8/26 Recap

Busy morning with PDD getting decimated in China, it is down 29% right now. That was China’s hottest e commerce name with Temu under their umbrella. Temu was the one many feared would eventually hurt Amazon and that was never going to be true. More interesting was how the other 2 Chinese ecommerce giants BABA and JD were only down 4% as PDD got destroyed. So it seems like a PDD issue and not a China issue. Aside from that we’re back to that rotation into the IWM and the junk names as the rate cuts are being priced in. This is where markets get tricky, you have people that tell you it’s not a casino but the reality is they’re selling crowded trades like MSFT and AAPL, true leaders, to buy names like AFRM or ROKU because rate cuts change up DCF’s and benefit the junk names far more than they do the mega caps.

It is what it, these mini rotations are constantly occurring and while the mega caps have been weak for a month now, they remain literally all our market has, especially from a weighting perspective, and there is no chance the market goes materially higher without their participation. For the moment we’re broadening out and buying value names, dividend stocks, small caps, etc. This is all trade, but at the end of the day these other names are still quite mediocre with no growth and pretty uninspiring balance sheets.

The SPY sits at near highs well over the 8 ema and we are in a clear uptrend for now.

The IWM is clearly the strongest look how the 8 ema is sloping up and how far it is from the 21 ema. It is very much leading at the moment, but it did this a couple weeks back then completely collapsed in 4 sessions. These small caps move very quickly and they are just junk at the end of the day.

The QQQ is clearly the laggard right now, it’s sitting right ontop of the 50 day average and just looks like it may roll over. This week is big with NVDA reporting Wednesday and Apple just set their iPhone product event for September 9th. Big tech is always fine, but for now, it just isn’t participating in this rally. You need a big report from NVDA this week likely.

Recent Trades

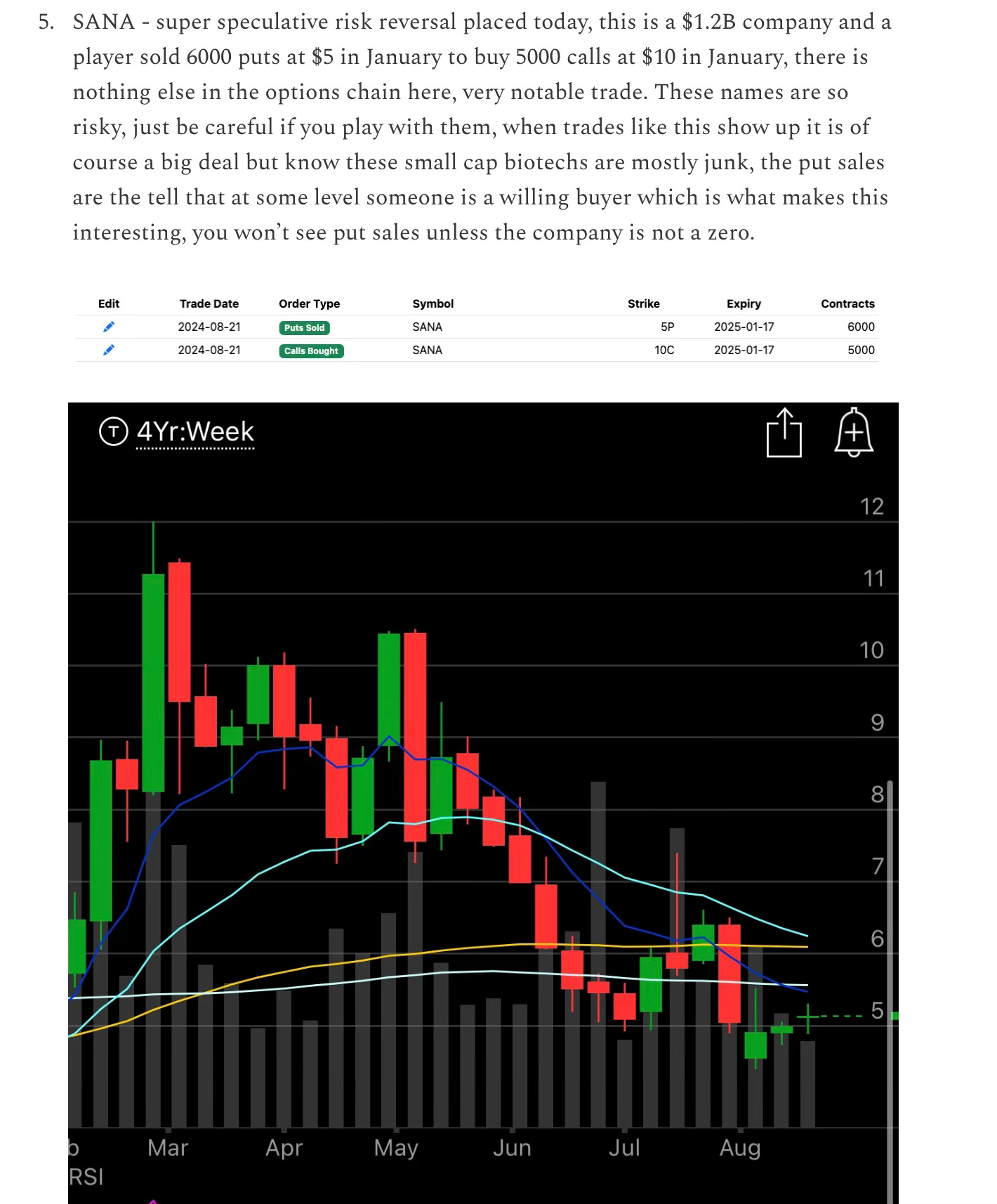

SANA - Last week on 8/21 I wrote up this weird risk reversal here on 8/21, the name was up over $6 this morning for a near 20% move in 3 sessions since. These risk reversals when they’re placed in biotechs are just so rare, you really have to take note. This paid off very quickly.

Trends

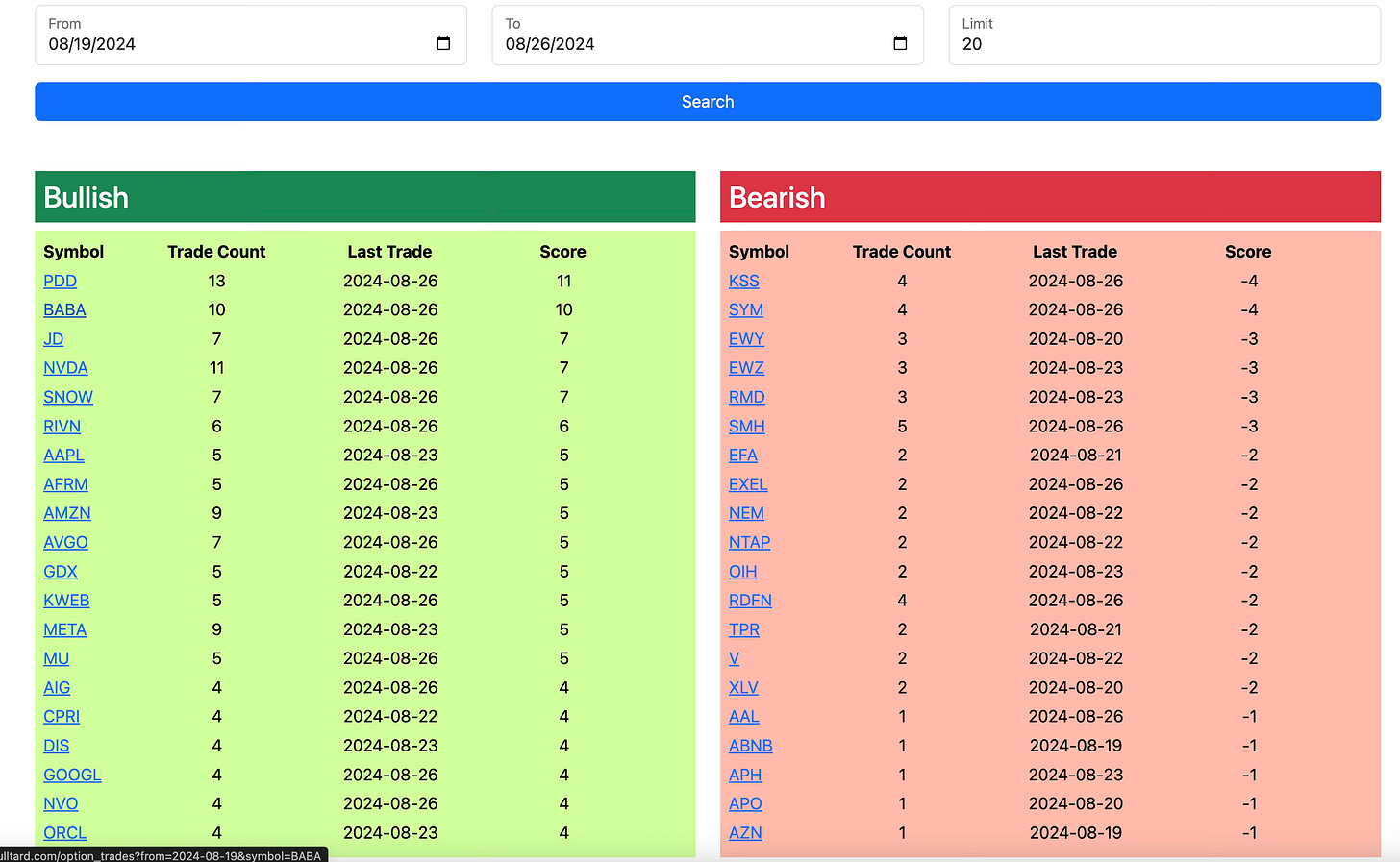

1 Week

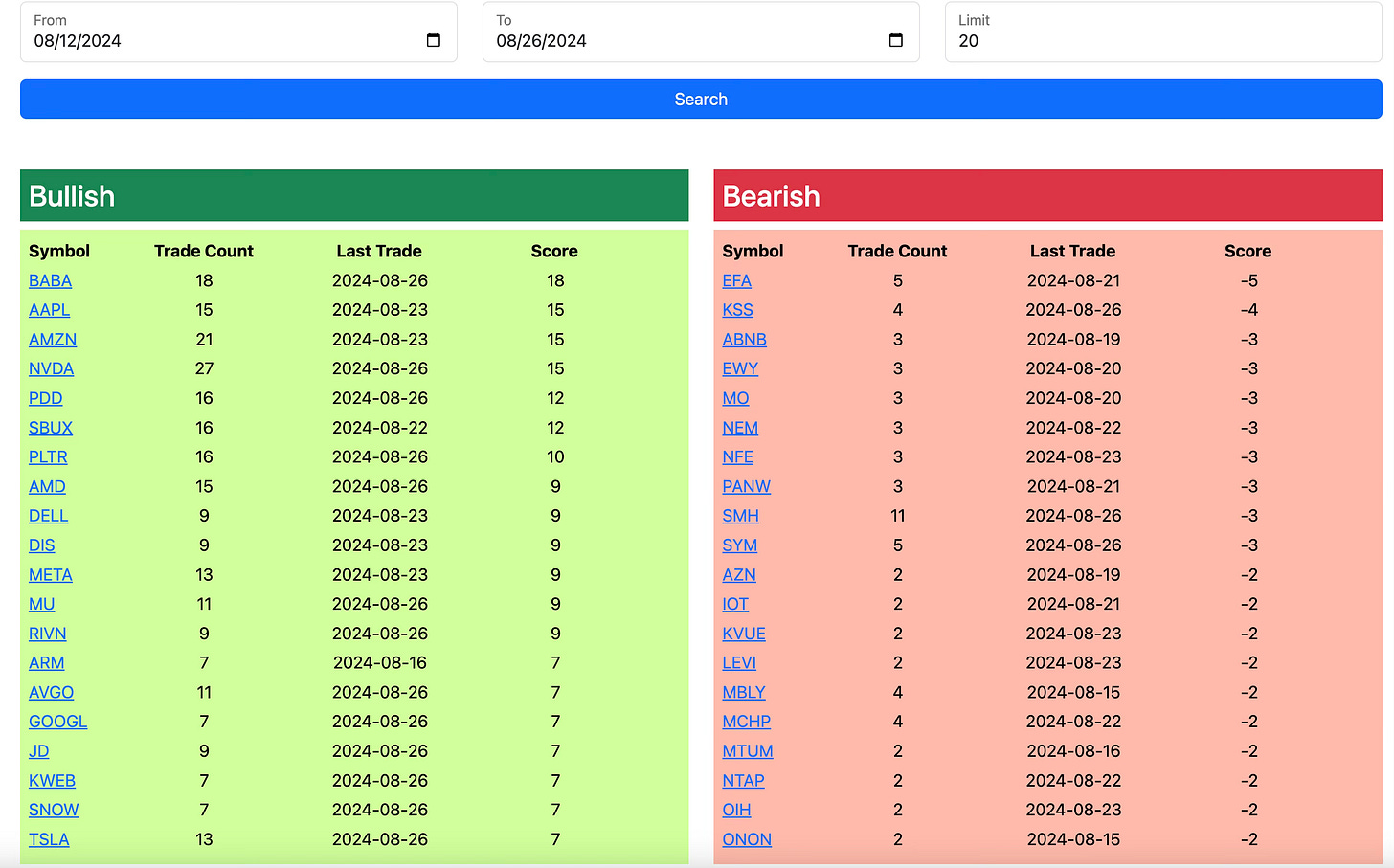

2 Week

1 Month

Today’s Unusual Options Flow

Here is today’s link to the database as always it will expire tomorrow at the open, the rest of today’s trades will be added by this evening.