7/27 Recap

Going back to yesterday’s post and the topic of PEAD, today was a classic example of what that was all about. The /NQ is up 237 right now and everything is flying except MSFT. It is the laggard now and will lag for the period ahead. That’s how the game works, when names are weak, you move aside, it doesn’t mean anything long term, Microsoft is still one of the premier names in our market. All it means is for the short period ahead, if you want to sit in it, be prepared for it to underperform. Google meanwhile continues to shine after that big move up and is drifting as I suspected it would outperforming the /NQ by alot as it is up 2.8% with the /NQ up 1.5%.

I try to help with idea curation below everyday but make mental notes of what names are having good reactions on ER and try to focus on those for the period ahead. Look at a name like CVE today, I’ve been noting that one for weeks and its up almost 5% today. That is another that likely will remain a pocket of strength for the time ahead.

The SPY continues higher but today’s candle isn’t the best so far, could this be a local top? I don’t know but we just emerged out of a bull flat we had been forming for the last 10 days or so. RSI remains incredibly overbought but in general as long as remain over that blue line, the 8 ema we’re still in a powerful trend higher.

This weekly chart is otherworldly, but again very overheated as the RSI confirms. It can stay this way so don’t think of it in terms of it must cool off, NVDA has been overheated for months, but its rare to see on the overall market. Moreover when names pull this far away from the weekly moving averages there is usually a cooling off period where the moving averages catch up. We’re about 5% away from the weekly 8 right now. Just be cautious if anything is all.

Trends

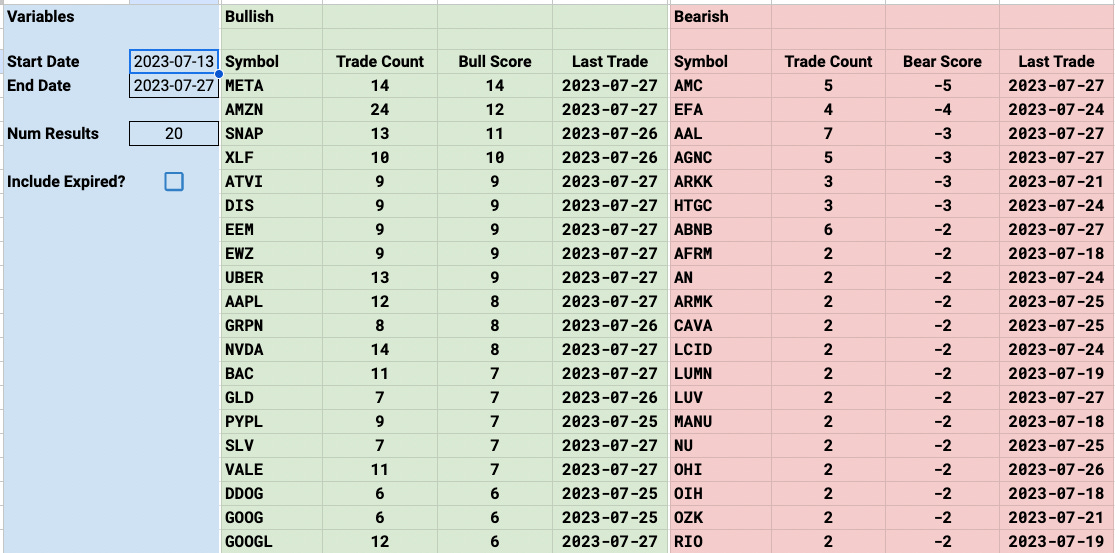

Week To Date

2 Week

1 Month

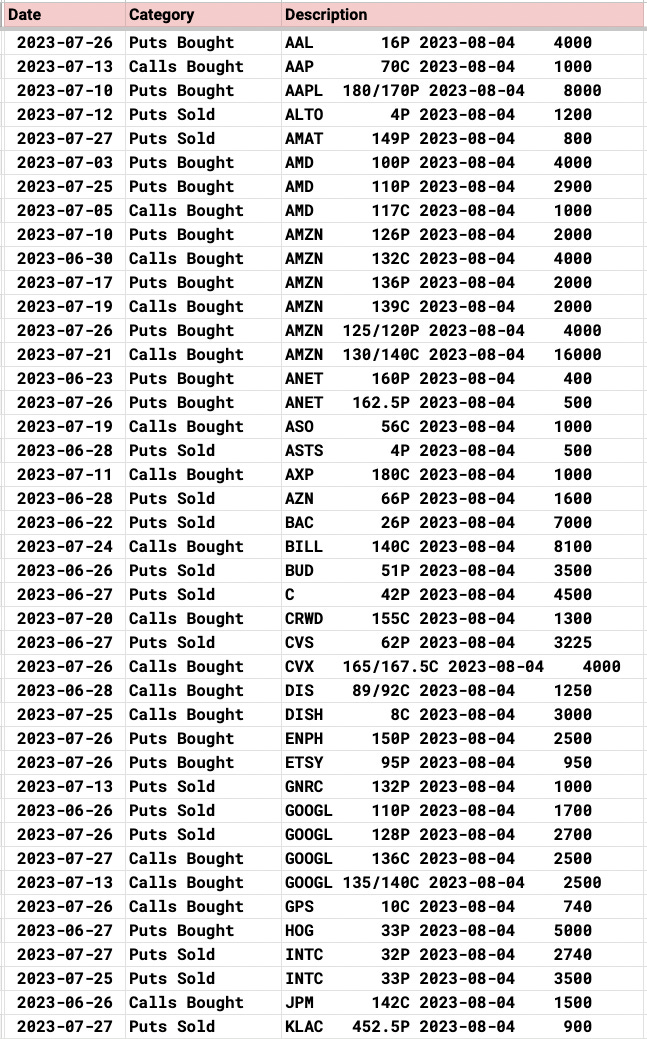

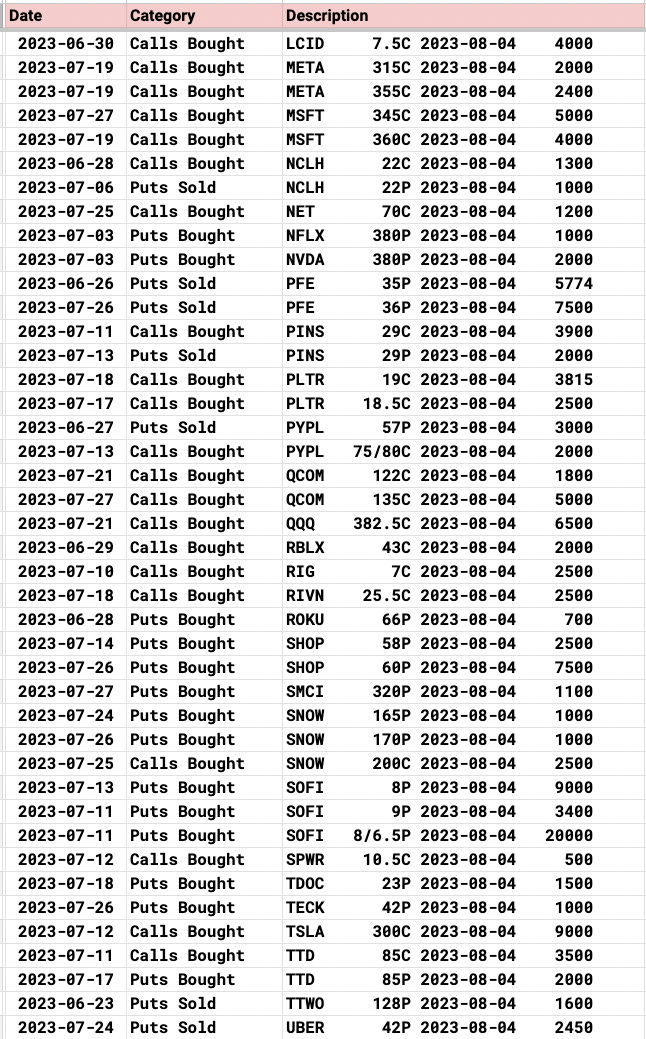

Today’s Unusual Options Flow & What Stood Out

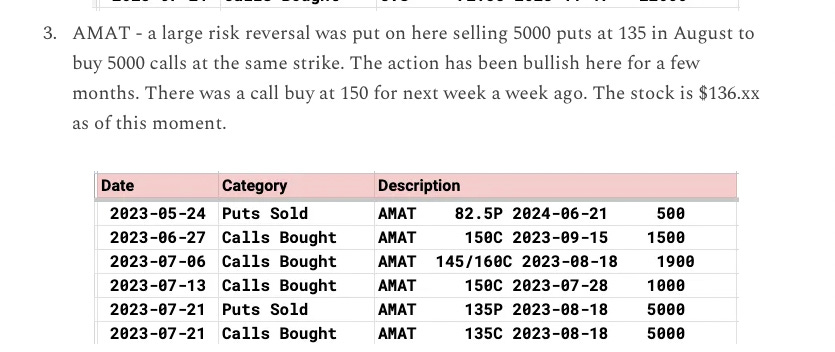

The one that stood out to me today was AMAT, I highlighted it a few days back and today it was +8%. All those trades below really paid out nicely today on this big move

124 Trades Today

Trades Of Interest

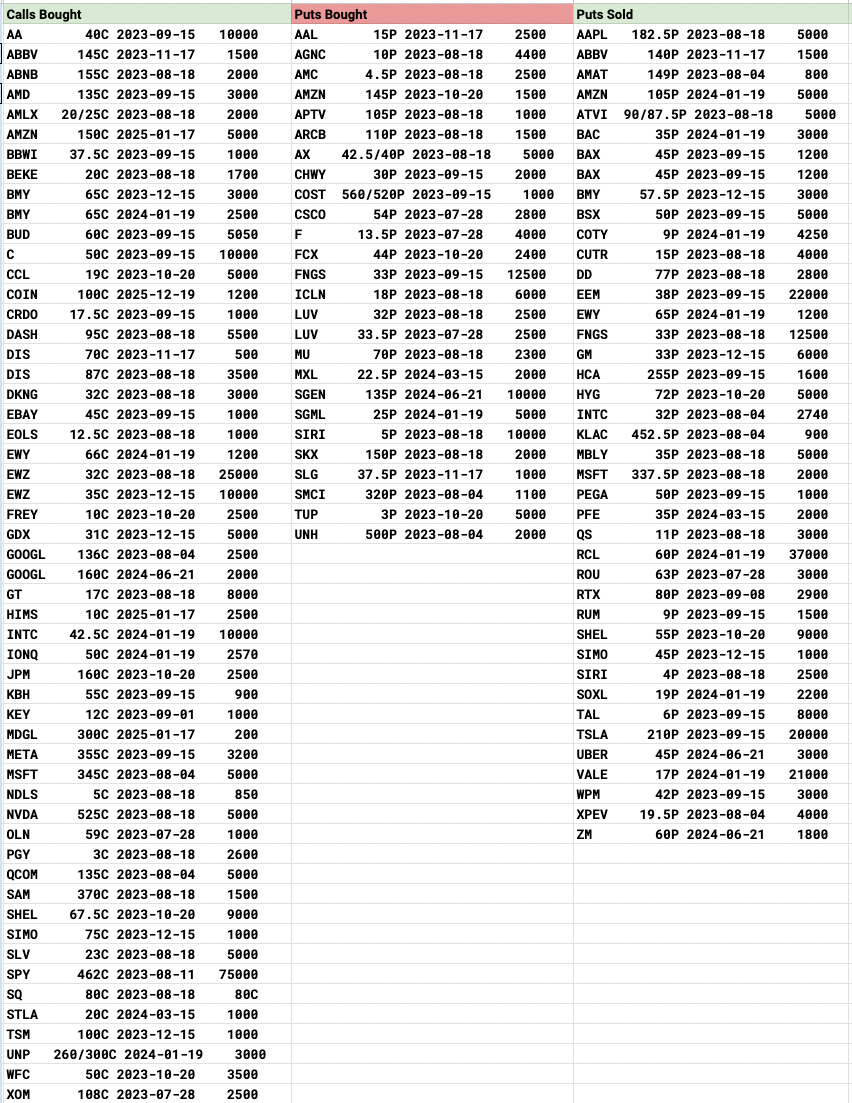

NICE - this is an interesting one, its a very underfollowed name but it keeps seeing these really small odd lot risk reversals. 2 in the last 2 sessions. The weekly is close to a big move up if it can just get over those 2 moving averages overhead. You can see all the put sales pretty much at the money here and using the funds to buy upside call spreads. That 180 level looks like strong support if you wish to be conservative and sell puts there but very odd lots here.

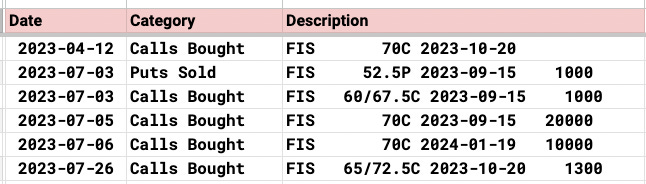

FIS - I noted this name a few weeks back on some unusual calls being bought and there’s been a few more since with 1300 more 65/72.5 call spreads bought yesterday. On the chart below you can see FIS in a huge spot but if it can push over it has alot of room to run into the next big pocket of resistance at 80. Those 52.5 puts sold below for September look like a nice spot into some strong support and you can use the proceeds for upside calls if you want to partake there. The 20,000 September 70 calls are interesting, as are the other 10,000 at 70 in January.

RCL - This had a tremendous earnings reaction today up 11% right now. There has not been anything really in the past month just 2 put sales. Today there was another massive put sale at 60 37,000x but that doesn’t really pay out much as its so far away. With a name like this likely to drift for the coming quarter, and a large pocket of support at the 100 level, you could look to sell puts even lower like $80 or below for January. This name should continue to be a strong one for the next few months after this report.

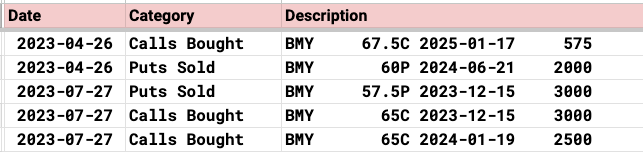

BMY - keeping up with that healthcare rotation theme I’ve noted, Bristol Myers has been seeing some bullish flow today for the first time in months. I haven’t noted anything still open here since April. I have to say that weekly chart below is awful, truly. While I don’t advocate ever being involved with charts like this, we are seeing a healthcare rotation and this is one of the quality names 20% off its 52 week highs. It pays a nice yield as well. The puts sold today are at 57.5 in December, the calls bought are all 65+. If you really wanted to play this you can go lower than those put sales to 55 or 52.50 and see what comes of it but yes a bearish engulfing candle on the weekly at lows and below every moving average is a bit of technical damage that needs to be repaired which will take time.

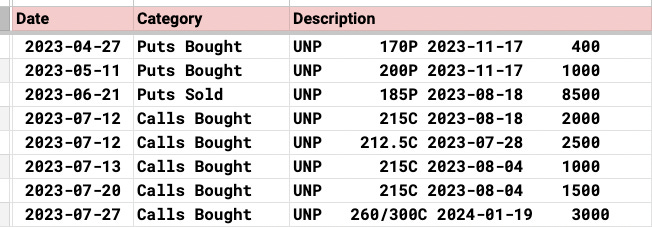

UNP - This had a tremendous earnings reaction yesterday and today saw a big call spread bought 3000x at 260/300. They were adding this one all of July before that huge move. Pretty clear breakout on the weekly chart and this is another name that should drift for the quarter ahead. There is huge support below and selling puts at 215 or lower longer term is probably a nice spot to get long this name as the moving averages slope up. A move over 300 would be incredible for a railroad like this going up 50% in 6 months, but the flows are the flows.

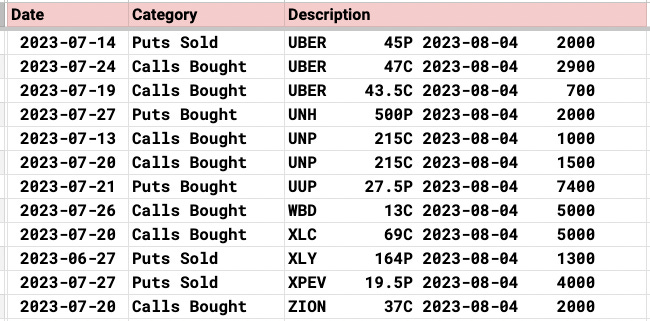

Expiring Options Of Note For Next Week

I’ve looked for my original email so I can enter discord but I can’t locate it. Anyway to get the link? I hate to ask but I really feel I can contribute a significant amount.

Now that you’ve been X’d from X, think you will be more active here? Elon must’ve realize you’re one of the best kept secrets on the platform. I believe there are quite a few superb investors from Twitter that follow you here and believe this community could be great for ideas. Maybe a discord for paying subscribers? Just some thoughts. Cheers Z