9/1 Recap

The market held up last Friday for the 2nd straight week right where it was supposed to if the uptrend was to continue and sure enough look at the bounce we had this week. That uptrend line has been all that has mattered for nearly the past year and I’ve pointed to it for the entire run while people kept looking for answers using macro or earnings or whatever metric they wanted. None of it mattered, the line was all that was needed. We still have alot of stuff ahead like CPI that should come in hot 2 weeks from now with oil rising, but until then, we remain in a bull market. Today Tesla really weighed down tech and consumer discretionary. Tesla launched their refreshed model 3 and it was incredibly underwhelming with no material changes other than some new lights so it sold off nearly 5%.

On a shorter timeframe, the daily, you can see when we broke the downtrend on the SPY Tuesday, this is just a continuation of the rally. anytime the moving averages begin to slope up, you cannot be bearish, you just can’t. Even now, it looks like we’re just going sideways waiting for the moving averages to catch up, just normal consolidation. All in all, last Friday’s potential crisis was averted.

The TNX, below, was up 2.5% today which is what weighed on equities. This is just a back and forth at this point. Yields up stocks down, yields down stocks up. The VIX is back to 13 now, there is no fear on the horizon at this moment.

Overall, the market looks fine for now. I finally returned after my 3 month hiatus and you will see my book posted down below. I’m not too concerned with anything and actually placed the single largest OTM call buy of my life today which you’ll see below. So if you’re wondering my opinion, that’s my take on that

Trends

Week To Date

2 Week

1 Month

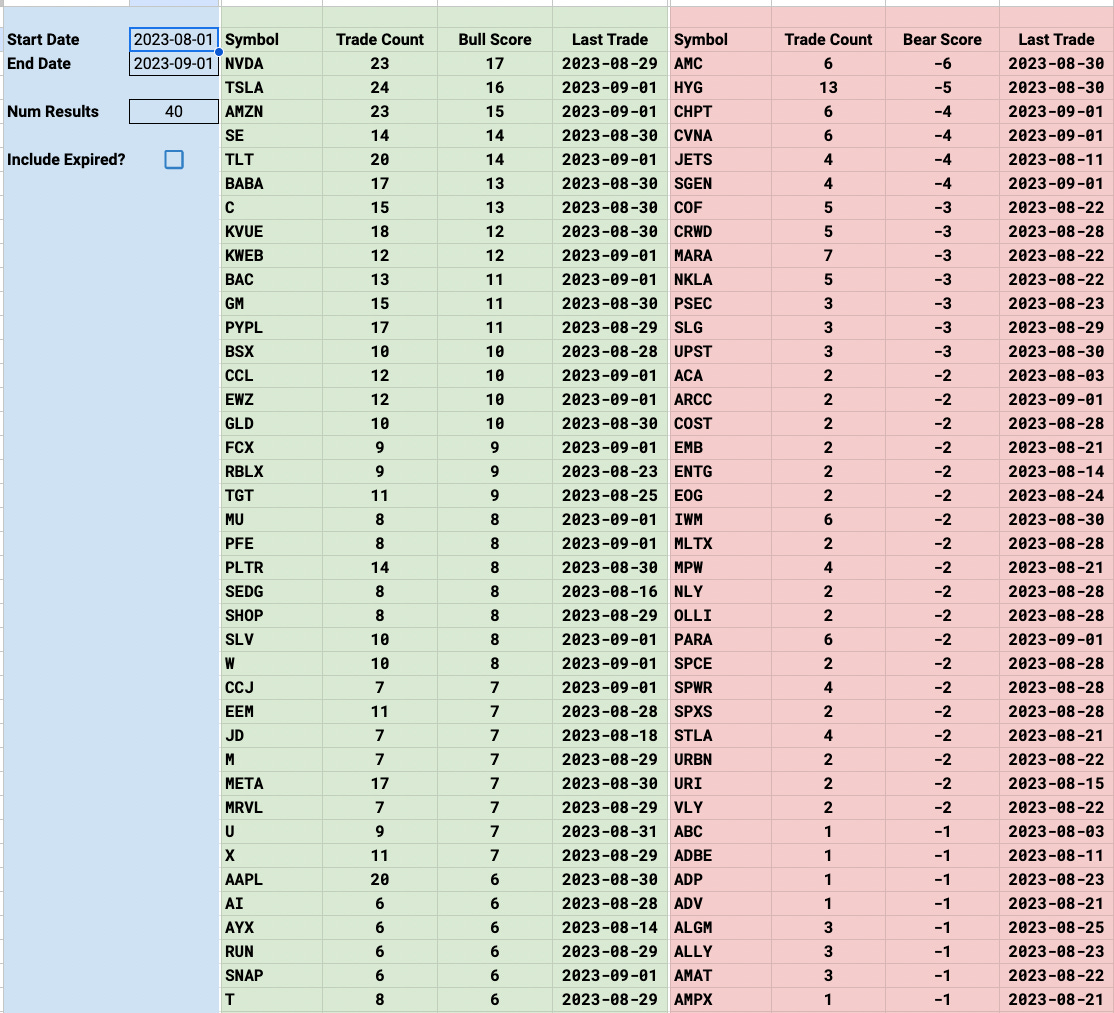

Today’s Unusual Options Activity