8/7 Recap

I’m wrapping up just a little early today. Like I said, I’m on vacation for a while. I still add all the days options activity at the end of the day, so things still appear in the trends and if I do see something notable, I will mention it the next day.

Apple continued its move down after those awful earnings. It hit max oversold levels pretty quickly. This chart is really broken now and with all the moving averages sloping down, this is going to be ugly for a little bit. Surprisingly the /ES and /NQ are brushing it off and both are green today even with all of the weighting Apple commands.

Tesla also was another top component hit hard today on news that another CFO has suddenly departed the company. It’s a pretty big red flag when the CFO just quits out of nowhere. Do you know how many CFO’s Tesla has had over the last decade? Look at the other megacaps, that isn’t exactly a revolving door at most reputable companies. Very odd, the selloff makes sense, but there was a nasty head and shoulders forming on the chart before all this anyways.

The SPY is trapped right below the 21 ema(pink line) and well below the 8/10 ema(blue and yellow line above) so for the moment it still is weak. That gap below at 443 or so is still open and acting as a magnet for now. The target to the downside if you’re bearish remains that 432 level where the white line from the October trend is, as a bull, as long as that doesn’t break, the setup to be long remains.

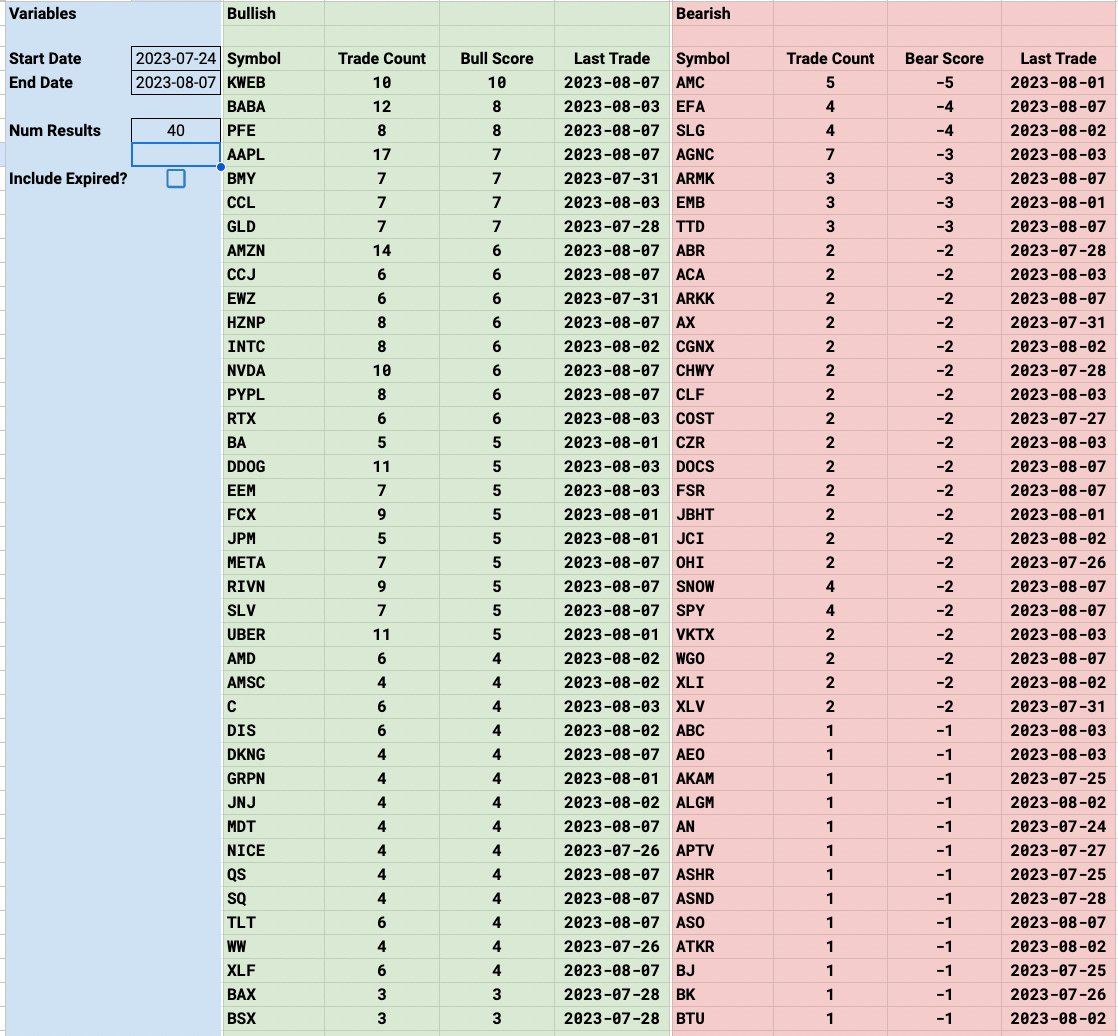

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity