9/1 The Various Ways To Be Bullish

Before we get into this week’s best idea, let’s talk about how many various ways you can play all this data in a bullish manner. I get so many emails and questions that say XYZ trade was “wrong” the reality is below

Hedge Funds do not always beat the market, you have to remember the market is 100% long and I joke about it alot, but stocks really do go up 90%+ of the time. Look where we are now vs that crash we had a few weeks ago. Hedge funds are an alternative investment vehicle, their goal is give you access to long/short strategies, heavier allocations to things the SPY won’t, etc and the reality is most underperform the SPY, they just do. These big options trades we look at here, the reality is we will never know why they’re placed. Some might be hedges, some are just wrong, but the point of all this that I do is simply to see where big money is betting and then we can look at charts to find what levels to play a stock at and combine it with the data we have to try to draw up a trade that can work regardless of if the. original trade worked.

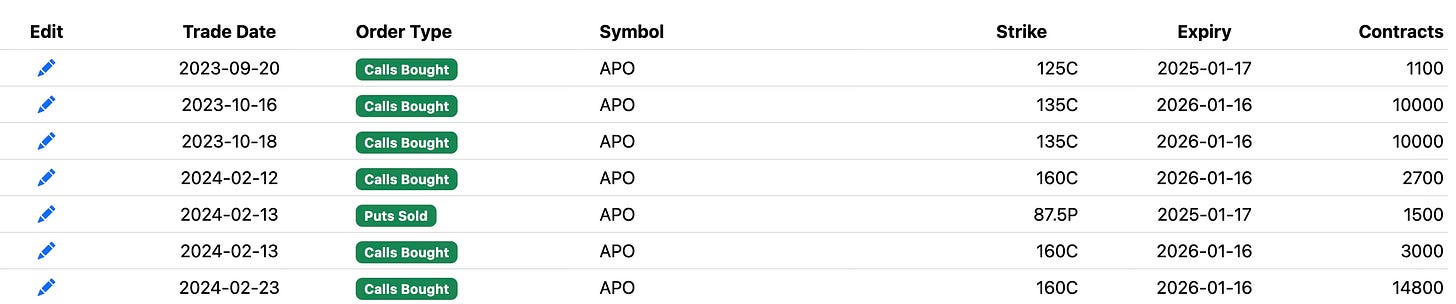

Let’s take that massive 90,000 block of APO calls I discussed a few days back here.

Does APO go to $185 by January 2026 rising another $70? Maybe, if you look in the database you will notice someone did the same thing last October on 10-18-23 and back then the stock was below $80 and they loaded up on $135 calls for January 2026. They were dead on with that trade as APO rose dramatically after hitting highs of 126 recently.

So now we have all this data on directionality in the database, we can see levels big money is targeting, and we can build trades around it. So let’s talk about how many ways you can do that.

Buying shares - the simplest form of following a trade out there, no explanation

Buying share and selling covered calls - here you would buy shares with the goal of following a trade to a certain level higher and along the way you sell covered calls and generate income or if you’re too busy, maybe you buy shares once and sell covered calls higher one time at the target date of your choice, in the case above, maybe you buy now at 115.xx and sell say 150 calls and play it conservatively because if that player is right at 190 you will be right too at 150.

Buying Calls - this also needs no explanation, you see a trade, you find it interesting and you want to follow. In the case above maybe you think those 185 calls in January 2026 are nuts, you could buy the 160 calls which are 4 x 5.50 right now, 4.75 was the last trade, if this equity is going over 185 those 160 calls at 4.75 are going to still be a monster trade and you're in the money $25 below the big player at 185.

Selling puts - this is where you simply sell puts lower to get long this stock because you want to play along but starting at a lower point, in this event you still profit if the stock goes up, just less. The stock is 115.xx today and you sell January $110 puts for 5.15 today. Now you profit as long as the equity is over 110 in January but should it fall, you go long at 104.85 which is a better proposition than going long at 115.xx if you’re conservative

Selling put spreads - This is the above but margin is an issue for you so you sell puts and buy puts together because the margin requirement is the max distance between the 2. Perhaps you sell a 110/105 January put spread for 1.50 as it is currently 5.20 - 3.70 leaving you with a $5 wide spread with a 1.50 profit risking 3.50. In this case the margin requirement plunges to $5 x however many contracts you utilize. These are best for people worried about the bottom falling out or those tight on margin

Risk Reversals - This is my favorite approach and you see me draw these up everyday. The reason is, every stock is a buy somewhere, usually into a cluster of support we see in a chart and/or at a key moving average. Even junk stocks are still buyable somewhere on a chart where we know computers are going to step in to try and save it. With that in mind we can play the bullish upside calls while selling puts at support to offset costs and maybe even turn the trade into a credit. This is the ultimate, yes it requires a decent bit of margin but you can still profit if you are slightly wrong. Now if you’re horribly wrong and the stock plunges you’re going to get double whammied but that is why you try to look at the puts sold in the database, look at the moving averages and go off those to try and find a level of institutional support to sell the puts at. If these work, they really work because the calls cost you nothing and the puts sold melt away to 100% profit.

All the above is how you can see a bullish trade, and I post tons daily, and then draw up your own trade around it. Again this is where the community discord is as valuable as any place you’ll find regarding trading. You have just under 1,000 people in there, with a ton of brilliant traders and you can bounce ideas with them, there’s so many equity discussion areas, the trade idea discussion tab is a great place to post your idea and have people give you their input before you place them. There really is no one right way to play all this information, you just have to build your own trades using it to your advantage, I try my best to highlight 5 trades a day that I found most interesting in the session, but there are so many trades and you don’t have to directly follow each call buy, you just need to use the direction as a starting point to a trade.

Just remember the big call buyers can lose and you still profit, and if these big call buyers were infallible, every hedge fund, family office, etc would return hundreds of percent per year, instead most underperform the SPY. All this data shows is the end result of hours of research and planning with a followthrough of money bet on a thesis. Unfortunately people aren’t always right, but that doesn’t mean we can’t utilize their hours of research condensed into 1 trade in an effort to save time as we decide what to trade.

This week’s best idea is nice value name that has seen some very bullish out of the money positioning this week, 3 trades specifically, exceeding all analyst targets meaning some players are looking for a re-rating or some other good news that analysts aren’t seeing.