8/22/25 Recap

The SPY broke out to new highs today, look how it continued to cling onto that 21 day yesterday to give everyone max anxiety coming into today and the reaction to Jackson Hole was a sharp move higher. The market held up right where it was supposed to both times it broke below the 21 day this week and we got that move up today. So yesterday was a complete headfake with everything breaking down and rates rising right before they all reversed today.

You look at the QQQ below, that close yesterday was below the 21 ema for the second straight session, this is literally where you’re taught to not buy until the 21 is reclaimed and sure enough we bounce right back over it immediately as tech stocks finally caught a bid today.

Bitcoin was the real surprise, IBIT, below, closed under the 50 day yesterday for the first time in 4 months and immediately 1 day later it is back over all the key moving averages like nothing ever happened. I actually closed up my huge IBIT strangle late in the day yesterday once it looked like a close under the 50 day was certain and sure enough, that was a foolish move on my part thinking a technical breakdown mattered.

What is the lesson in all of this? You see my book everyday, as cautious as I sound I’m still incredibly levered up. I’m telling you to be cautious in case you are using leverage I don’t want you to blow up and you have to learn to lighten up the risk on technical breakdowns and I do, but you almost always have to be long because the market is up 90% of days. The moments you should be cautious, it almost feels like in recent years are when markets snap right back. That’s what is so hard about being bearish or a technical trader, if you really respect the moving averages and de-risk where you’re supposed to you miss out on these moves like today. As you know my name isn’t James Bulltard, but what is a bulltard, well the definition sums up today perfectly, a person who is bullish in the presence of bearish indicators.

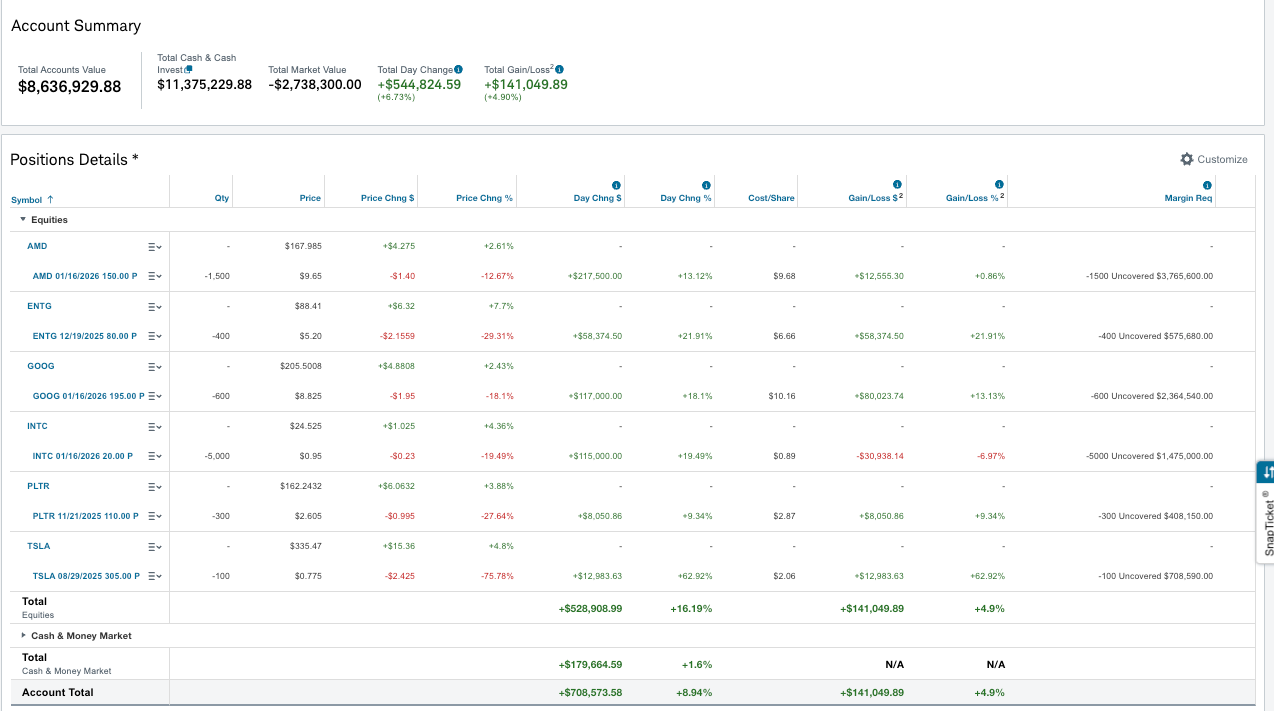

My Open Book

Trades I Added Today

I sold 400 ENTG 80 puts for December at the open for 6.66 and this took off with everything else today. I wrote this one up yesterday and why it caught my eye.

I sold 100 TSLA puts at 305 for next week for 2.06, yes I still think TSLA sucks, but there was a huge put seller off the open at 307.5 and I went in a little lower and sure enough TSLA exploded higher with the rest of the market, these are up 50% already but I think I’m going to just hold them to expiry in 5 days

I sold 300 PLTR 110P in November for 2.87. There have been so many PLTR put sales this week after the sell off around 100-110 and I just wanted to partake on a short timeframe.

This is why I prefer selling puts on margin, days like today your book completely rips, yes it is a struggle when markets are dipping, but you have to look at the end goal and not the day to day action. I get it, that is hard to do because humans are naturally emotional and you see some short term losses and you get worked up. I know the tickers I was in are fine, but sometimes markets don’t go up all the time and I can’t just adjust everything for a few days here and there. You saw me continue to add to some of my positions as they kept declining.

Now if NVDA has solid earnings next week and AMD can hold up, I am in a tremendous spot heading into the final months of the year and without another change I could end this year up 70 or 80% . Markets are at all time highs here, we should drift for a little bit and that would cause alot of quick decay considering there’s only 90 or so sessions left in the year. The thing for me that keeps me a put seller is the ability to profit whether markets go up or not. When you’re buying calls you better be sure we’re going up, but find good names with directional option flow, sell puts lower and a stock could fall 10% and you still profit by expiry. The increased probabilities of success are why I do it. Still though, you have to respect these moving averages because you can’t use leverage and be uber long when the market falls apart or you will blow up. Being a little prudent will save you a lot of pain and suffering like today instead of being levered out to the max I’m probably 70% as levered up as I normally am when bullish and we’re cruising over all the short term moving averages.

Today’s Unusual Options Activity

Here is this weekend’s link to the database it will be up until monday morning