7/24/25 Recap

The SPY is melting up, I really have nothing to add here, like I’ve been saying for week we are just riding this 8 ema higher. There will come a time we break that 8 ema and caution will be warranted then, but for now, you have to be long this chart is clear as day with that smooth ride up over the dark blue line.

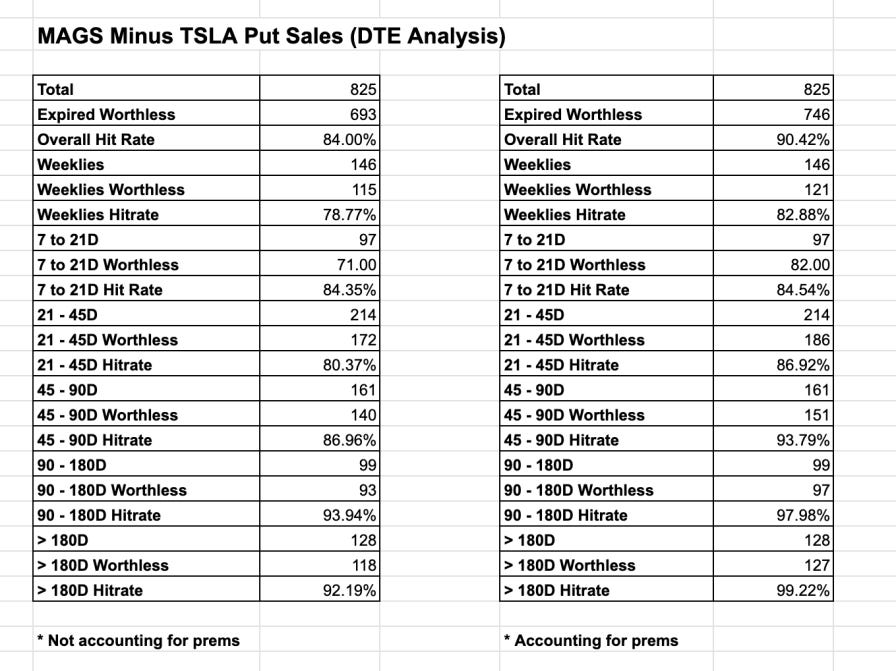

One of the things alot of you ask me about is the put selling and why I prefer it to the call buying. So geoffbezos in the discord compiled all this data off my database. I asked him to do a longer write up and he’s hoping to have it for you all by this sunday. Basically he took every trade in my database since I began sharing it and he pulled up historical data on the trades including the price they were executed at and below is all his data. We’re trying to incorporate all this into the database and individual names but the thing that should stand out to you is why I always say the put sale data in the database is the most valuable. Down below you can see especially on the megacaps ex tesla, the put sales over 180 days out succeeded at a 99.2% clip. That is pretty remarkable and shows that big money is rarely wrong on long term put sales. More impressive is the fact that if I flag a put sale, 72.6% of the time it expires worthless and it goes to an even higher number over 90% if you just focus on the 6 megacaps ex Tesla. The probabilities of success are just much higher with put sales which is why you see me trade around this data with leverage. I increase the odds in my favor and I fully understand when to cut the leverage when the overall market breaks trend. Combining those two things is a very powerful thing in the market because you don’t have to be directionally right like you do with call buys or put buys, you can still win whether a stock goes up,down, or sideways.

Anyways just wanted you to see all this and he will go into more in depth this weekend. Again you can do whatever you want with this data whether you buy commons, buy calls, etc. I am just explaining more on why I prefer to sell puts and it is the edge involved. I’ve given you plenty of explanations on how to use risk reversals to buy calls for free, that is another big step in limiting your losses should you be gambling on calls. Bottom line, you see my book everyday, I’m very concentrated in a handful of names that I think have the best charts combined with the best option flow. Just remember you don’t need to focus on 30 tickers in your trading book, just pick a handful you think are lining up right, for me that usually means they’re high on my ranking system and go at those, that is how you maximize this data by taking the most bullish names and then focusing on selling puts into the strength where 72.6% of overall put sales I flag expire worthless and it is definitely even higher in top trending names.

My Open Book

Trades I Added Today