8/7/25 Recap

The SPY is putting in a very ugly candle so far today. We completely reversed the gap up and are at lows of the day right now at just past noon EST. We do remain over the 8 ema but this looks somewhat like a bear flag forming here. All we can do here is stay vigilant and as long as we’re over that 21 ema stay long and when we move below it like last week take risk off. When I look at last week and think about how I said you should de-risk on friday when that 21 day broke that was just prudent book management. As we’ve discussed before, you can never get caught up in a waterfall selloff if you remove risk when that moving average breaks. It so happened we reversed back over that big spot 1 session later, but you could have gotten long then with a stop loss in mind on a close back below the 21. That’s really all you can do to avoid pain but sometimes you’re going to get stopped out and any technical trader last week did. That is why I always say don’t even think about your long term positions but manage your short term ones because long term, it’s always up and to the right over time.

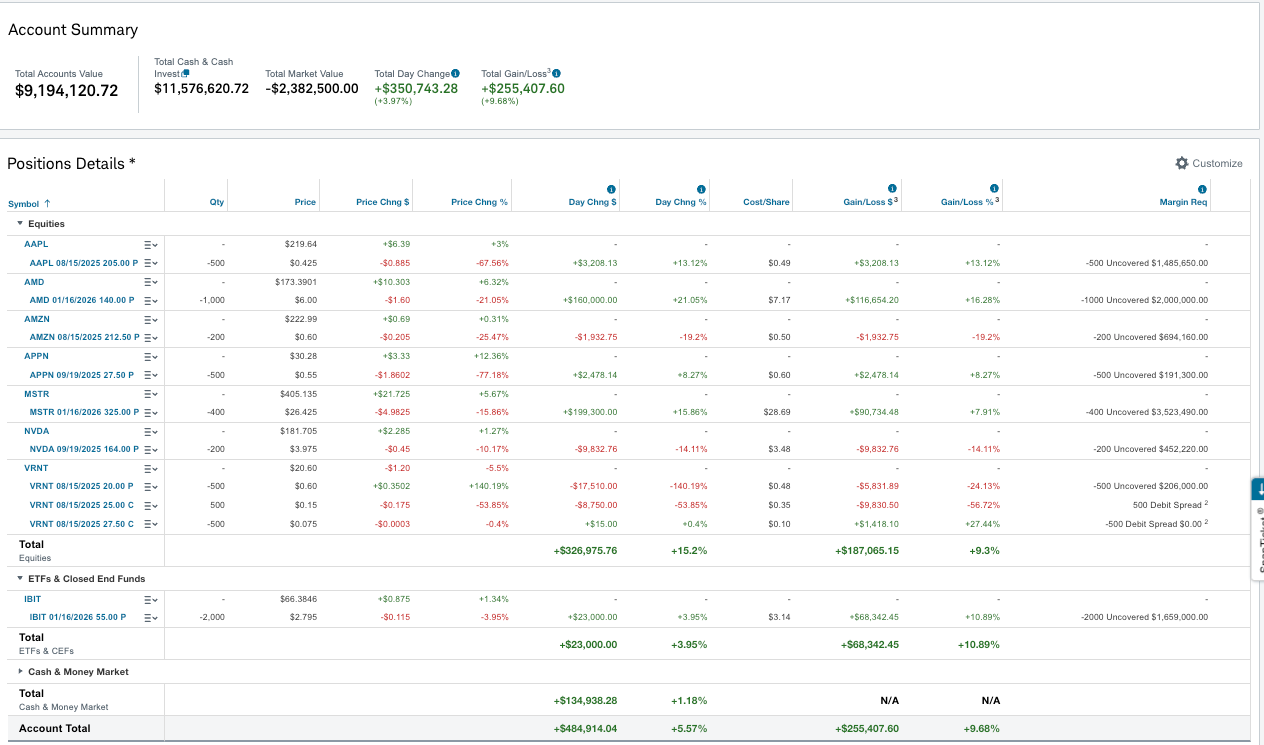

My Open Book

Trades I Added Today

AAPL - I sold 500 of the 205 puts for next week for .49

AMZN - I sold 200 210 puts for next week for .50

NVDA - I sold 164 puts in September for 3.48 following a block sold to open today.

APPN - I sold to open 27.5 puts in September for .60 following a huge 30,000 block I flagged down below

Days like this are exciting with the market red but I’m up nearly 4% because of MSTR and AMD. That’s why its critical to pick the right names when you’re about to lever up into them. Here’s where I stand, that move yesterday to close NVO was bad because it popped nicely today, the good news is I closed to to double down on AMD which is up 7% today so it worked out just fine as those puts I sold yesterday decayed hard today. You’ll notice I sold some short term puts on AAPL and AMZN, in terms of the trade, these aren’t good returns if you sold cash secured puts but because I’m utilizing leverage, the returns are nice in real terms for 6 days.

You’re going to see this more with me going forward, my book is up over 500% from when this all began in 2022, now smaller returns on larger capital with the highest quality names are easily achievable for me. If the names like Apple or Amazon come down, great I will take one and roll the short puts down on the other to a further date. Right now I’m literally sitting at all time highs in my book, I’m up 54% YTD and I’m just trying to focus on short term trades at the moment because I don’t like where this market is. We’re over the 21 again so I don’t mind pressing leverage for the time being.

Today’s Unusual Options Activity

Here is today’s link to the database, it will be up until the morning, I have some Dr appointments this afternoon but I will have the database updated by tonight, sorry again.