7/21 Recap

The market continues its levitating act. Yesterday the /NQ had its big flush lower off the Tesla report and today nearly all the megacaps are red yet the /ES is green. It’s amazing the resilience this market has when it can’t even go down when the largest components aren’t working, but that shift in breadth is a good thing as the tech trade seems to mostly be running out of steam for now.

There are some warning signs flashing in this market right now. Utilities and Healthcare are breaking out, that is usually not a good sign of what is coming.

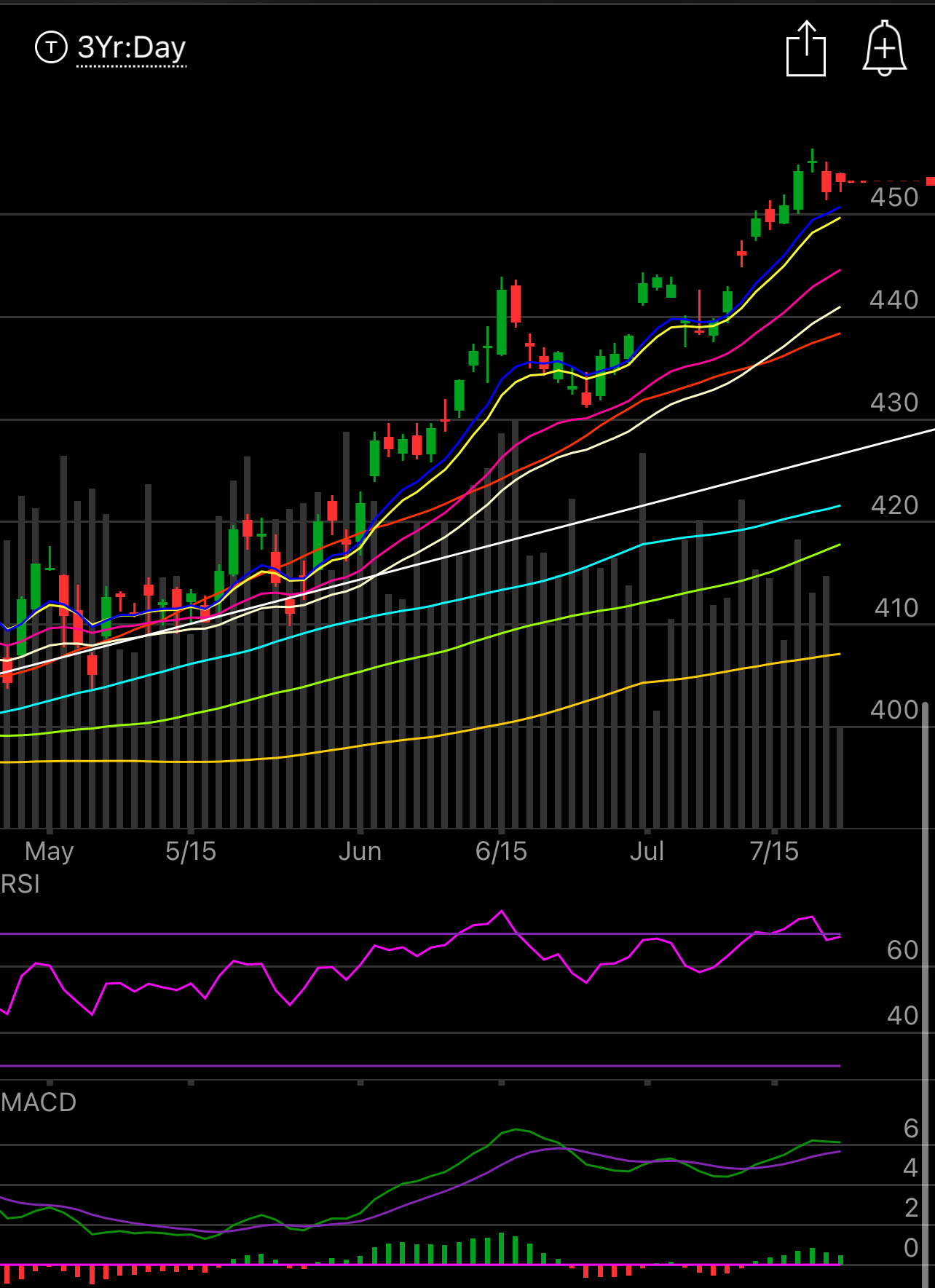

Here is the XLV(healthcare)

and here is the XLU(Utilities)

So keep an open mind, there is a much larger market than tech stocks. I am not changing my positioning, I still do think into the next 6 months most tech names are flattish but I do think a very large re-rating is still coming to Amazon. Moreover in regards to Amazon, do I think MSFT and Apple have 100% upside still at $3T? Absolutely not. Do I think Amazon had maybe 50% upside from $1.3T to $2T as they right the ship? Yea, sure that isn’t nuts to say. So I remain positive on my positioning.

Trends

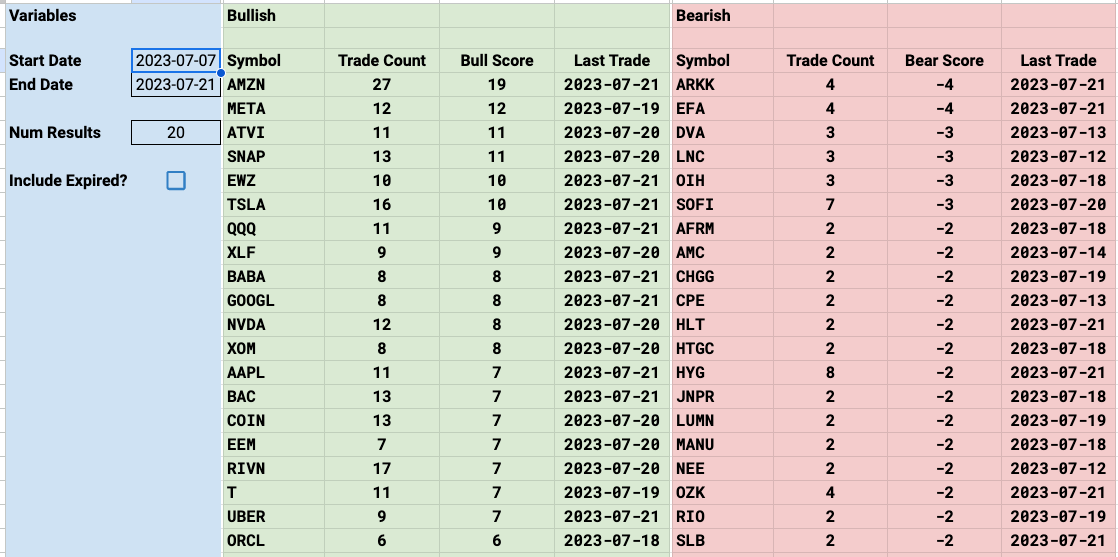

All those Brazil trades that have been showing up here for weeks are finally working. EWZ is up 2.3% today over $33 and looking for its highest close since November 2022. All that positioning took weeks to play out but it is working now. T which may the worst stock of the last 3 decades with a 0% return in that timeframe was up the last 3 days as all the bullish flow came in. On the medium timeframe XOM having 8 trades and them all being bullish is catching my eye. I do like energy names alot in the short term as they’re showing relative strength.

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow & What Stood Out

90 Trades Today

Slow day, OPEX, pretty slow day as I usually see way more interesting stuff by the time I cut off but with earnings next week for so many names lots are exercising caution most likely.