7/6 Recap

We got a continuation lower out of that TNX breakout from yesterday. You can see the treasury breakout continue today, this is clear as day now. Yesterday there was still potential of a reversal, now we’re going more confirmation. This is going to weigh on equities for a bit so please be careful if you’re using leverage, you don’t want to blow up on this/

The SPY did fill the first gap today which is good to get it out of the way. It’s hovering over the 10 ema now, depending where we close, this still isn’t horrible

Just remember these dips are all nothing of context as we are still in one giant uptrend zooming out one year. As you can see below, until we break that white line, we remain firmly in an uptrend and all these dips are just normal, healthy moves. We have not tested that white trendline in 7 weeks, a pullback to it would not be crazy, that’s about 3-4% lower.

The VIX did finally spike today to 17+ and was up over 20% at one point but has given alot of it back. That move right there was why I’ve been on the sidelines in terms of selling puts, it was only a matter of time before the VIX spiked and we went from 13 to 17 in a flash, that is a 30% move. If one was selling puts on margin into that, you would have had serious headaches to deal with. I wish this didn’t fade and I would like to see a move back to 20 just as a place to begin to sell puts again.

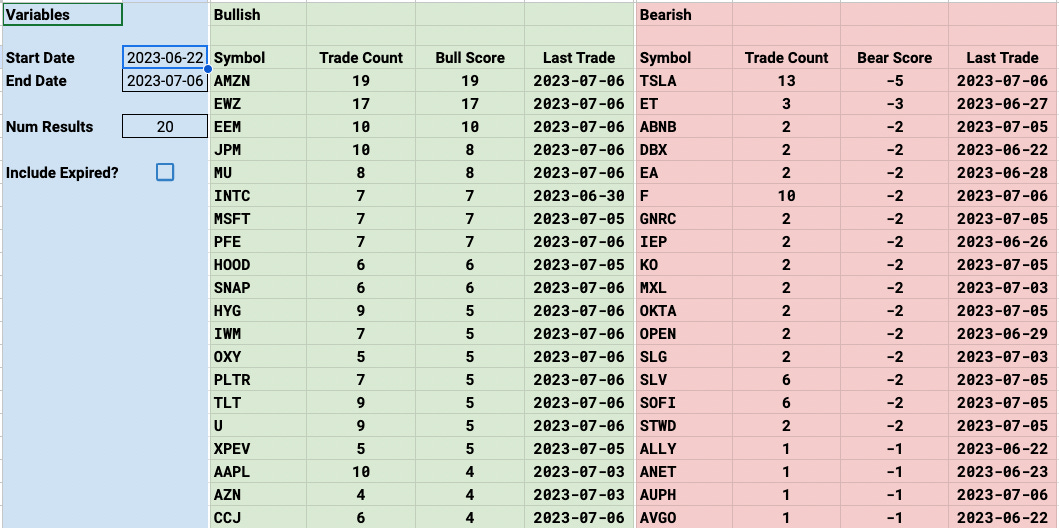

Trends

Short term there are alot of calls being bought on HOOD, CVE, and FIS. FIS I know I noted the last 2 days had another massive call buy today that you will see below. That’s 3 days in a row they’re buying huge calls 20% OTM. Will have to keep an eye there. Those 2 weekly GNRC puts they bought yesterday paid off nicely today.

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity & What Stood Out

117 Trades Today