8/15 Recap. Will The Market Ever Go Red Again?

This move seems endless, everyday we’re up in the face of worsening economic data. Who saw the Empire manufacturing number today? We just had our worst print since the peak of Covid. We aren’t manufacturing things and neither is China. What a mess.

Let’s look at the SPY, it finally ran into and closed at the 200 DMA at 430. Like a magnet, it went right to it in almost a straight line for the last month when we were at 370 exactly 1 month ago.

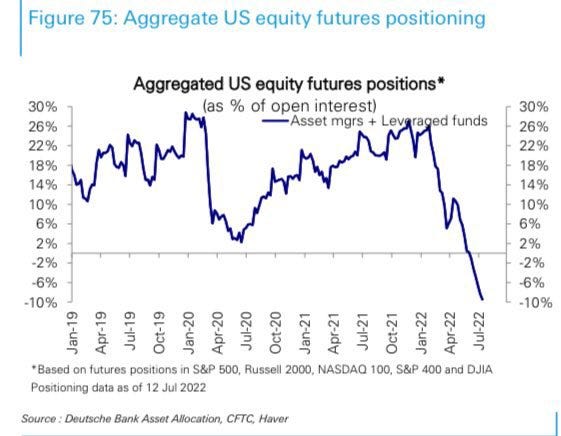

The short covering into this was epic and why not, I posted the chart of how short everyone was in July, actually July 12th to be exact. Here is that data point. We were at record levels of short interest and naturally, the squeeze was epic.

Trade Of The Week Update

I suggested selling the 93/92 put spread on RTX over the weekend for .20, I was actually able to put the trade on for .19 but it was there for .24 for a time. Regardless RTX had a really nice day and closed at 96.13. Very strong candle today as you can see below. For now I don’t have anything else to add, the chart looks strong and the name is cheap. That 93 level still remains key support as you can see below.

Today’s Unusual Options Activity & What Stood Out