8/12 Recap

As bad as last week looked, we pulled right back to the bottom of this uptrend we’ve been in since the start of 2023 on the QQQ. Tech stocks are fine as long as this trend holds, you can see this week we’re back up into the underside of that 21 week below. Look I don’t think anything is wrong with tech stocks, we just saw their earnings, they were all spectacular in terms of profit generated. The chart below held right where it was supposed to last week, so what is happening?

The issue with the market is we’re so weighted to big tech, that’s nice because they basically go up and to the right every single year as they print money and seem to be unstoppable. The problem with that is when 30% of the market weight is megacap tech and they enter a capex cycle where they’re spending way too much money on AI and it just isn’t translating to anything notable today, you get people hitting the pause button. The hope is it will in time lead to massive returns, you don’t spend $10b+ per quarter for nothing, but its hard to tell investors to think in multi year horizons when a potential recession is looming. Amazon and Microsoft are the 2 biggest hyperscalers, they’re both spending well in excess of $40b this year just on cloud capex, they both have the same YTD return of around 10% now, the market is not rewarding the great numbers they’re posting because their capex numbers are just too big for anyone to be comfortable with. Google is the 3rd biggest cloud player and they just told you they’d rather overspend than underspend incase AI is actually a big deal.

So combine the fact that AI has seen no meaningful revenue with an economy that seems to be teetering on the edge of a recession with datapoints weekly giving us conflicting signals and you get the choppy market we’re seeing where people are exiting. This also doesn’t factor in a presidential race that is now a complete 180 with Kamala leading in betting polls when Trump was a big favorite recently and you have to potentially adjust those DCF every analyst uses and price in much higher corporate tax rates with Kamala and their negative impact on stocks should that come to be. Overall we’re still up nicely on the year and considering all the above unfolding I would say that is a big win.

The SPY below shows you how oversold we got last week as even 6 days of up we are not even touching the 21 ema. This very well could be just a deadcat bounce to the underside of that 21 ema. You have your levels below to play off, you can sell puts at the 200 day around 505 and close on a break below that. If we’re honest here, that looks like a bear flag forming below, just waiting for the what to sell us off again. We need to invalidate it by pushing over that 21 ema right below 540. We also have potential war unfolding with Iran and Israel after last nights strikes and the amount of question marks we have regarding the economy, war, AI are just too much for the market to overcome for the moment. Will the market overcome them? Sure we always do, but in the short term, open questions mean stocks struggle until they get answered, that’s just how it goes. We have a constant stream of economic data weekly and now everyone is laser focused on it all with the notion a recession is near, as long as the market is below the 21 ema, it unfortunately is a sell which is why reclaiming it is of the utmost importance right now.

Trends

2 Week

1 Month

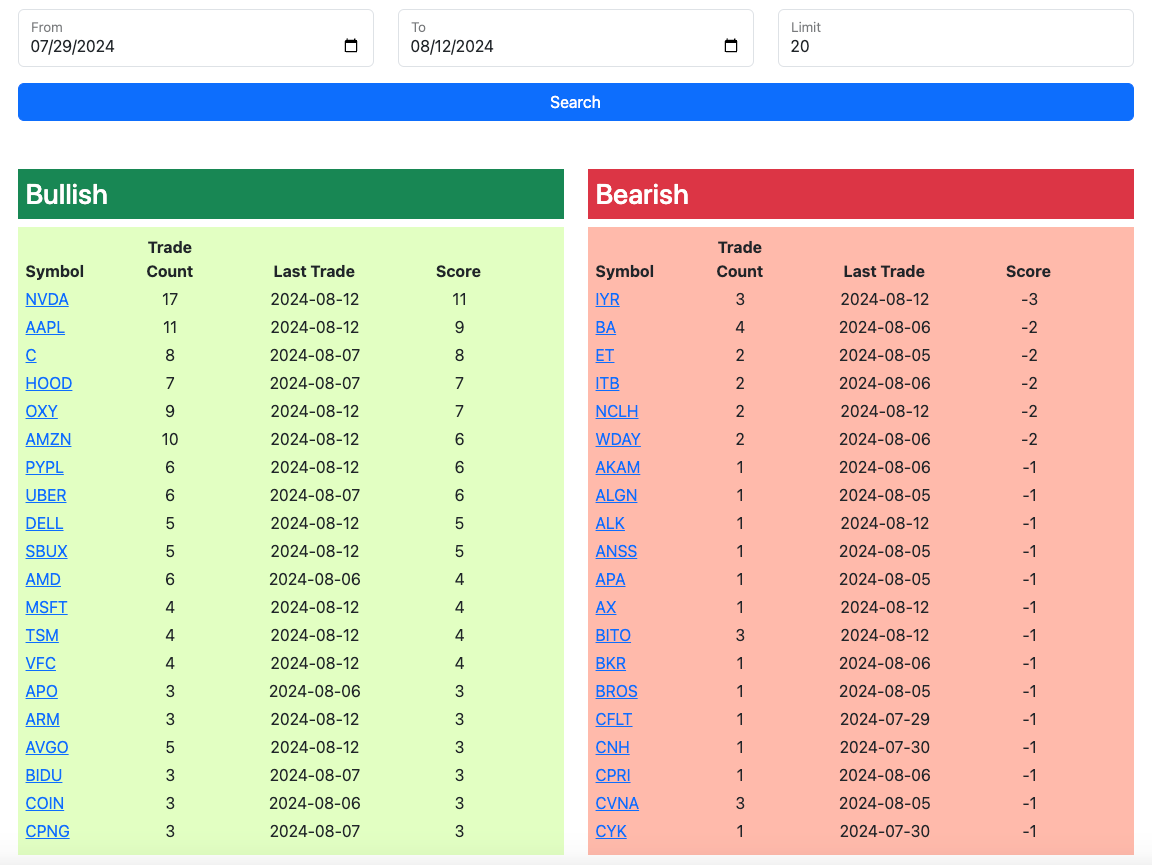

Today’s Unusual Options Flow

Here is today’s link to the database as always it will be open till tomorrow at the opening bell and the rest of today’s trades will be added by the afternoon.