7/5 Recap

Today was another ho hum day. Very low volume and the market is probably in a spot like this until next week. Too many people are on vacation and there is really not much to read here. We remain trending over the 8 ema, so short term, bullish, but I would like to see that gap below fill.

Now here is what concerns me, the TNX is breaking out. This is the 10 year treasury. As you can see we haven’t seen strength here in over a year. This is not a good sign for stocks. If this continue to break out and the dollar keeps strengthening, this will put a lid on equities. High multiple names more so than others. This whole tech boom we’ve had could be in for a pause. Does it mean I’m changing my positioning? No, I really don’t care, a period of weakness is probably due after this crazy run, but some names will outperform others as they report and guide in the coming month and I’m more interested in seeing all that first that panicking and closing on something like this. With that said, I do expect weakness/chop as long as this sustains.

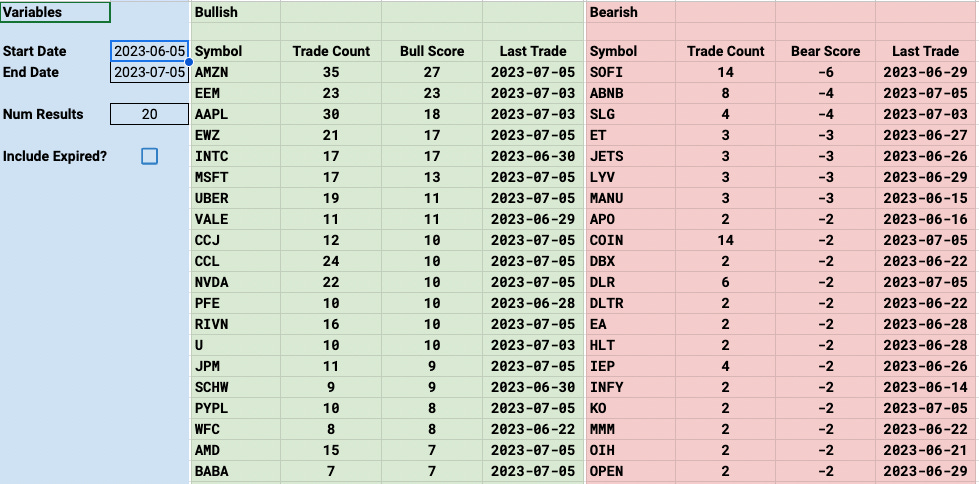

Trends

How about that RIVN pop this morning? It almost hit $21/share, it up was 20% at one point this morning between today and the last session. It’s faded that move but all those call buys that have been showing up in these trends for the last month really paid off. Even with this move lower, RIVN is still +40% this month.

On a short term basis, names we don’t see often in these trends like HOOD,APEV,AZN,URI,COMM,COTY,URI are dominating the short term bullish trends. PYPL is one showing up in the 2 week trends and it appears to have bottomed after a very long period of pain.

Alot of you ask me the purpose of this. These trends are designed to show you where the money is flowing too, the focus should be on selling puts lower into strength, when a name is seeing alot of bullish call buying or put selling, don’t we want to sell puts into that? We certainly don’t want to sell puts into weakness, so you have to take these names one by one, pull up a chart and see where the levels of interest are if you want to play. It’s just a tool to try and keep you out of weak trending names.

1 Week

2 Week

1 Month

2 Month

Today’s Unusual Options Activity & What Stood Out

108 Trades Today. I wanted to say here that although I have not placed a trade in nearly 2 months, I know alot of you are here simply for what I do. That’s the wrong way to look at this. The table below everyday is a curated list of the days most unusual options trade. I’m doing the hard part of taking all the activity in a session and giving you a cheat sheet to make your homework of charting that much easier. Aside from that I’m highlight 5+ trades a day that stood out to me. Even if I don’t place a trade, the ones I’m highlighting are names I would trade via short puts…….if the VIX was not 13 and the market was not extended and if I wanted to manage a book of open positions through this summer vacation. So focus on the table below, that’s what this whole substack is about.