7/23 Weekend Discussion.

I had nothing planned today after sending the options preview and the best idea early so I wanted to do one long primer on this substack and how to utilize the data along with an update I’m thinking of implementing if there is enough interest.

I know all I’m about to say is up in the links at the top, but I will go over this one more time because there are so many new users from the last time I discussed this.

My Objective

Before writing this substack, the table you see everyday was something I did for myself for many years handling money. The point was for me to have a way of seeing all the days unusual activity in a simple to use manner. I could then take that dataset and do my homework on what was occurring within the market and how I wanted to position my book around it. Pretty simple stuff, money is going into XYZ, and I want to conceptualize a gameplan for myself.

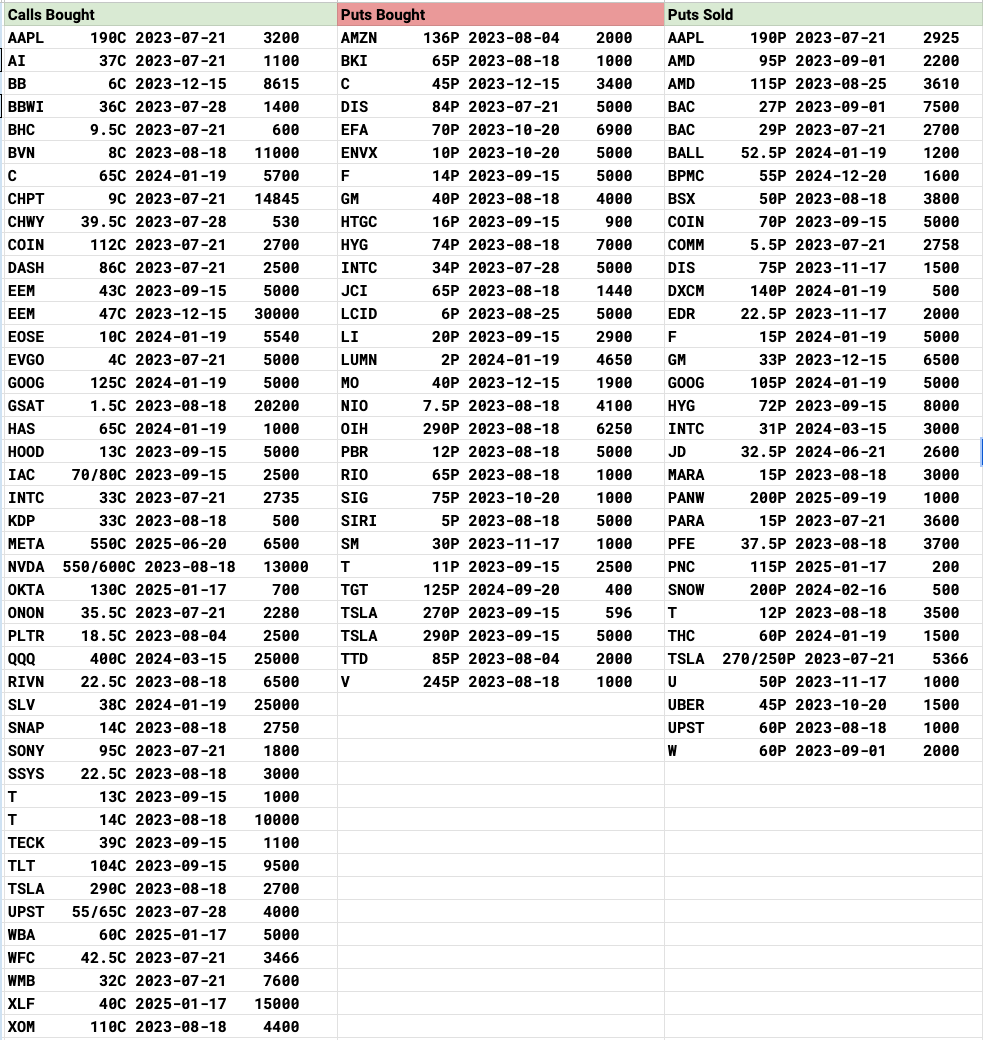

So everyday, you get something like this table below which is from the 7/17 recap last Monday. Here is the LINK

Of all the millions of trades placed in the options market on a given day, these were the ones that came up in a scan I set for the parameters that I was interested in. My parameters are based on many things, but the main thing is I look for unusual size within the historical contexts of a name. If a name historically trades 1000 calls a day and today it traded 8x that, I want to look deeper into that.

Now the table above is sorted into 3 columns: Calls Bought, Puts Bought, and Puts Sold. Simple enough call buys are bullish, put buys are bearish, and puts sold are levels institutions are looking to go long a stock. Due to the nature of these trades, it is often hard to gauge what is what in terms of calls buys and put buys. These very well could be hedges, you just never now. The only way is to look deeper at the name, the short interest, where it is on a chart and go from there. The put sales are really more my focus as I’m trying to position my book around where other professionals are looking. Having worked in the space a long time, I know the decision making process involved with placing large trades and when others are placing these huge bets, I know alot of time and effort was put into the process.

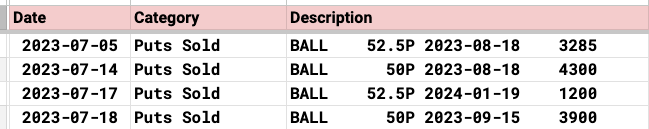

Take the above from last Monday, those weekly Apple put sales at 190 were sold 2925x. That was a trade from someone willing to take on $55m of Apple shares at 190 by Friday. The stock closed at 191.94. The trade worked beautifully and they made money and moved on. Take that trade you see on BALL where puts were sold 1200x at 52.50. That name has seen repeated put sales recently, look at these 4 total in the last 2 weeks. Funds are attempting to get long this stock at the levels you see below, and if you remember I highlighted it last week and it was up every single day since.

That tends to be how these things work, especially in the smaller names. The point of it is you see how funds are positioning, on your end. You can do some chart work on your own, you can ask questions to the hundreds of other users in the discord to get more eyes on something you are looking at, the main thing is you know how funds are playing a name and now you can play it however you want, even more conservatively. In the example above, a fund is willing to go long 3900 x 100 shares of BALL at $50 in September. That is a notional value of 390,000 x $50 which is $19.5M. Not the largest trade, but very notable in a name like that which doesn’t see massive buys daily like say a Microsoft. If a fund is a willing buyer there, I’m interested in selling puts even lower, maybe $47.50. Do you get the point I’m trying to make?

When you look at the trends section everyday I post 3 timeframes: 1 week, 2 week, and 1 month. The purpose of this is to see where are the bullish/bearish trades being placed. This gives you an edge so to speak on what names to look into. If you look below, those are the names with the most odd action in the last month, that gives you a great spot to begin your homework of looking into what charts do I want to look at. Look how the banks JPM,BAC,SCHW were popping up repeatedly before the big moves they had, FCX had a huge move this month, ATVI finally got its deal pop, the point is this is just 1 more tool to help you in your journey to gain an edge.

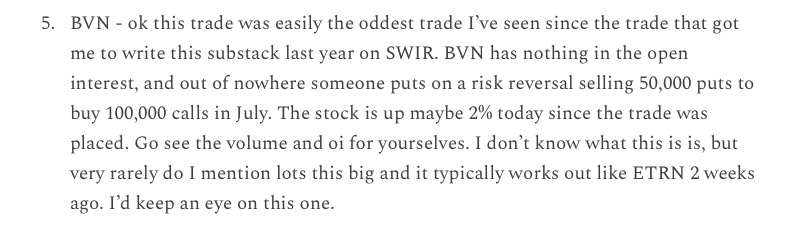

There is real alpha being presented to you in these recaps with the live flow of money and while it is highlighted to a degree it still requires some work on your end. Option flows show what funds are doing today, retail investors focus on the 13-F which shows what funds did months ago. Access to this data isn’t cheap so it is understandable why retail investors don’t focus on it but it allows you to potentially position better than the so-called “smart money”. That is how I view the data, but I am an aggressive put seller typically. Many others in here like to buy the calls and puts and that is fine, its just not my cup of tea to play short term calls, even if you play common stock, things can work out fine. Take a month back on 6/7 in the recap when I noted a very odd trade on small Peruvian miner LINK

At the time I said this and the stock was 7.10 when I said this

Here is the BVN chart from that date.

The stock as you can see ran that day and within 2 sessions had touched 7.80. So had you just bought common you were up 10%. The name faded, but before the 7/21 expiry it did at one point touch 8.20 so you could have sold your common stock multiple times for a sizable gain. The player who placed that trade was right and wrong. The fact they used a risk reversal which is what I always suggest allowed them to be wrong on the calls bought but still be ok because they sold puts. They financed the whole trade using free money at that point because they were willing buyers at $7 and that never hit

Timeframes

As you all know I try my hardest to get this recap out everyday with 2+ hours left in the day for you all. The reason is I know many of you are daytraders and want information to place trades before the day is over, I fully get that. I know others want the full days data as well. What I will say is all the data after I cut off is still added to my database everyday and you will see it in the trends.

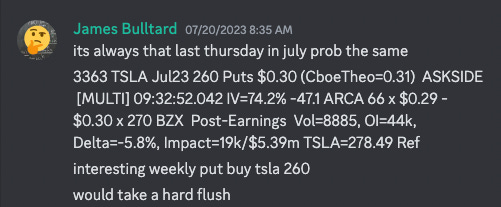

I’ve mentioned before that I know many have asked me about a live channel in the discord. If you are interested in something like that please comment below. I am willing to dedicate more time to this whole thing if its a worthwhile project. I’m obviously not around all day in the discord but take last Thursday morning I posted this in there. It was the morning after the earnings miss from TSLA and 5 minutes after the bell, someone bought 3363 weekly 260 puts on TSLA for .30

The stock opened that day at $280 when those puts were bought and at one point Friday morning those puts had gone from .30 to $7+, a 20x gain within one day. Now would you have seen that in the recap? Sure but I didn’t even post it in the recap because from the time I saw it the stock had already dumped $15 and I didn’t want someone to see that and jump in too late, so in many situations, right after the trade is placed, the equity makes a subsequent move. I do think a live tier is a big help but its really more a matter of how many are interested if I’m going to dedicate myself to sitting in that all day. So I will wait for your feedback below.

In Closing

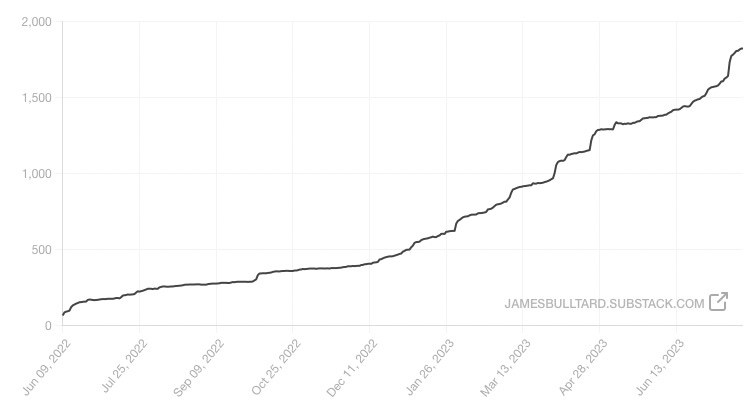

As I said in the post the other day, tonight at 10 PM CST, current members by that time retain their pricing forever, that is whatever number you signed up at. People who are on free trials I don’t know what happens to be honest, I messaged substack billing Saturday but got no reply so far. Every new member after 10 PM CST tonight will pay nearly double. That’s just my way of attempting to slow things down until I figure out how to best manage things. At this point, things were out of control for me when this quarter began in July and as you can see below I’ve almost grown this substack another 20% in less than a month here in July and I just can’t keep having people sign up everyday at the low price because I really cannot keep up with the requests by myself at this point. I figure higher prices may deter some in the short term. The number of users has quadrupled nearly since January and by myself I cannot handle all the emails/requests.

Actually I just cracked the top 20 paid newslestters in the finance space so don’t feel bad for me, this is going very well. I just think the nature of my substack with so many things changing daily in the charts/flows is what leads to the constant stream of questions regarding things. It’s a whole different dynamic from someone writing just 1 deep dive and sending it out.

Which brings me to my last point. I am no longer answering any emails regarding charts or options flows. Period. If you have serious questions, yes I am happy to help you on your journey but if you have a question about a chart, as I said there are hundreds in the discord who can easily help you. If you have a question about options flow for a name, first off I would say many people in here built something very similar to what I use which is a simple google sheet to monitor their own data at their own leisure. I saw someone say they don’t want to manually input the data. What do you think I do everyday? These are all manual inputs. So if you want to know what names are seeing what, that is the best way. Of course I post the charts and trends daily so I really don’t see the need for you to go through that trouble, but some want their own to search and that is fine.

Again, I don’t mean any of this in a rude way, it’s just not easy answering all these emails/requests. It just isn’t possible anymore as most who sign up shoot you questions in regards to the how/what/why. I get it, I really do want to be helpful, but the reality is there just isn’t enough time in a day to reply to every person regarding their specific situation.

My whole goal here is to provide a curated list of unusual options data on a daily basis, add in some chart setups of interest & that’s it. I cannot spend multiple hours a day answering emails as I have for the last few months it has mentally drained me.

Again think about the live tier, if you’re interested I know we tried a couple months back for 2 days and you all enjoyed it. I can post the options flows all live in a channel in the discord for all those interested to have real time access. At the time there just wasn’t enough interest to keep it going. I created the live channel on the discord, go in there drop your interest, and we can bounce ideas, and go from there.

Thank you all, I hope you have a great rest of your weekend and I will see you tomorrow.

PS - Substack still doesn’t have spellcheck and I don’t proofread my work ever, if there are grammatical errors, I apologize, but the errors give it a more authentic feel imo, I write from the heart and hit send.

Absolutely interested in live channel!

new here, how do I join the discord? TY