7/22 Recap

The big chart for everyone at the moment is the QQQ. Big tech runs the market and we all know it has been the weak spot the last few sessions. As you can see below the clear uptrend from April broke on friday. Today you can see the rebound and rejection on the underside of that uptrend. This is pretty standard stuff for a trend break. You move up, you reject, and proceed lower. What can change this? Tomorrow Google reports, the rest of megacaps do not until next week. If Google knocks it out of the park and does something to surprise or guide higher, we very well could be done with the recent rough patch. If not, it could get messier. The broken chart shows there has been alot of selling and it is going to take something good to reverse that. Now that we have more clarity on the election and know that it will be Trump vs Harris, both are very friendly to big tech, so alot of the unknowns are removed hence today’s small bounce. The 8 ema is now crossing down through the 21 ema on the daily, that is a bearish cross, not good either. Tech is just simply going to remain a laggard for now barring a miracle from Google this week. Continue to focus on other sectors we’ve discussed in the meantime until we see some strength in tech.

Recent Trades

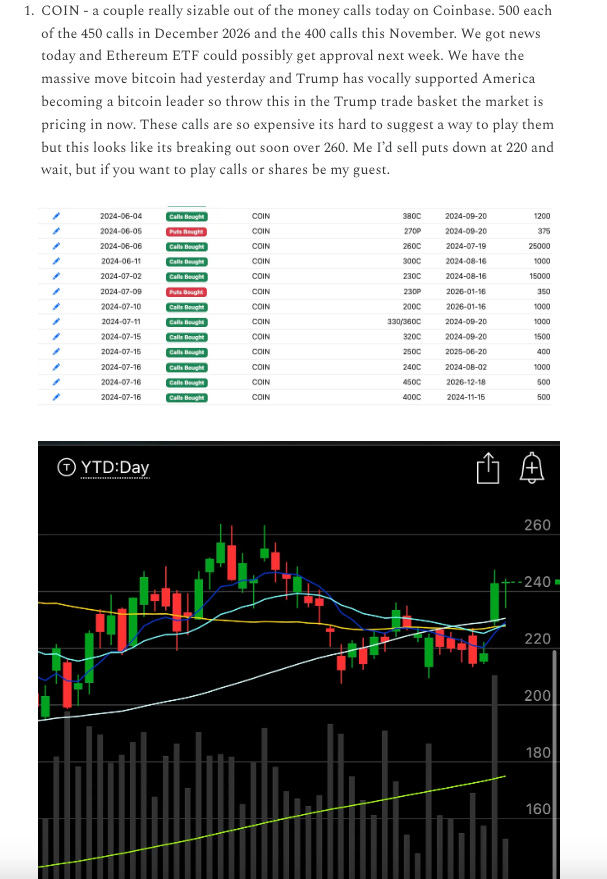

COIN - This was one I highlighted last week here. It was just over $240 at the time and lots of bullish flow came in, it remains the top trending name in the rankings below over the last week, it is up nearly 9% since to 263 and this name looks excellent on longer timeframes. I like this one alot still even with the quick move. Just be mindful that this name moves very harshly in both directions so you really more than ever have to sell puts into support and be patient.

Trends

1 Week

2 Week