8/5 Options Preview For The Week Ahead

Before I get into this options preview going over every name reporting next week, I wanted to go over a few things since I did not write a recap yesterday. Tomorrow I will have my best idea for the week ahead.

The market in general looks awful right now. You can see the last 3 days since we broke below the 8 ema we have just seen prolonged weakness. Even yesterday we tried to get up over it and were rejected and reversed lower forming a bearish engulfing candle. If you remember I have pointing at that gap you see below at 443ish for a while, now that we’re at 446 it doesn’t seem so outlandish anymore being less than 1% away. After that, the next gap is way below at 420ish.

The weekly chart still looks ok, fear not, contrary to popular belief stocks do not just go up in a straight line normally. We deviated from the moving averages and trend by quite a bit recently and things are just normalizing. Look below, we are still maybe 3% away from the trendline off the October lows. What happens when we get there is what will tell the story, not what happens as we levitate at the highs. Even if next week is rough, for now, we are still in an uptrend and equities are just pulling back within it. Normal stuff.

I am on a family vacation for the next few weeks, I’m still going to send out the recaps at the same time everyday, but, I likely will not be around in the discord much. Obviously it is still on my phone, but if you tag me and I don’t answer right away, that is why. There are still hundreds of others people in there you can get what you seek from in there.

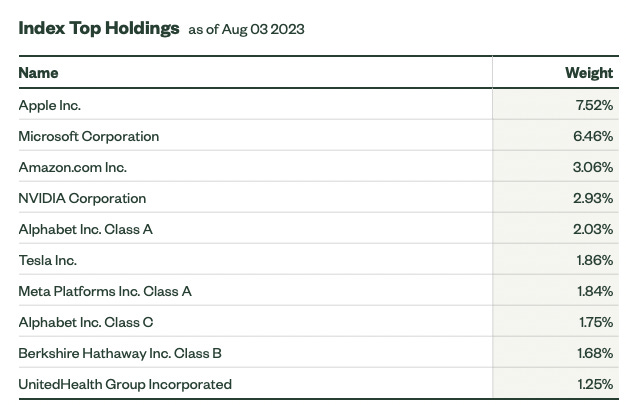

Secondly, we are at a major point in our markets. Earnings season is over, well, the important names with the heaviest weighting. Typically, markets are weak after that, names that did well trend up, and names that did not trend down. The problem this time is the 2 largest names in every index did bad and will trend down now. That is going to be a headwind for equities going forward. Those names have been straight up for months and dragged everything up with them.

Here is the weighting of the SPY, those two are about 14% of the index. Yesterday’s violent selloff some will say was due to yields, but, having a 7.5% component go down nearly 5% is the real culprit.

As I’m sure you noticed, Apple has been straight up all year, so has the overall market, but now, Apple broke trend in a big way meaning it should be weak for an extended period, therefore stocks may be weak going forward? We will see.

Here is a weekly chart of Apple, it’s clear as day that the uptrend has been violated. This really should be my best idea for the week, but I’m not going to complicate things because so many haven’t done it before, but being short Apple here is probably a decent bet. You can see the MACD is about to rollover to negative for the first time in 2023 last week and it closed last week on the lows wiping out nearly 2 months of bars. The company also told you the next 2 quarters likely won’t be good after 3 quarters of negative revenue, those aren’t things you want to hear when the stock is at $3T and worth 100% more today than the 3rd largest SPY component Amazon which just grew revenue at an 11% clip.

Speaking of Amazon, that is now your market leader, it should outperform going forward. Yesterday was a 3x volume day, it had a huge inflow of new buyers and why not, it had by far the best report of any megacap. All its best segments are on fire, management is finally dialing back the heavy capex and the next few quarters should be very big beats. Meanwhile they didn’t warn about more capex for cloud like Microsoft and Google, they didn’t warn about anything related to the consumer and seasonally Q3 and Q4 are their best every year. So imagine how good those will be if Q2 was their best in years?

Amazon saw a slew of upgrades, too many to count really, they’re all in that 170-190 range. Some of the best ones I read were this one saying what I’ve been telling you for weeks that FCF inflection is coming and now it is here as the TTM FCF was +$7b. Many analysts raised estimates across the board yesterday, and I think they’re going to do it again after Q3 as well. The best one I read was from Barclays which said “ it’s finally time to sit back and enjoy the ride”

The Amazon chart is the exact opposite of Apple right now, the weekly chart closed over that yellow line which is the 200 week DMA for the first time in 16 months. It was the last megacap to get over that and now should see sustained strength going forward, that is if the market doesn’t cool off.

On the daily chart Amazon created what is called a power earnings gap, you can look back at META the last few quarters or even NVDA last quarter to see how these go. When I always joke about most gaps will fill, these are the very tiny few that tend not to fill. They usually come after a company has changed a narrative, in this case it was Amazon moved up profitability by alot and surprised people by how much they could generate. Typically, one of two things happens next: it either goes sideways for a week or two until the 8 ema below catches up OR it drifts lower for a bit on declining volume forming a bullish wedge and then it rips higher out of it. That is typically what happens, but of course this is different because of Apple and Microsoft dragging this market down for the time being. If that gap from earnings fills below 130, consider yourself very fortunate and that is a great opportunity to go long at a pre earnings price. It shouldn’t happen, but crazy things happen in periods of market weakness.

With that out of the way, as you think about the last 2 weeks and who has reported what. Now it is time to think about the Post Earnings Drift I always tell you to focus on. Especially now with a likely period of weakness ahead, the names that outperformed, should also outperform here. Step back and think about what those names were, ask the chat for ideas, but I promise if you stick to those, whenever we emerge from whatever we’re in, those will lead the way.

Earnings Calendar

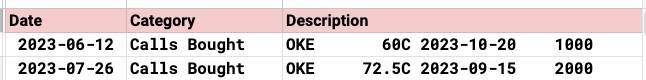

As always I will break down what is in my data by premarket and afterhours. Some big recently hot names remain like PLTR,RIVN,TTD, DDOG, UPST and BABA but mostly earnings season is over. These are all the open trades I have, please check the open interest to make sure the trades are still there if you’re interested in something, I only note when the trades open, I don’t have the time to go back later and check on when each one potentially closes.

Monday Afterhours