8/3 Recap

The market bounced back a little but you can see where the SPY is stuck right below that 21 ema. Everything hinges on this afternoon where you have over 10% of the weighting reporting in Apple and Amazon. This setup is not ideal for bulls and that gap at 443 is wide open still, its hard to say anything more than we will know more tomorrow. It’s just hard to say anymore when so much can change on the reports of those 2 megacaps tonight.

The TNX continues its textbook breakout over 41 and is sitting at its highest point since November 2022. This is going to continue to pressure equities. The VIX is also over 16 now but tested over 17 this morning, its highest point in nearly 2 months.

Oil also had a huge rebound on the news of the Saudi cuts closing up 2.5% just under $82. This could be a scenario like 2022 unfolding where tech stops working and energy comes to life. These energy names are seeing alot of inflows and oil doesn’t seem to want to go down at all.

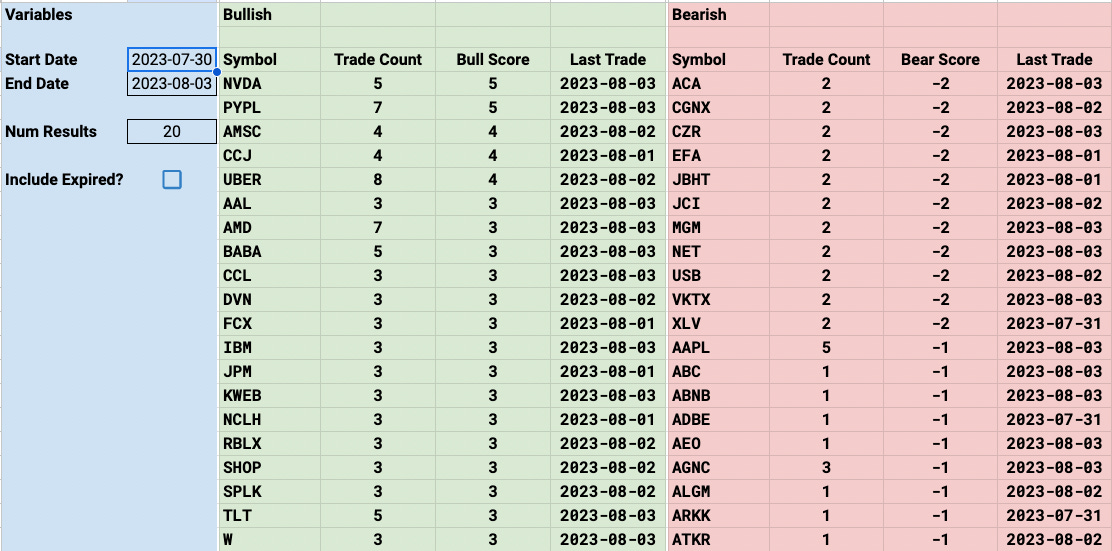

Trends

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow

111 Trades Today

The one that stood out to me was BALL up 5% to almost $60 after earnings, I think I’ve highlighted this name twice in the last few weeks as I noted the repeated put sales on it.