7/24 Recap

Really ugly move in big tech today which is rattling the whole market with the nasdaq down 600 now. Are any of you really shocked? We’ve been discussing this breakdown on the QQQ for awhile now, again you will always see every breakdown in a chart before the worst actually happens. Look back at the last 3 sessions before today below, what do you see? The QQQ kept rejecting that uptrend in a bear flag below the 21 ema, that just wasn’t inspiring and the hope was Tesla and Google reporting would potentially save megacaps, but they didn’t. Today the QQQ is breaking the 50 day(yellow line) for the first time since mid April. You can point to whatever you want on the “why” side of things but the charts have told you tech isn’t where you want to be for over a week now. Nearly every megacap chart is breaking down at this moment.

Google spooked many with their comments yesterday. Think about this huge run we’ve had in markets pricing in how AI was going to change the world and Google basically said capex would be rising beyond estimates for AI but they still do not see anything meaningful in terms of return from AI. That scared everyone but because Google makes so much money, they said they’re ok overspending because it is better than underspending incase AI becomes big. Really odd commentary and not what investors want to hear when so many outside of the techies are already skeptical of this AI boom. Zuckerberg also said something similar yesterday which is why META is hammered today. You cannot shock investors with comments like Google had and expect anything positive out of it when you’ve been telling people how you need to spend fortunes for AI but you see nothing material from it. Bezos did the same thing at Amazon 2 months back in an email and it hit Amazon hard. Tesla was no help with another complete earnings disaster, every metric was just awful and the company is still the most egregiously overvalued name in the market and it isn’t close. It really is disgusting how the whole valuation rests on made up segments that are nowhere near revenue generation and the actual existing business is trading 100x earnings while the main business of cars ie automotive revenue was down 7% year over year. When you have 2 of the top tech names kicking off earnings in such a bad manner, investors get spooked and now everyone panics before hearing from the rest.

The next landing place for the QQQ is the 100 day just below 460. The SPY, below, is also looking terrible with a clear breakdown below the 21 ema today.

The biggest problem today is we no longer have variations. The SPY, the QQQ, the Dow Jones are all basically the same thing now. Because big tech is all we have, they’re all so heavily allocated to it now so these moves down, impact everything. The SPY is 30% the 6 largest tech names. Even the “dow jones industrial” they got fed up with the 30 names underperforming so much over the last decade that now you have Apple, Microsoft, Amazon, Salesforce,etc so when big tech dips, they all dip. On the flip side this is why big tech mostly goes up because there is just so much more inflow than outflow over longer timeframes.

Bottom line, we broke the 21 ema on the QQQ 6 sessions back, that was your tell, tech was over for a little while. Today we broke it on the SPY. Markets are simply going to be weak for a little while. Sometimes there’s other stocks to trade besides the big 6 tech stocks everyone is in. I’m not sure anyone reading this everyday could say they’re surprised or they have missed me literally saying please avoid trading tech in the short term everyday for almost 2 weeks now. If you’re a short term trader, you should have been fine and if you’re a longer term investor you also should be fine as these names will come back because they always do. Big tech was incredibly overweighted amongst everyone, names like Google, while quality, were at historically high multiples.

Recent Trades

I have 2 to discuss today, one is a big loser.

Starting with TEL, I highlighted this one 2 days back and I mentioned it was the most interesting one I saw just simply because the name had nothing in it. These call spread are up 100% today on a 5% move up today. If you want to hold on you can, but I think 100% gain in 2 days in this weak tape is time to sell.

The big loser was LW, what a disaster of a quarter, they missed earnings by a mile which is how you get these surprisingly big moves on names that don’t typically see them. People get a shock they weren’t looking for. This isn’t even a retail name, its the largest frozen potato supplier think McDonald’s french fries. There were put sellers galore in this name and the put sellers rarely are wrong, much less this wrong, but they were this time. Yesterday I highlighted the $70 put sales for August for $1, there were plenty more put sellers who thought this was a stable name instead it is -27% on a shocker of a quarter. The put sellers, those were decimated today, you have a couple choices when that happens if you played.

you take shares and you sell calls working your way out of it, it takes time, but you never have to take a loss, especially on a name this cheap, it is sub 10x earnings. This name earned almost $8/share the past year and earnings weren’t awful. It also pays a dividend so you will collect that as you wait.

you roll your puts down and out, those August puts are down big but you can roll them down to say January 60 puts and sell twice as many at 7.30 each which would actually give you a credit too.

Me personally if I was in this, what I would do is this, this morning there was only 1 analyst and they reiterated $96 as you can see below. Fine, your $69 basis on those put sales yesterday in August really isn’t the worst no matter how bad it looks now. Today is just capitulation, again this isn’t something egregiously overvalued, but there is panic and moves get overdone. The quarter was awful but you can see eps was $5.08 and at 58.xx now, it isn’t expensive at just over 10x earnings.

I would heavily sell January $50 puts for 3.20 right now, I mean heavily. I would let your shares come to you in August and I would sell a January $70 call vs those shares when you get them. Again now you have to work your way out of this backwards. So $69 basis on shares, put sales at 50 to try to average down and then call sales at 70 to try and get called away. If you get these shares in January it is below 47 and blended in with your shares at 69 + a covered call, you now have a very low basis to work out of with more covered calls in January on a very cheap name. Do not panic, as long as names aren’t horribly overvalued you can always work out of every trade with shares but it takes some time and effort.

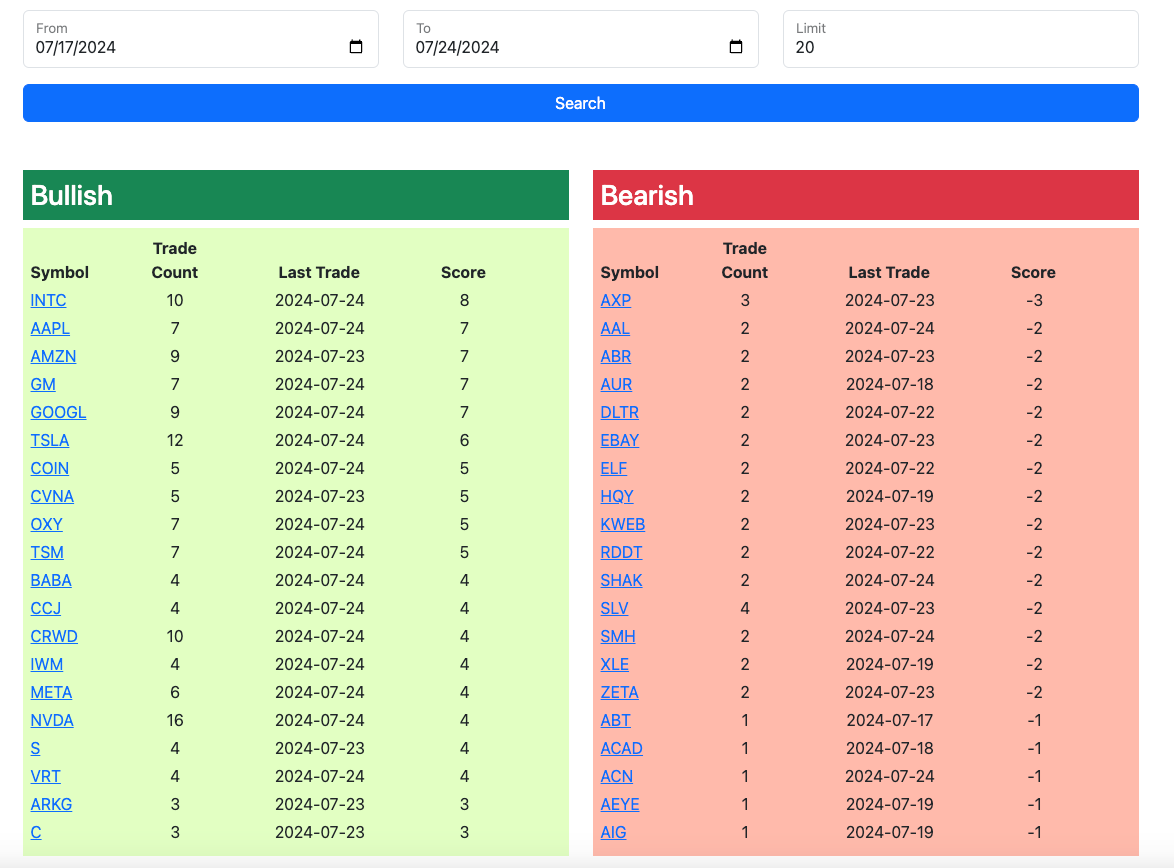

Trends

1 Week

2 Week