7/5 Recap

Fairly slow session, nothing out of the ordinary after a mid week holiday. This market has been vertical for the last months after that small pause in April. I don’t think its a bubble I think 2021 was a bubble, I think 2023 was just normalization after the big down move of 2022 and now we’re just continuing off that. I think most of the big re-rating type moves are done and from here as cash flows grow so will names. It’s hard to be bearish when every megacap is breaking out. Even Tesla is breaking a 3 year down trend as we speak. This is the buy everything rally. This weekend we have our first hurricane making landfall right in my backyard, how this storm develops over the gulf could have big ramifications on things like oil with refineries being potentially affected.

When will this hot run in the market end? I don’t know but I can promise you what I always tell you, whenever we break below the 21 ema we will know it is time to be cautious. That’s why we always end up seeing every break down here where I spend alot of time warning you repeatedly and so far I haven’t heard from anyone who got seriously hurt. Whether you stick around here or not, that 1 simple rule, do not touch things below the 21 ema, will save you hours of agony in your trading journey, please remember it if you take nothing else from me. For now we’re just on cruise control and life is good as long as you’re not trying to be a hero and be short.

Also, you’ll notice below in the trades I highlight everyday that I added some analyst price targets today, nothing overkill, just a few so you can get a better feel for where analysts think the value is when you’re thinking about how to trade the names.

Recent Trades

In the 6/7 Recap here I highlighted AGQ on a day where it was smoked. It held the 50 day and has rallied nearly 20% to just over 43 up over 6% today alone. These September 44 calls highlighted below are still in the open interest and are now 4.80 each. Even with such a big move the calls didn’t move much only 30% or so because of the IV, but if you added those short puts I mentioned below they’ve gone from 1.30 to .30 which would have pushed your total return materially higher.

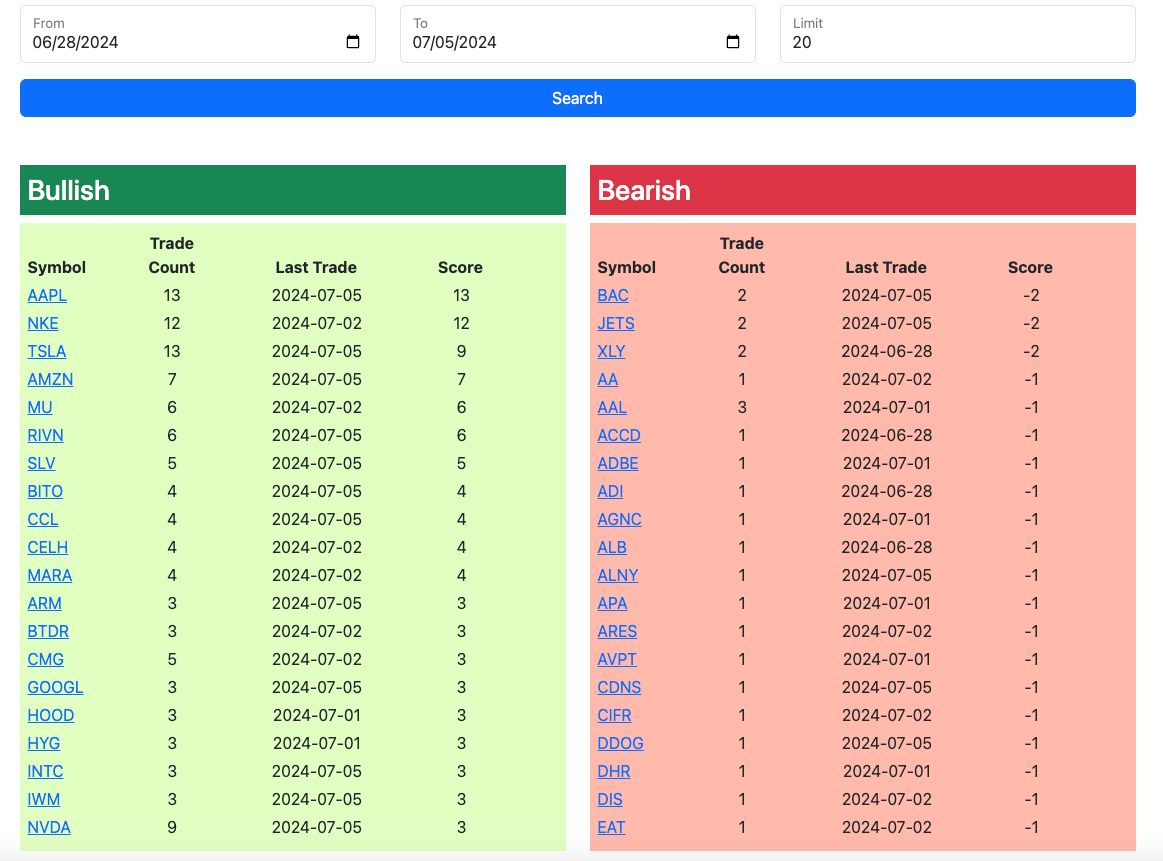

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database it will be open all weekend until the open monday morning. I will have the rest of today’s trades posted by the afternoon.