8/17 Recap

Yields keep rising and it is pressuring equities. The TNX below is over 43 now and has made a colossal move since May. That is why you’re seeing growth names like ARKK down 20% in a month. All these bits and pieces fit together and you need yields to weaken for growth to recover. More than that the VIX is over 17 now as it continues to normalize. I don’t buy into the market selloff notion just yet, people are so dramatic, we’ve been straight up since last October with a couple pullbacks along the way. You will know when a pullback is coming and it won’t involve the VIX being 17 which is still laughably low on the fear scale.

We are less than 2% away from what I would consider a big spot and still firmly planted below all the key moving averages. How we react when we get to the uptrend line, that there will tell us what we need to know, until then it is too early to say this run is over. We are barely 5% off highs and the macro crowd are already hollering from the tree tops like they haven’t missed this entire run back up over the last year. All I’m saying is we have our issues, but there is nothing at this moment in the charts other than a normal pullback within an uptrend. That may change soon, but I focus on things after they confirm.

Trends

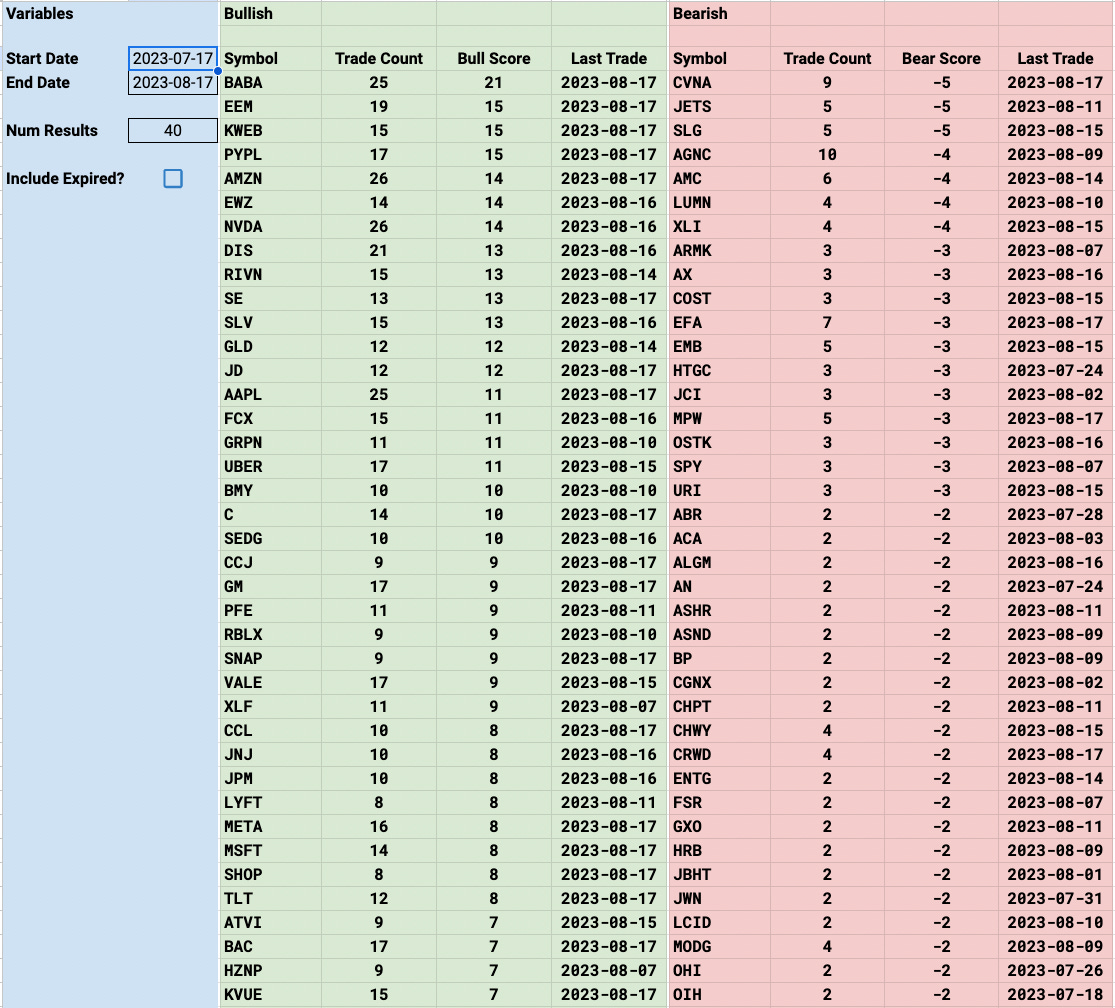

SE is leading the way this week naturally after that huge gap down, lots began to position into the future on it. SEDG is another name down big that saw alot of bullish activity this week. KVUE is the new JNJ spinoff and it began to see heavy action. What you don’t see alot of in here are the megacaps, the bullish activity on those has slowed considerably. Even on the 2 week timeframe you’re not seeing MSFT,GOOG,TSLA and those are some of the most traded names usually.

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity