7/24 Recap

A dull session today as everyone awaits Microsoft and Google tomorrow. Those should be 2 very large reports as they give so much insight into all this AI hype that has driven the market to this point. Will Microsoft give any insights on their ChatGPT investment. Will Google surprise with anything? Both have run so hard and their numbers likely won’t be that impressive YOY. So it’s going to take alot to keep this tech only rally going. You can already feel the weakness in these names. Then you have the looming UPS strike in 1 week. Will they be able to strike a deal in the next few days to avoid one of the biggest strikes in American history? I hope yes, too many jobs are at stake, but short term that could have an impact on names like Amazon which announced earnings a week later than expected to see what happens with UPS.

The SPY refuses to worry about any of the above, it has now been 10 sessions since it has even touched the 8 ema, one of its longest streaks in a long time. It is flagging now, but remains max overbought on the rsi. The next few sessions should give us the breakout/breakdown we’re looking for. The SPY could pullback even 5% to 430 and still be within this 10 month long uptrend we’ve been in, so fear not.

Oil is up almost 20% since the end of June to nearly $80, you have to wonder when this will begin to impact all those “inflation is dead” estimates everyone is running with. The guidance from alot of these companies over the next 2 weeks will be interesting to see.

Lastly the dollar is following through after reclaiming the breakdown level from 2 weeks ago.This still has alot of resistance above but higher oil and higher dollar are not good things for equities. So that rotation I noted on Friday into the XLU and XLV will is making a little more sense here as people move to defensive things.

Trends

VALE finally got that +4% pop today. This has shown up in these trends for a month now with nonstop action. If you remember last week I noted that massive 50,000x risk reversal on it. EWZ as well up over 2% today along with the EEM up almost 2% all those finally worked out. On the bearish side AGNC has alot of recent puts and reports today. Were those hedges? Were they shorts, we will find out, today they added 40,000 more puts on that in 1 swoop that you can see below. It’s nice to see the bearish trades finally happening in the low quality names like ARKK,CVNA,LCID,LUMN,AFRM over the last week, those names were too strong for too long recently.

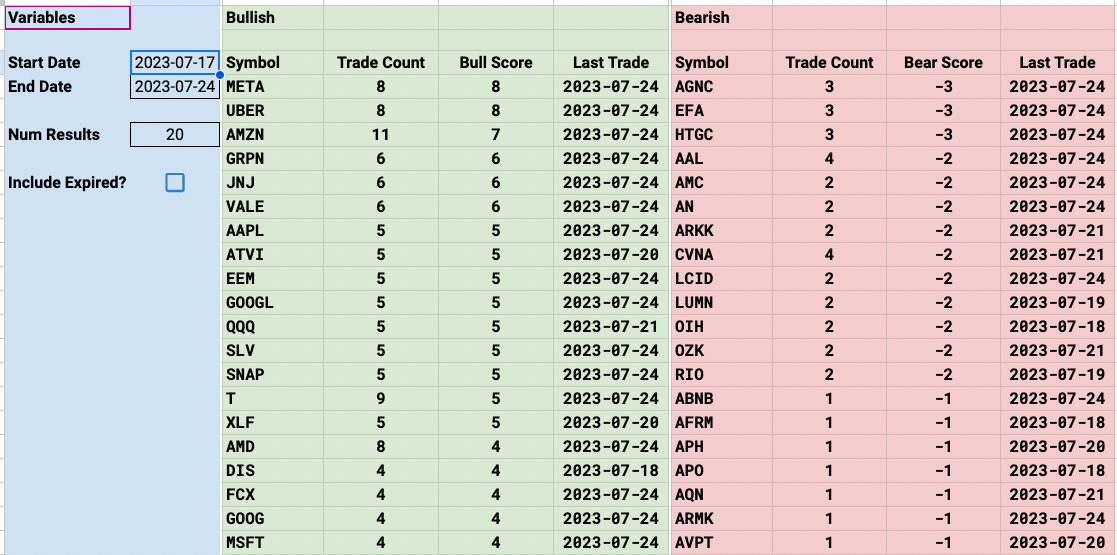

1 Week

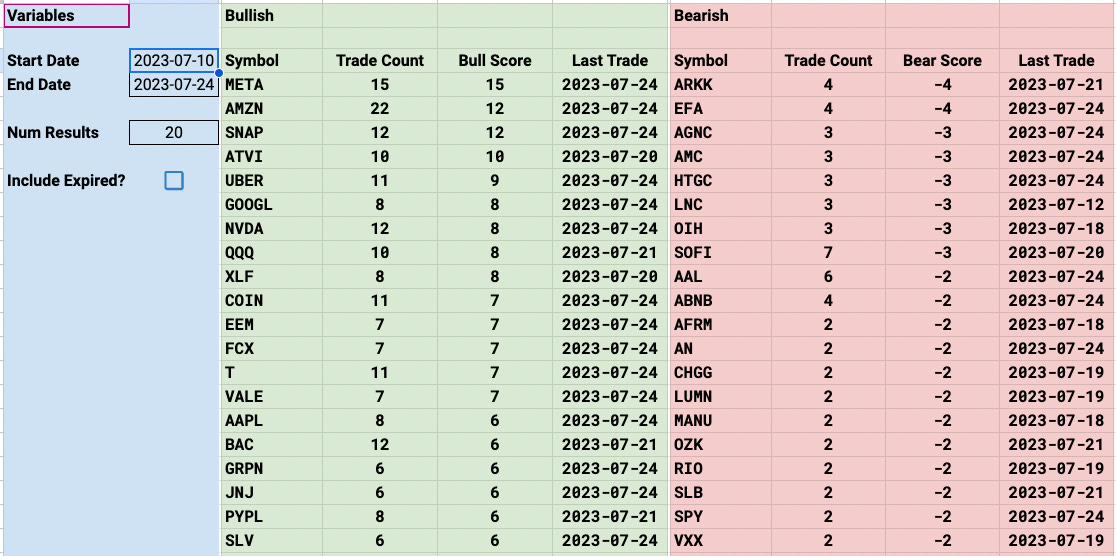

2 Week

1 Month

Today’s Unusual Option Activity

120 Trades Today, one that stood out today from recent trades was APLD which was up 25% at one point and I looked through my notes and I noted a risk reversal on it back on June 26th. Amazing move today.

Another that I highlighted last week was those KMI calls it is up 2.5% to 18.25 today. That’s why I say pay more attention to these smaller names, there’s alot more alpha to be had there than in these large caps where countless trades are going off daily.