7/10 Recap

The SPY continues to look like a double top has formed. Coming off that gravestone candle on Friday we remain stuck under the 8/10 ema today in a position of weakness and that 425 level now looks more important than ever. That’s the spot you’re looking for a bounce should we get a move down, that’s the trend we’ve been riding for 10 months.

The TNX fell more to 40 which should have been a boon for stocks today but it wasn’t

Lastly the VIX is up 3.5% to 15, it’s been perking up the last few sessions but still very low historically speaking.

The big story this session was the rotation out of large caps continued today. I mentioned this possibly happening a few days back. Look these companies are great, they’re fine, they generate alot of FCF ex-Amazon. The problem is they’ve run so hard, so fast and to be honest looking back at the past quarter, other than Amazon, the others really showed nothing from their best segments. What do I mean?

Amazon grew it’s services almost +20% YOY, while people always like to mention Amazon revenue growing single digits, that’s silly because half their revenue is first party and grocery that nobody cares either segment and those were flat weighing it down, that was 45% of revenue. The other 55% of revenue was very high margin services and it grew massively last quarter as you can see below up almost $11b year over year.

Meanwhile look at Apple, it’s products are it’s most important segment and that was down $3.5B year over year as iPhone and Mac sales cooled. Woof. Whatever, Apple generates a ton of FCF even still, they can buyback stock forever, they’re fine.

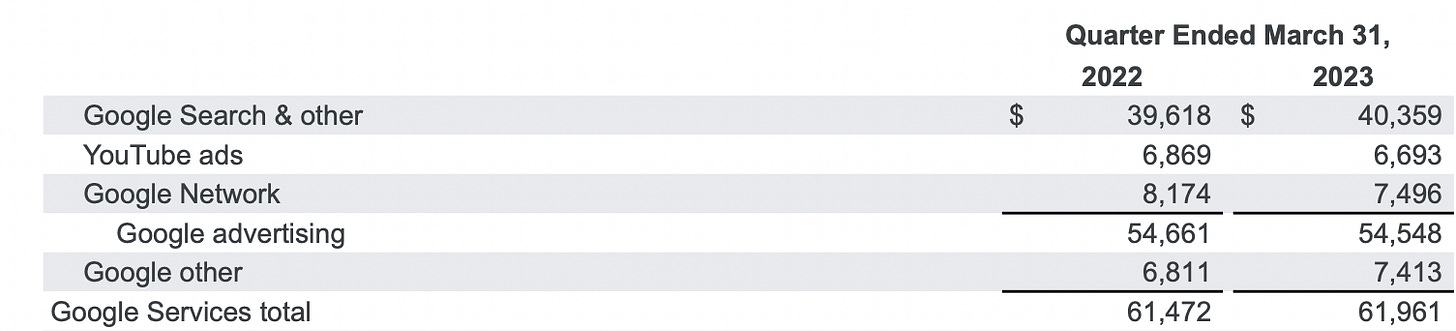

Google saw their ad business slightly negative year over year, there was no growth at all here, and actually YouTube which is their star growth segment was in decline. They too still make alot of money and can buoy the stock.

Microsoft grew Revenue 7%, a nice number but nothing to write home about. Azure grew nicely from a much smaller base, but otherwise this was pretty mediocre.

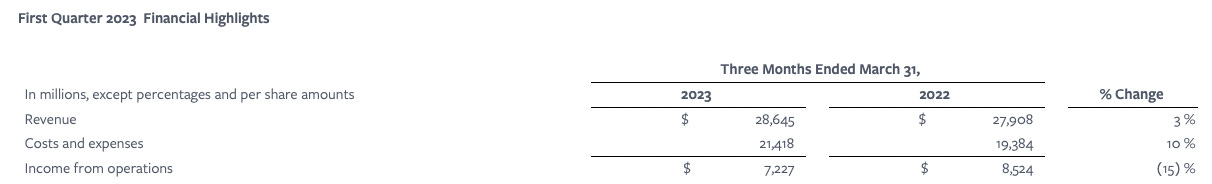

Meta grew 3% and saw its income decline 15% while the stock tripled.

So if you step back and be objective about last quarter, truly outside of Amazon which is eating away at the ad duopoly of Meta and Google. The rest of the mega caps have run more than hard enough based on the moderate numbers they’re showing. Apple hit all time highs on declining revenue. Who would’ve thought that? Google went up on negative numbers in its core business? The run has been epic. Meta tripled on 3% revenue growth YOY? If Amazon could ever figure out how to slow capex and show some FCF which I think they will in the coming quarters, their catch up will be epic as well. The point is, organic growth is nearly gone in mega caps, other than Azure at Microsoft or services at Amazon, it just isn’t there anymore. So I don’t know the bull case other than buybacks at this point for most of these, but I’m curious to see what they report this quarter and how the market reacts. Hence why I’m sitting patiently after the amazing last 12 months we had in here waiting for the re-ratings I think will happen to occur.

The flight to the safety of junk remained today look at ROKU,CVNA,JMIA all up 7-10% as the utter garbage continues to rip, this is really not what you want to see with quality names selling off and the money rotating back into very mediocre to put it kindly names.

Trends

Looking here today at the trends of the past week: HOOD was up 2% today, PLTR up 5%, MGM up 4%, DKNG +7%, RIVN up 2.25%,MU up 3%, XOM was up 1.5% some decent movers here amongst the top trending names.

1 Week

2 Week

1 Month

Today’s Unusual Options Flow & What Stood Out

103 Trades Today