8/1 Recap

We are finally cooling off somewhat. The RSI on the SPY has been overheated for 2-3 weeks now and we’ve mostly gone sideways as this bearish divergence is unfolding. Amazingly, we have not broken the 8 ema yet so technically, still bullish. It feels like a move lower is coming, but with so many names left to report and with so much left that could change these next few days it’s hard to say anything more than wait and see.

The big worry here for bulls is the TNX is breaking out, again. When treasuries broke out a month ago, they quickly reversed lower and now the breakout is back. I said last week something had to give soon, you can’t have stocks and treasuries ripping simultaneously. It feels like we’re going to find out soon who is telling the truth. Historically once all the big names have reported, and after Thursday they mostly all will have, the markets tend to cool off as there is no longer a catalyst in the short term.

Today/Tomorrow you have so many names reporting that are going to have so many ripple effects on various sectors. So you’re going to have to be careful with friendly fire hitting other names you may hold.

SBUX/PYPL/ELF - Consumer

PINS - Advertising

SHOP/ETSY/MELI - E-commerce

AMD - Semis

CVS/HUM - Healthcare

OXY/DVN/PXD - Energy

Trends

I expanded the 2 week and 1 month view to include 40 names because a few of you had been asking for more names. There just aren’t enough on a shorter timeframe, maybe by week end, we will see.

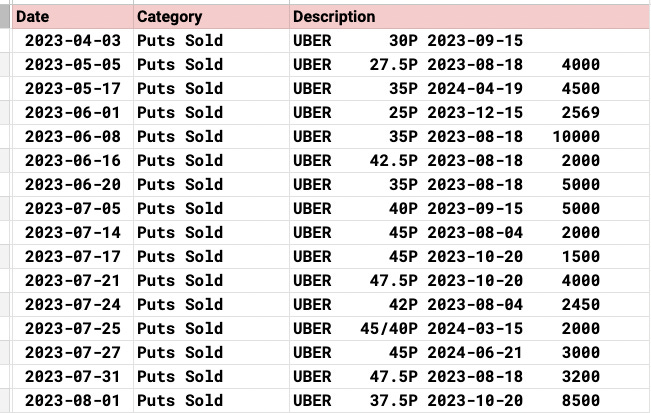

UBER had a really interesting earnings reaction up 9% in the premarket and reversed much lower now down 6%. Just highlights no matter how much I try to note what I’m seeing, even these funds aren’t right on every single trade as that was a very bullish name. It did have a great Q. The stock is 46.50 now but I wanted to show you this because I always tell you to focus just on the put sales column below as key levels, of the 16 open ones in my notes, only 2 of them are underwater now and only by $1. These put sales are usually executed at levels where you’re going to see a heavy bounce on a move down. The majority of the time put sales are going to work, moreso than calls or puts bought, so that’s why I say focus on those for where you want to play with a name.

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity

125 Trades Today