8/27 Week In Review, This Was My Best Week Of The Year In The Market.

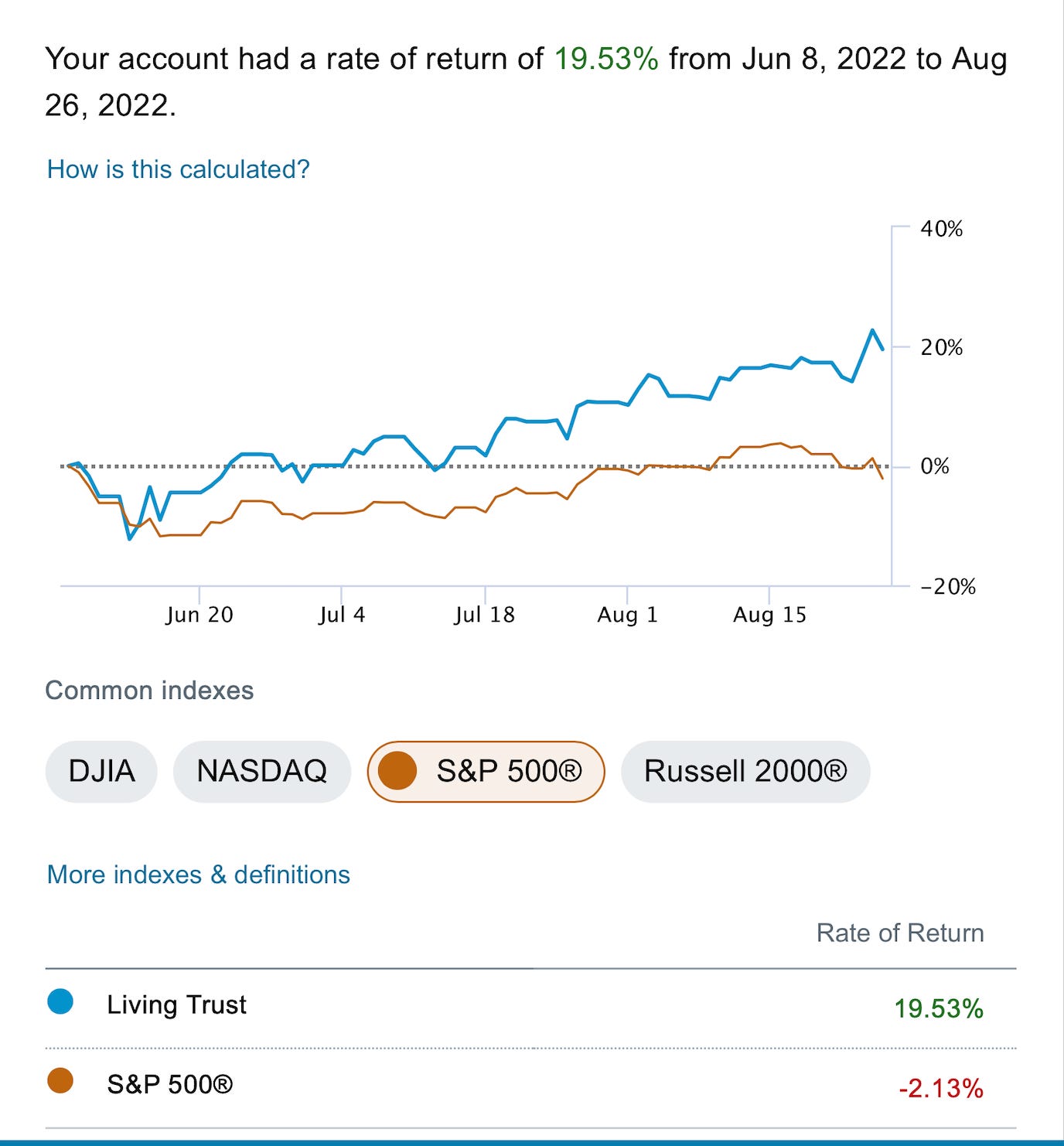

I had some time this morning up at 4 am at the hospital with everyone else asleep and I wanted to reach out. I will open up by saying thank you to all of you who were so patient with me this week, we went into the hospital tuesday afternoon, they induced labor the next morning and our son, Anthony was born on thursday night. I will post some pics at the end but believe it or not I had a few people send me emails/dm’s unhappy they weren’t getting “what they paid for” after I took off tuesday. I did apologize beforehoand, I always try to simply post a recap of the days unusual activity,charts, and my trades once a day, but emergencies happen at times and I just wasn’t near portal to have access to all the unusal activity. As for what people pay for, its outperformance like this below, from day 1 of this substack the S&P is -2% and I am now up 19.5% as you can see.

Even this past week my posts monday and tuesday of last week showed all my positions which were mostly in SU,PINS, and TWTR and those were 3 of the names that outperformed this week. Let’s discuss a few of these.

SU - A green candle on the week, the name was my best idea for this week and it played out beautifully. After a dip monday morning to the 200 day average it rallied hard in the face of all the mark adversity this week. It goes ex div on Sept 1 as I mentioned so this coming week if you still have shares you can sell an aggressive covered call before that date and get not only the dividend but the covered call income as well. The setup on the chart played out perfectly.

PINS - another of the few names with a green candle this week. It had a day on thursday where it jumped almost 15% on news and although it sold off hard yesterday, it was on lower volume than the day before and still finished the week green. Amazing how if you pay attention to names with activists, in this case the same activist as SU above, you end up in names with relative outperformance.

SIX - This is a name I’ve been mentioning for week with all the unusual options activity I’ve noted along with the 2 activist investors in the name. This week Arik Ruchim disclosed that he had added another 500,000 shares, his third block purchase of that size in the last few months and SIX was again one of the few names that outperformed this week.

The Market Ahead

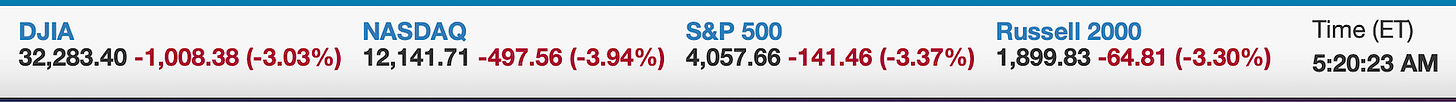

As most of you know I’ve been saying for weeks I wasn’t really buying this rally as a new bull market but merely just a squeezing of record short positioning. We reversed right where at max pain basically as you can see below and closed this week below most key moving averages.

As we look at a daily chart of the SPY, you can see where we stalled out at the 200 day telling you that there was no buyers willing to pay more and that was follow off with a big dump through multiple moving averages and right to another key one yesterday. The selloff yesterday was significant because it was on decent volume coming off hawkish statements from chairman powell. The FED has always wanted to kill stocks as their preferred method of cooling down inflation and Powell reiterated that yesterday. This week is the beginning of September and the start of a massive $95B per month QT.

Trade Of The Week

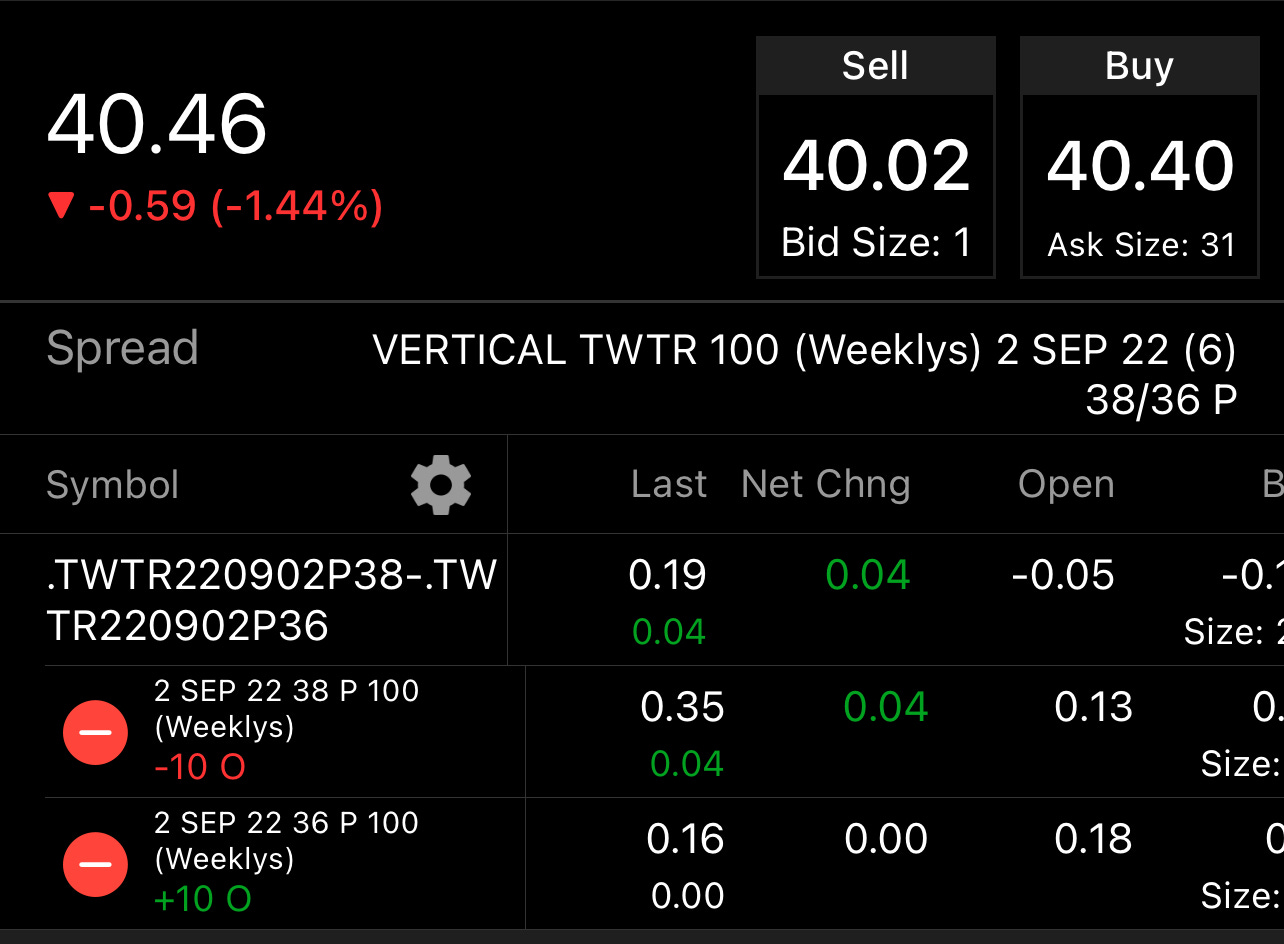

With the SU trade last week working out, I’ve now had a successful trade in 14 out of 15 of those that I post as my best idea. Going forward, I will do what I’ve always said, focus on strong names, preferably with activists involved and target selling premium on those names around key levels. My focus list going forward this week again is going to be highlighted by TWTR because of Elon Musk and the likelihood he will be forced to buy it. The court hearing he faced this week included a judge openly mocking him. I am not not only selling put spreads for this week but the weeks ahead as well. The reason being is simply, I don’t like where the market is now and Twitter as I said in my final post tuesday and all week on my twitter account should outperform and it did drastically with it only being down 1.44% yesterday vs the Nasdaq being down 4%.

The trade for this week is selling the 38 puts and buying the 36 puts for a .19 or better credit. That would fetch you a near 10% return on the name and potentially get you long sub $38. Is there risk the twitter deal falls apart? Yes but it is very small. Even last week on the whistleblower news which to me was a giant nothing, the stock dipped below $39 and was bought right up. I just think overall twitter is a good name to hide out in during these turbulent times. If you want to buy shares you can sell covered calls on it,etc. I’m just saying it should hold up better than the market if you’re in the camp the market is going much lower.

How Did I Do In The Bloodbath Yesterday?

I’m not a magician so I wasn’t green but I was only down 2.6% vs the market being down 3.4% and the Nasdaq being down 4%, mind you that is while being levered up and being short a myriad of puts for the next few weeks. Overall though for the week I outperformed the market by quite a bit, going back to the weekly recap from 7 days ago that you can find here

I ended this week up almost 2% while the SPY was down near 4% and the QQQ was down near 5%. In my book this was one of the biggest wins of the year for me especially considering I wasn’t near my screens and to outperform the market that much in the turbulence is just every traders goal.

My focus list going forward is the same, companies with good earnings, good charts, bullish options flow, catalysts, activists,etc. I mentioned on twitter the other day that Google looked like it was about to die.

It followed up that bearish setup by confirming the breakdown as you can see below.

Yes, Google, fundamentally is the best company in the world, but so what? None of that stuff actually matters short term, fundamentals aren’t going to save you. What will save you is names with bullish positioning because as the old saying goes “there’s always a bull market somewhere”. In fact my chart recap from last week I specifically said now was not the time to buy any tech names, you can see that here

I will do my bset to continue to point out the most unusual options flow, the best setups, and the things that really matter most in the market. This isn’t 1900 and Benjamin Graham is dead, markets have changed and you can either learn and adapt to this new Algo driven casino many think is a “market” or you can keep buying fundamentals and getting punched in the stomach, the choice is yours.

Baby

As for the update on our baby, as I mentioned above, pretty eventful week, went to a routine office visit tuesday that ended up with an early induction which also did not work and an emergency C section after 30+ hours of labor but the end result was worth it. This was the first photo I took of our son Anthony.

We have one more night in the hospital before we can go hopefully but he has been a joy. It’s not our first child but it was just as fun an experience as all the rest. Anthony got his welcome to life with a nice /NQ -600 day yesterday in his first day here, lol I hope that wasn’t an omen of what’s to come.

Anyways, just wanted to get out an update, say I love all of you, and we will get through whatever the market throws at us here soon. Rob especially is the one you should thank for the idea of the discord chat most of you are in. He was the one who wanted a community where everyone could chat. It let all of you make some likeminded friends and you get a place to chat markets all day.

Anyways monday, everything should be back to normal. Have a great weekend.

Awesome first picture of Anthony. Congrats man, very happy for y'all that he arrived healthy and well. Great writeup for the week too, thanks as always.

Hey! Many congrats on the baby ❤️