially with a short week where we only have 3.5 trading days with a short day Monday and no market Tuesday.

Before I get into this weeks best ideas can I say I told you so about Elon? I may have been his biggest critic for months on end, but today’s failure in Twitter is just classic Elon. He cheaps out on everything, thinks he’s smarter than everyone, and he ruined a pretty great product. Twitter is such an essential resource at this point and I can’t even tweet tonight because Twitter thinks I am a bot. Mind you this is after I had to change my username after paying him because I was shadowbanned. Today this is what we’re rewarded with? Limits on paying users? This isn’t 1995, data is plentiful and cheap, but that’s if you pay your AWS and GCP bills which he didn’t.

I’m sure from my tone many of you get I don’t like the guy. It has more to do with just constant lies, which is the polar opposite of me who is so upfront with you all about everything. Call me old school but I believe in Honesty and Integrity, I don’t find it amusing when someone says things so nonchalantly like him. So much deception about things and people eat it up as “he’s trying to save humanity”. Do you know without all those lies Tesla would have been bankrupt? From 2013-2020 Tesla was constantly teetering on bankruptcy but he was able to keep the company afloat with “his way” for so long eventually he was able to do 1 massive offering and now bankruptcy is off the table. That’s so unethical there are no words, but hey so is making up a fake buyout to take your company private at $420 or releasing software that’s killed 30+ people and calling it Full Self Driving while it’s nothing more than a level 2 driver assist tool while Mercedes remains the only company approved to sell level 3 autonomy in the US meaning Mercedes actually accepts liability if their product fails, Tesla does not by remaining at level 2, it’s on the driver. Google has had Waymo functional and operating real self driving taxis for years in Arizona without killing 1 human. Weird how that works when you don’t turn humans into crash test dummies, but hey lots of rich people sign up for these exotic experiences as we saw with Oceangate and their Titan sub last week.

Anyways, if today was the end of my Twitter existence because the app died or I was banned, this is where you will find me.

Trade Of The Week

This company is breaking out of it’s 2023 base in a sector that seems to be gearing up, but at $400b+ market cap I wouldn’t expect a crazy move here. Again my focus is on presenting chart setups that line up with great option flow and that’s what we have here. There’s a ton of new people here today, if you look at the top there’s a post about what to do with all this data. Obviously I present ideas, but there are so many ways to play this. I try to point you in the direction of equities that have 2 things that matter most to me: A nice chart + Directionally Bullish Options Flows. That doesn’t mean run out and buy the names, it means the name is one of potential strength, find support levels on a chart and sell puts to establish a position, but that’s just me, if you want to buy shares or calls, you’re welcome to do as you please.

JPM

Last week we got the news the banks were finally allowed to lift their dividends after passing the stress tests. Many still don’t look good but if you’re a believer in price telling the truth, then you will see what I see here.

The Weekly is breaking out closing over its entire 2023 range. All the moving averages are sloping up, this is a textbook setup you would find under “Beautiful Setup”. It’s a perfect inverse head and shoulder as you can see. If this isn’t a false breakout that neckline should hold.

The daily to me looks like it has support at 134, the 200 dma. If anything you could focus on selling puts there and using the proceeds to buy calls if you insist. For me, I’d be content selling puts alone and getting long a quality name like this. Remember this was the least hit bank during that recent banking crisis. Jamie Dimon does a fantastic job running this company. It’s definitely in a league of its own amongst large cap banks like Wells Fargo, Bank of America, or Citi.

The monthly is also trading with the RSI in the mid range, it still has plenty of room to run, it’s emerging from this multi month base and could lead to a powerful move. If you’re very conservative you could sell puts at 115 for a bounce off that blue moving average maybe a few months out.

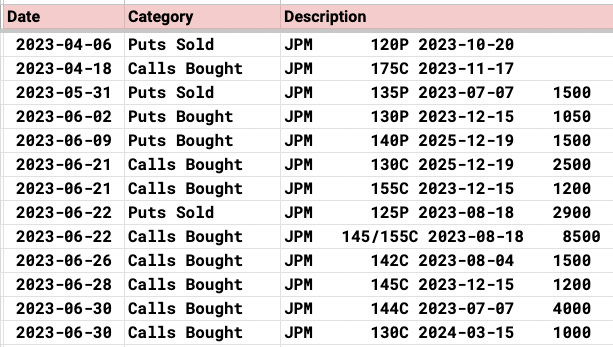

The Options Flow

As you can see, there has been a flurry of bullish trades on JPM since 6/21. There have been 8 trades that I’ve flagged as unusual size in that timeframe. The August 125 puts sold intrigue me, that’s a solid level to sell them at. The 8,500 call spreads bought at 145/155 are also interesting. Friday there were 2 more large trades as well.

Now before you run out and do something with JPM, it does Ex-Div this week. Typically, not always, but typically names fall in the same amount of the dividend on ex-div day. So remember that. It doesn’t have to happen, just a high probability it will if you’re thinking of using short term calls.

What Would I Do?

You all know I’m a big fan of utilizing risk reversals simply because it’s the type of trade where you know the levels you’re comfortable going long at and you’re using the proceeds to buy calls for unlimited upside.

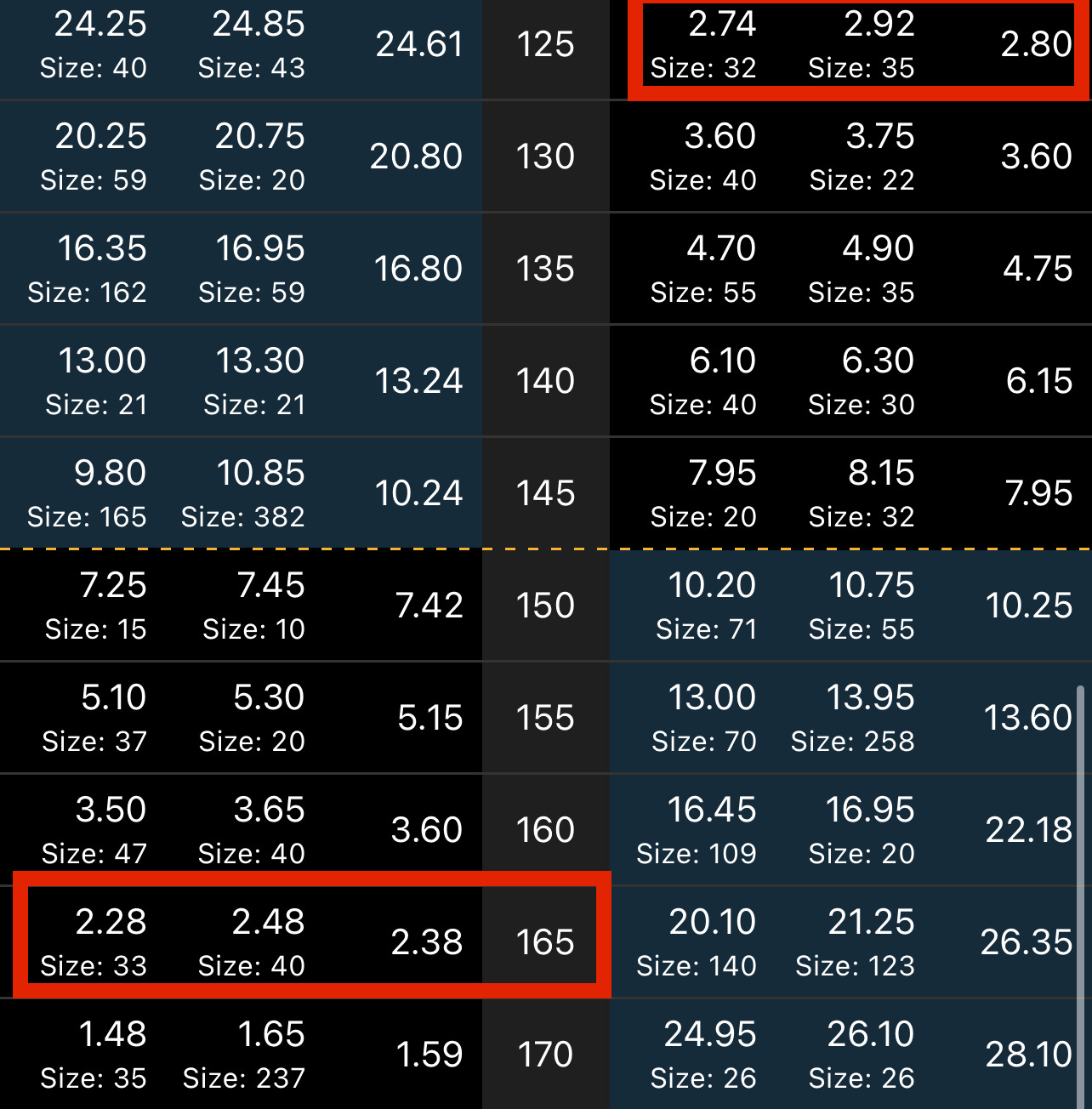

I highlighted the 2 strikes I would use to put this trade on for not only free but you get paid to take this trade on through a credit.

I would sell the January 2024 $125 puts for $2.80

I would use the proceeds to buy January 2024 $165 calls for $2.38

So when all is said and done you received .42 to place this trade. The stock is breaking out at 145.xx, selling puts to go long at 125 is conservative to say the least. Worst case you have to go long JPM at 125- .42 in premium received so $124.58 next January, that would be a substantial decline. If JPM zoom in the next couple weeks/months, great you’re gonna do well on the short puts and the long calls.

See why I prefer the risk reversals? It’s all about minimizing your risk while still using my database trends to trade a trending name in the direction of the trend.

I hope you all have a great Sunday and I will see you Monday after the market closes with a recap.

Good call on JPM. Was eyeing them up after stress tests.

Still only selling cash secured puts, right?