7/30/25 Recap

The SPY is doing nothing notable today, we’re all waiting on the fed today and what Powell has to say. Trump made it very clear in a post on truth social this morning that Powell has to cut rates right now and we all saw the showdown between the two last week at the fed building. Tensions are high and Trump is hoping to hear some good news today regarding the cuts. We have 4 of the 6 largest companies in the world reporting today and tomorrow which should have a major impact on our markets, so there is just alot going on right now which is why I stepped aside yesterday from all the leverage I was utilizing. Alot of people think they always have to be in the market, I’m completely fine with missing a couple days of action to be able to get some clarity and then pressing leverage in my favor when I have that. Who knows what happens today maybe we just rip higher off the 8 ema, these FOMC events are all over the place but for now the price action remains bullish I am just conservative enough to say I’ve made enough this year and I don’t care to partake in the risk the next few days. Even if the coast is clear after today, I would probably focus more on the shorter term trades because we’re something like a week away from the longest streak since 2000 for the Nasdaq over the 21 ema, this has been an insane run and these things do not last this long historically. So be mindful of that.

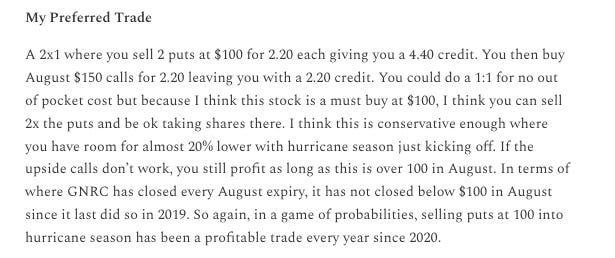

I don’t really discuss it much, but do you all realize the power of the risk reversal if you’re directionally right? The whole purpose of all this data is so we can be in the right names at the right time but when you actually swing at something with a risk reversal and hit it, the outcome is remarkable. Go back to all these weekend best ideas I’ve posted recently like AMD or GNRC you name it people always ask me why I discuss risk reversals and here is why, look at GNRC today up 15%, I wrote it up as a best idea on 5/25 here it was 122 then and 173 dollars today. The risk reversal below I put together for you paid you $4.40 to put on, today those August $150 calls went from $2.20 to $26. Your calls went up 13x and you got paid to take those calls, that’s why you use risk reversals because if these calls hadn’t worked, worst case you would’ve gone long at a great level. I’ve said it many times but being able to place trades for a credit is the ultimate life hack when it comes to markets if you’re a call buyer.

My Open Book