8/31/25 Best Idea For The Week Ahead

The SPY just had its highest monthly close ever, things are mostly looking good. There isn’t really much to say when you look at a monthly chart like this, we’re a bit extended from the 8 month which is way down at 605.

Under the surface is where things are getting a little messy. 3 of the top 5 holdings in the market are now well under the 21 ema: NVDA,MSFT, and META. Of those, MSFT lost the 50 day this week and META is sitting right ontop of it. The charts are below

NVDA

MSFT

META

What is notable here is those were the best performing tech names from July to mid August, if you remember both MSFT and META had huge earnings reactions which completely faded as money exited those and rotated to GOOG,AAPL, and AMZN which picked up the slack this past month.

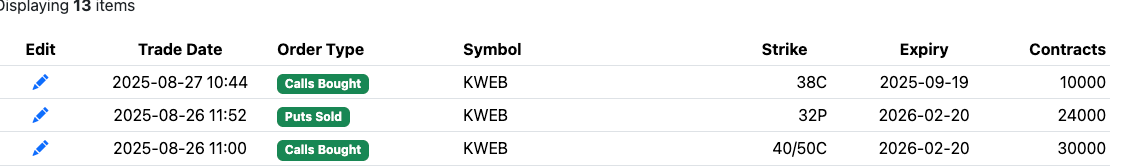

One chart to note as this month wraps up is KWEB, the China tech etf, it had a couple monster call buys this week if you remember and it just had its highest monthly close since late 2021.

Here is the KWEB chart, it looks like Chinese tech stocks are finally setting up to run. Is it because of a trade deal with China? Is it because of Chinese stimulus? Organic growth? The why doesn’t matter as much as the chart is finally showing accumulation and buyers willing to slowly pay higher levels as it moves out of a big multi year base.

This weeks best idea is a name that also was overloaded with call buys recently and just had its highest monthly close in years. I think it is setting up for a big run and I’ve structured a few various trades to capitalize on it. We will look at risk reversals, ratios, and put sales for all the various potential trade setups. The last time I wrote this up was exactly 1 year ago and the super aggressive trade I wrote up then is up a fortune with the December 2026 calls I pointed to then up nearly 5x while the short puts are down almost 80% as well, here is the link