9/12 Recap

We stalled out today before CPI tomorrow. Lots of people are looking for inflation to ramp back up tomorrow. Oil is now pressing $90 a barrel after being below $70 2 months back. We have alot of question marks going forward again and the market typically does nothing like that. We have been toying with this trendline for months now but have not decisively broken it for an extended period. If we’re going to, you’d need a big catalyst like tomorrow could deliver. Hopefully all goes well and we continue chugging along.

Other than that Oracle delivered some pretty mediocre cloud numbers and all those names sold off today, I do not know why it was such a read through that the 4th most important cloud name in America reported mediocre numbers but for today it was. We also have the ARM IPO this week so people could be selling tech names preparing to buy that. The Apple iPhone event is today and if the world’s biggest company can deliver anything remotely interesting and new, Apple could lift everything.

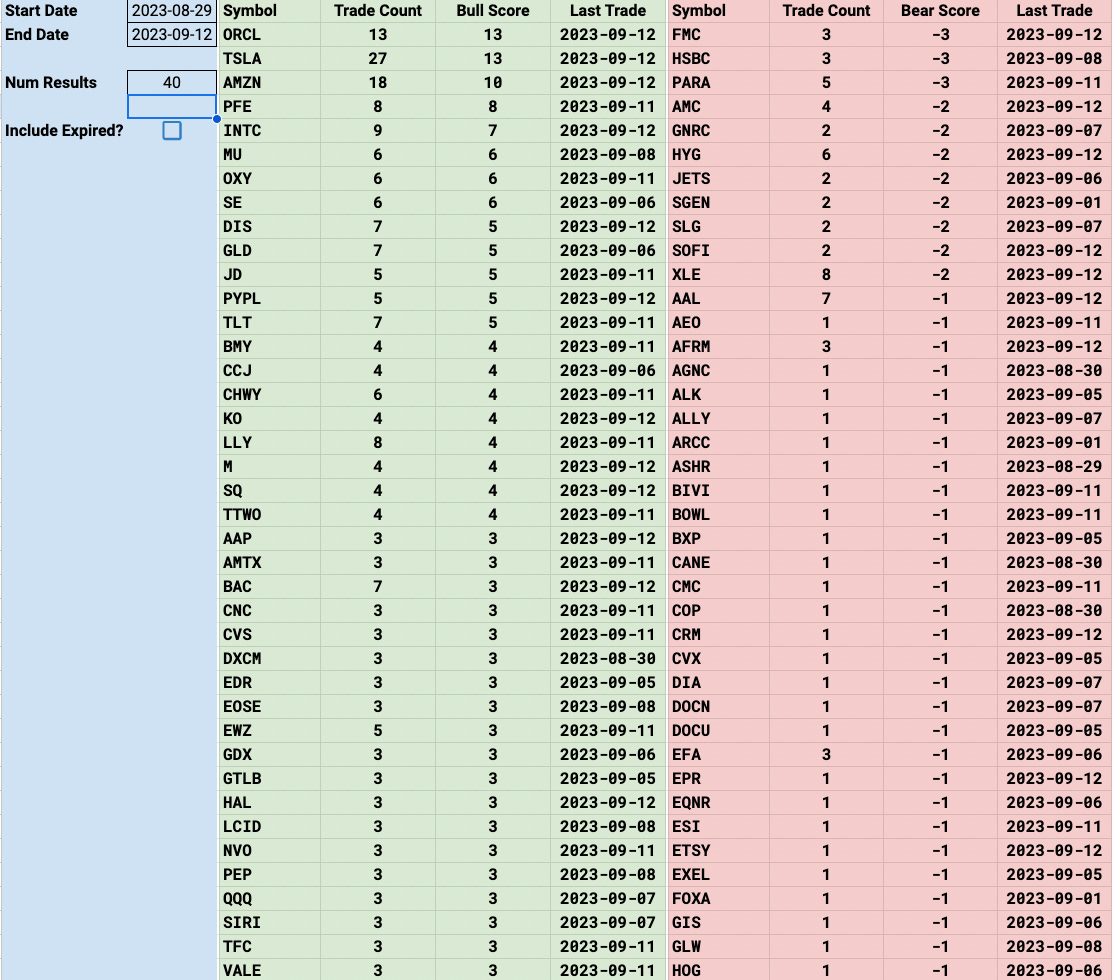

Trends

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow

One trade that stood out to me was that $25 call buy for this week on ARRY in yesterday’s recap, it popped 8% today right after that on a deal they made. Impeccable timing.

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.