8/2 Recap

Fitch cut the US credit rating yesterday after-hours and the market reacted in a panic today with tech stocks leading the way lower. While the actual cut was surprising, it wasn’t surprising that this comes at a point where the market has been extended for a few weeks now with the RSI sitting at 70 and bearish divergences forming. The market needed a breather and the credit downgrade was just the trigger. We finally broke below the 8 ema today, short term, the trend is now lower.

You can see today’s candle, until we reclaim that 8 ema, we are just going to be weak. There is a gap just below 443 that seems like our first natural point of support. Can that bearish trend change with Apple and Amazon smashing earnings tomorrow? It could, last quarter, we broke down multiple times and big tech saved the market, but for now, with the VIX spiking 15% today, the market is sending you a big warning sign. After the run we’ve had it would be prudent to listen. Again this doesn’t mean the market is in deep trouble, it means that there are other sectors besides tech and the big 7 companies. If you remember a week or so back I mentioned a rotation seemed to be happening under the surface into the XLV and XLU, both of those are green today, healthcare and utilities are defensives and go up in times like that.

The weekly chart is still nearly $20 from the uptrend line and for now a bearish engulfing candle is forming. We’re not even near the 8 week yet, that blue line, and a move to the yellow circle I drew is probably where we would bottom if this trend is to remain intact. If we break that, then we’ve got bigger issues, but we will deal with that then, for now, we have maybe 4% lower to go before we can even discuss this uptrend being over.

Tech especially looks awful as the QQQ lost its 21 ema today, the pink line, and we haven’t done that in months so again more warning signs that tech in general might not be where you want to be at the moment.

I’m going to go over my positioning at the end of this write up today.

Trends

Week To Date

2 Week

1 Month

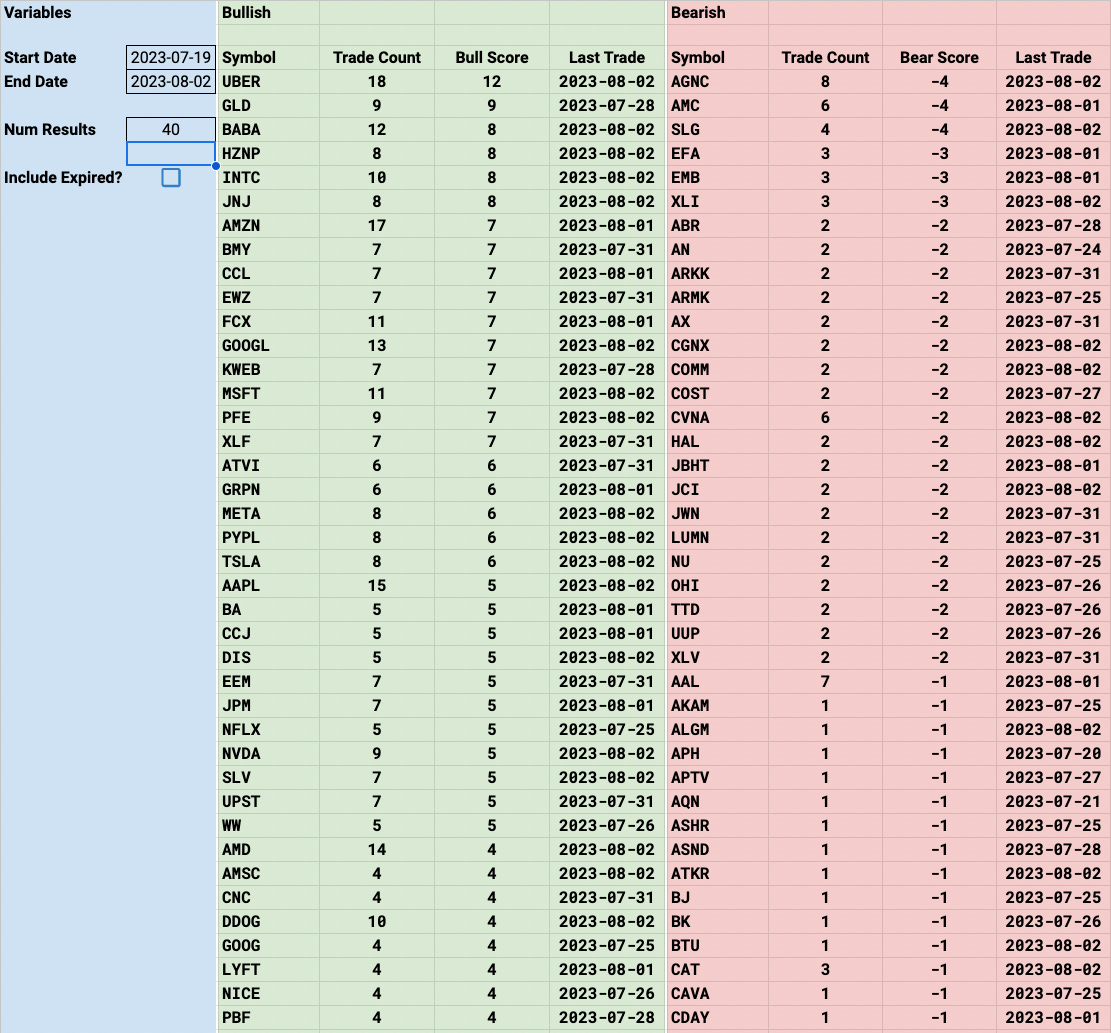

Today’s Unusual Options Activity

115 Trades Today

Keep reading with a 7-day free trial

Subscribe to The Running Of The Bulltards to keep reading this post and get 7 days of free access to the full post archives.