7/13 Recap

Wrapping up a little early today. Another day, another gap and go. The /NQ is +200 as I type this up. This move has been unreal. I don’t even know what bears are left to give their side of the story. What is most intriguing here is that on the weekly chart below, we are putting in a bullish engulfing candle this week after putting one in 2 weeks ago. Look at this trend for the last 10 months with that little hiccup in March which corrected itself in 2 weeks.Even going back 8 weeks ago, the minute we cleared that last little bit of resistance, we have been nonstop since.

The TNX collapsed today which lead to this upside. This was a false breakout for sure now, no question about it, 5 straight days down and it is broken.

The DXY also broke below 100. So while everyone is cheering stocks up, the dollar is getting annihilated. It is now down 15% from when I tweeted that it looked like it was topping out last September

It is now looking at its first close below 100 in a long time as you can see below. This really isn’t good, think about how much the market is up since last September and remember the dollar is worth 15% less. How much are you really up?

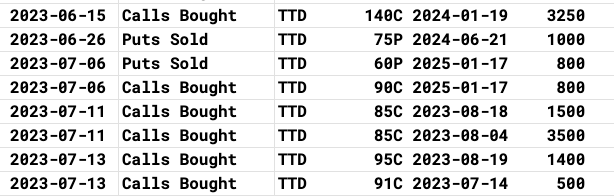

Recent Trades

Honestly, I can’t even keep up with how many of these unusual trades I’ve posted that have worked out recently. I know alot of you take many of these but are you starting to see how the game actually works? It has nothing to do with what 98% of investors are focused on like balance sheets and earnings, it really is impressive to watch.

This morning we had TTD get added to the Nasdaq 100, I know I had noted many trades on that recently with that very unusual lot of $140 calls for January that were almost 100% out of the money. The stock is up 20% since and flying today. Who had the foresight to grab calls that far OTM a month back is the question?

BVN also crossed $8 for the first time since I noted that massive risk reversal selling 50,000 puts at $7 to finance $8 calls for next weeks expiry. It is up almost 15% since

MGM is up 5.5% today. You don’t have to look far, it was in Monday’s recap where I noted a huge risk reversal put on. If you’re catching on, it’s not the large names in these recaps you want to focus on but the smaller names where you see an odd lot traded. The large names see so many trades its hard to gather much from them.

Lastly in the 6/29 recap I highlighted some calls on SSYS, someone randomly added 12,500 calls on a ticker that doesn’t see that action and today those calls end up being +500% for Jchenry in the discord chat. It’s just fascinating watching these unusual lots in motion after they’re placed. This trade was placed with around 3 weeks to expiry and sure enough, the stock rallied just enough!

I wish I had the time or risk tolerance to gamble on more of these but good for those of you who do. You’re definitely playing the game the right way.

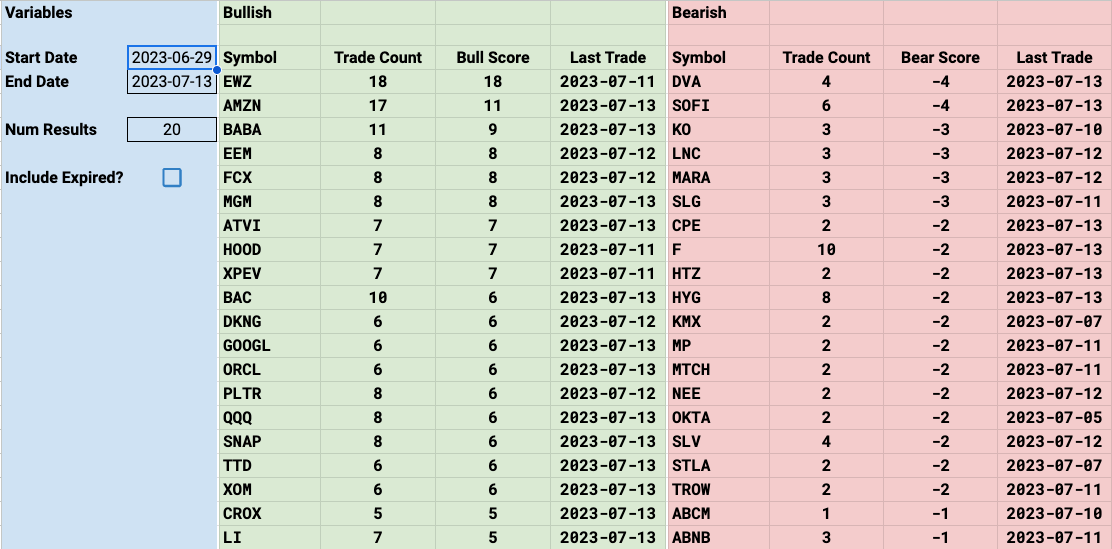

Trends

Well, Amazon finally broke out of that range its been in for 3 weeks, that flurry of call buying is finally paying off as it moves up to another range. SNAP is up a ton this week, BABA and MGM too. The market has been straight up so naturally there’s going to be alot of names up but some of these top trending names are up enormously: COIN,TTD,TOST,RDFN in the short term. Even on the monthly timeframe you’re seeing lots of these names like JPM make a power move into earnings as the EWZ and EEM calls are finally making sense with the dollar falling off a cliff.

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity & What Stood Out

118 Trades Today

Apologies for the small font today, there too many trades to note and I couldn’t squeeze them in.