8/29 Recap

Early in the session we got some pitiful economic data, consumer confidence missed by 10 points and following in the tradition of the past decade, stocks took off. The worse the data gets, the more likely the fed is to take their foot off the gas. What a world, consumers are losing confidence, that means its time to buy equities!

The SPY is breaking this downtrend it was in for the past month today. I noted in yesterday’s recap that a bullish divergence was forming and it looks like it finally played out.

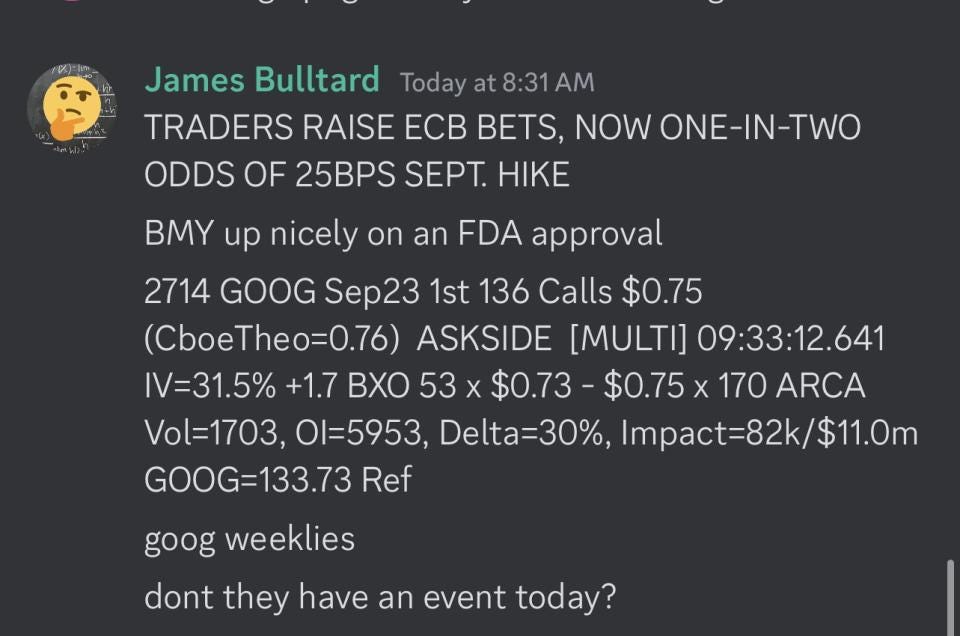

Tesla,Nvidia, and Google were leading the way today with Google having a big event. Right at the open there were some massive Google call buys that I noted 1 minute into the session. If you’re not in the discord, you should be because I send out things like this and you can see GOOG was 133.73 and then ran to 137+ and those calls paid out a ton.

Overall it looks like the market held the lows of the last 2 weeks, the trend was saved, we still have a large jobs number looming but things look ok for now. I have some big news to share below on my positioning now that I am back home.

Trends

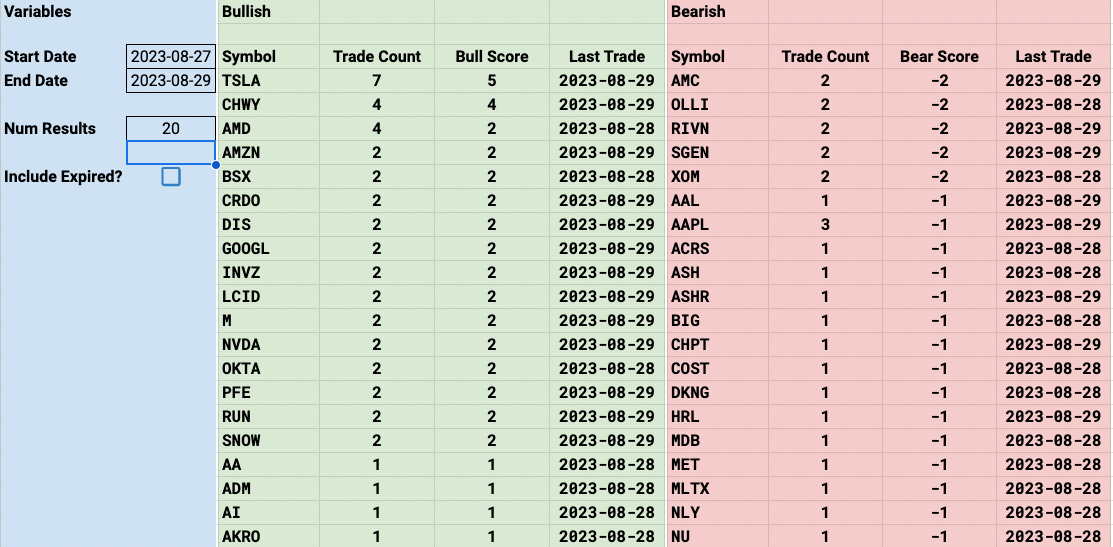

Week To Date

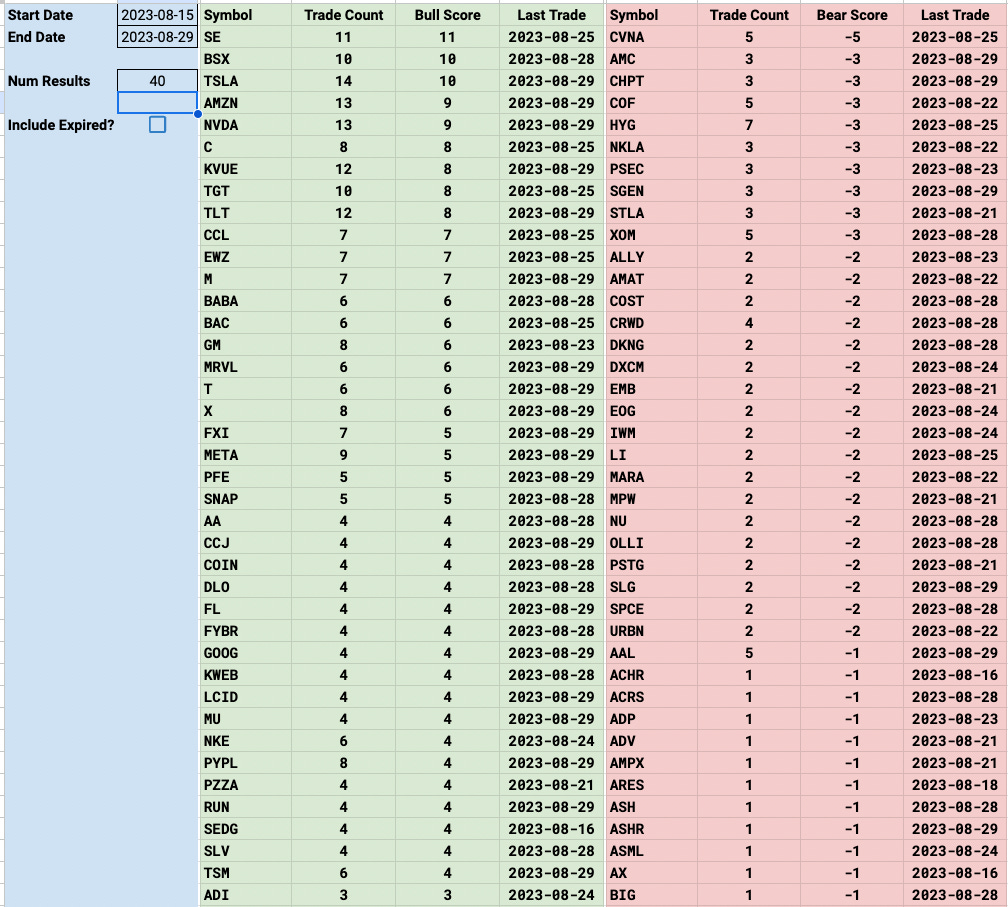

2 Week

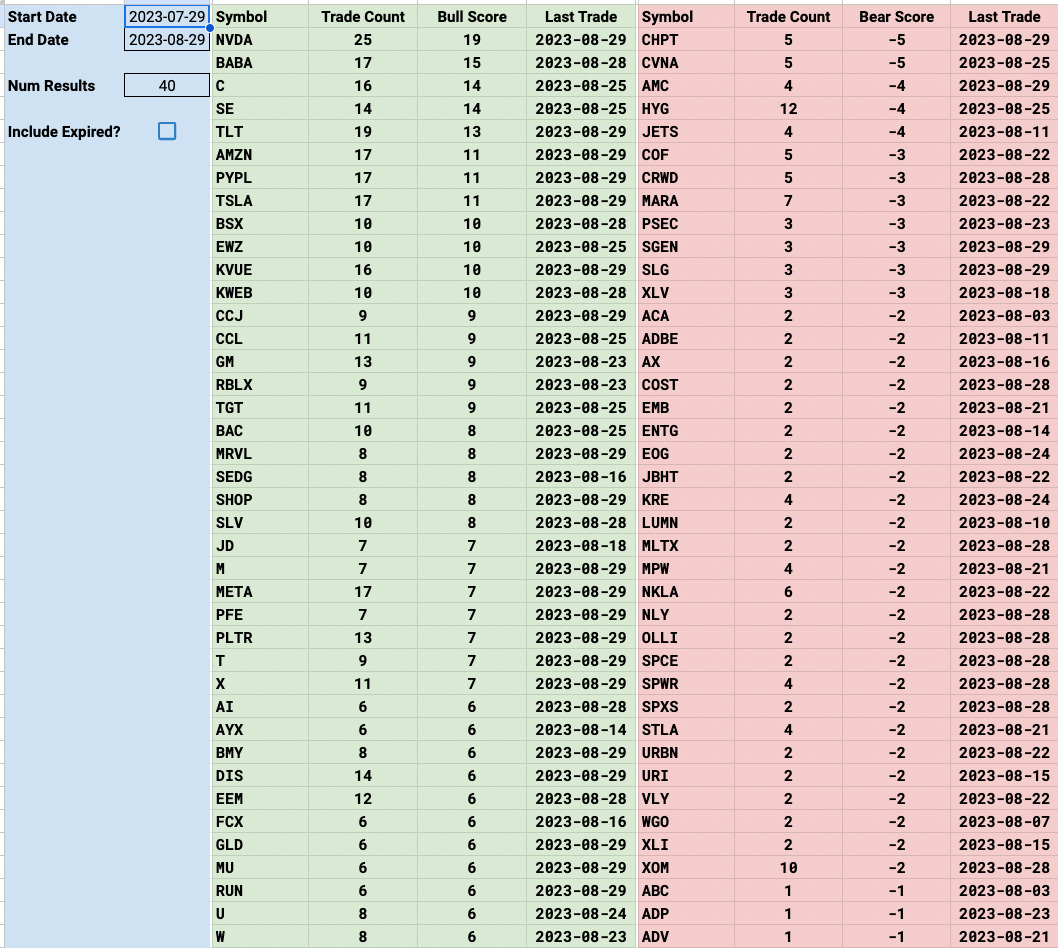

1 Month

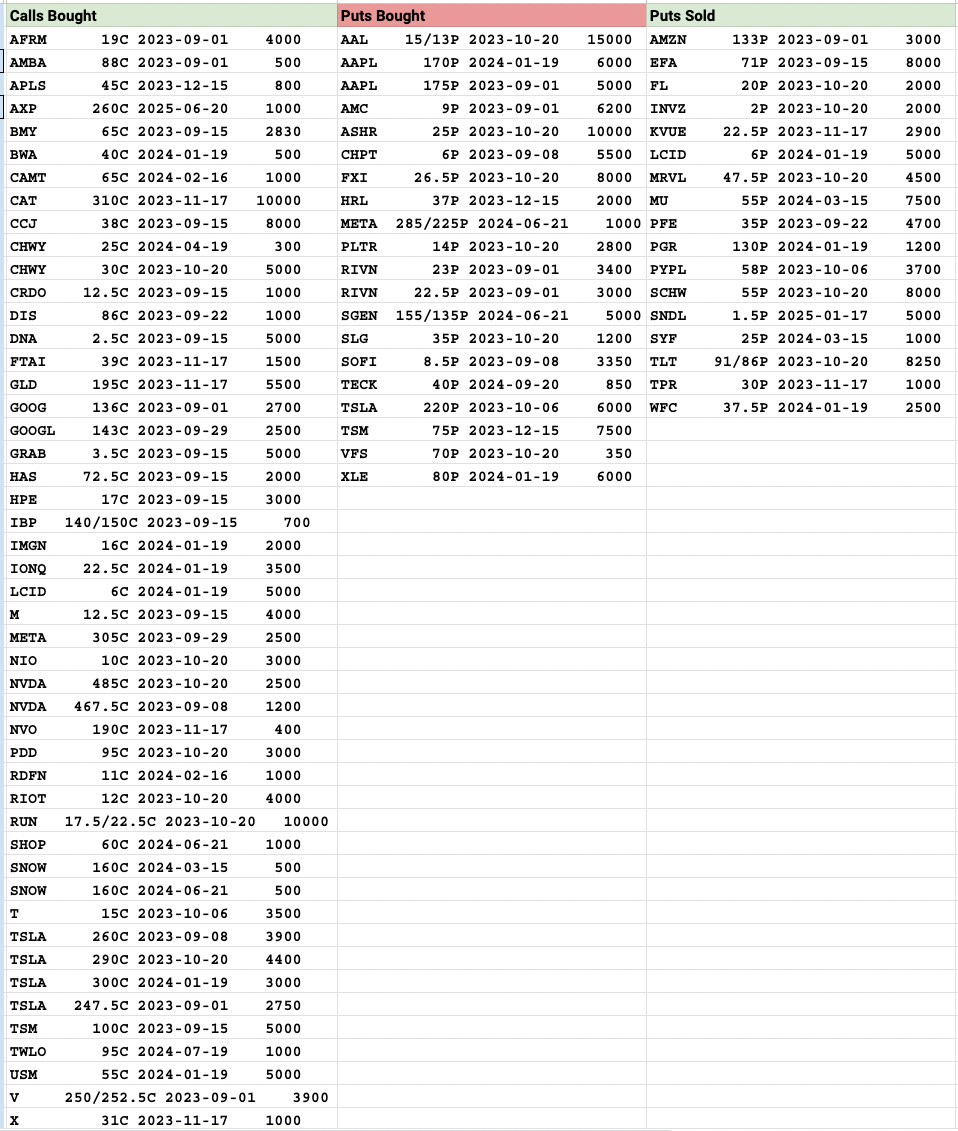

Today’s Unusual Options Activity

Trades Of Interest

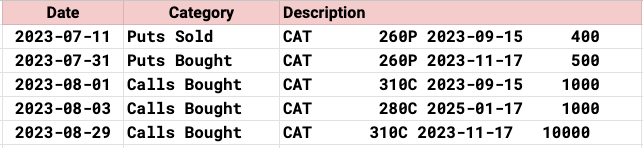

CAT - 10,000 calls bought at 310 in November. The name is breaking a downtrend after a post earnings pullback but you have to wonder if these calls are more about China stimulus ramping. Very nice setup here.

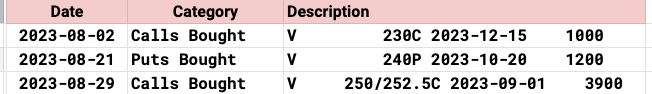

V - These weekly call spreads came in early in the session for .10 3900x. Visa is not the kind of stock that moves like that, so you have to wonder if there will be some news this week. These could payout 25x if V goes all the way through 252.50. That is a very nice chart setup.

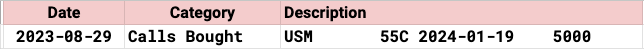

USM - This has been a rumored takeout name for some time, look at the move it has seen just this month up over 100%. I have nothing else in my notes and today it saw 5000 calls bought in January at 55, interesting trade.

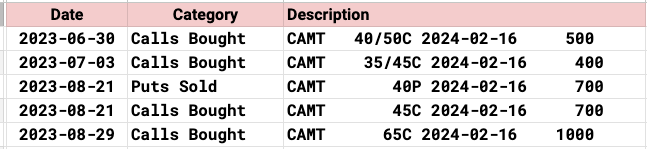

CAMT - I don’t know this ticker but it has seen lots of bullish activity the last few months and look at this run it has seen, today another 1000 calls bought at 65 in February.

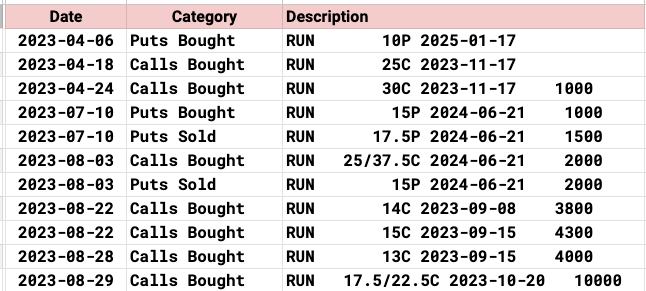

RUN - 10,000 call spreads bought today for October using 17.5/22.5 call spreads on a name that appears to be bottoming, this has seen alot of action below recently as well.

My Positioning

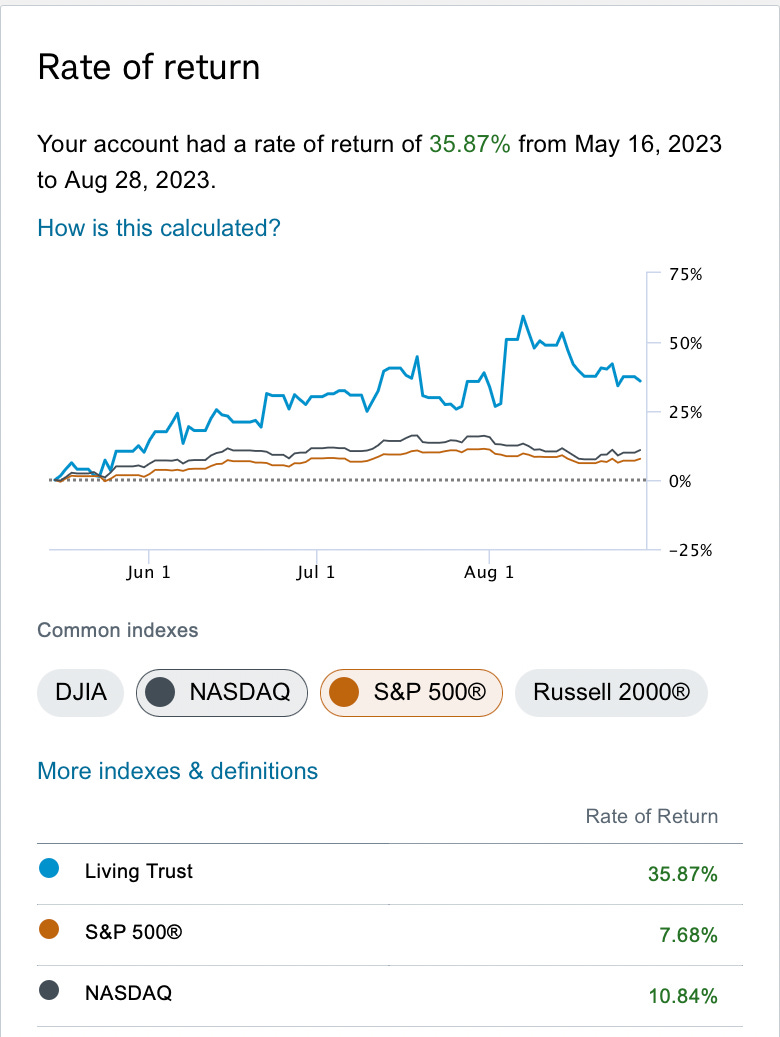

Well, I’m back now and the plan is to get back to my normal routine in the coming days. I closed out my massive position in AMZN leaps. The plan was to hold those while I went on vacation and it worked as planned, I ended up making almost 35% on my entire book in the 3 months I was gone. I was hoping to hold the trade for a longer period but Amazon was trading so poorly, even today it lagged by so much. Moreover, I’m a trader, not an investor, and sitting in 1 trade isn’t for me. I still do think Amazon is by far the best megacap there is, I think it is the most misunderstood, and I think it has the highest upside, but my goal trading is to generate consistent returns week to week, month to month, so now that I’m back I am going to all cash and coming up with my gameplan to deploy over the next few days where I will be back to discussing my daily moves. I posted below you can see the volume today on the Dec 2025 100 calls, as I posted many times I had 600 of them, and you can see them in the volume today. Sadly I could have had much more if I closed after earnings, but even good earnings, this name did not drift. So is life, I’m not going to cry over it.

Again that trade was placed May 16th and since then I returned just under 36% while the S&P was up 7.7% so as disappointing as the last 3.5 weeks were for Amazon post earnings, I tried, and that’s all you can do. Ideally I would have waited 4 more months into early January for tax purposes but I just did not like the price action and I feel confident about what I can generate between now and then.

I know previously I had said the plan was to sell short term calendars vs the position and then sell puts on margin but the reality is that the VIX is back below 15 and I just couldn’t do that so my choices were either sit in this Amazon trade and sell weekly covered calls or cash it in and get back to work. The choice was pretty simple for me.If you have a long term position don’t take this as a sign of anything other than I am a trader, that is my purpose here noting options flow and this was a very good 3 month trade where I made alot of money while on vacation and now I’m back and looking for action. The plan for me is to wait 2 more days, see how the monthly candles close out and slowly begin to sell puts to scale into positions.

Hope you all have a great rest of your day and I will see you tomorrow!

Congrats James on the AMZN leaps. Pretty inspiring ;)

Welcome back James!